The Commodity Futures Trading Commission is going down the wrong path.

Throughout its history, the CFTC has prided itself as a pro-innovation regulator that constructively engages with industry, academia and the public to deliver principles-based regulatory outcomes.

Sadly, some of the agency’s recent enforcement cases — or what they call their “continued enforcement focus in the digital asset decentralized finance [DeFi] space” — are a material departure from this precedent.

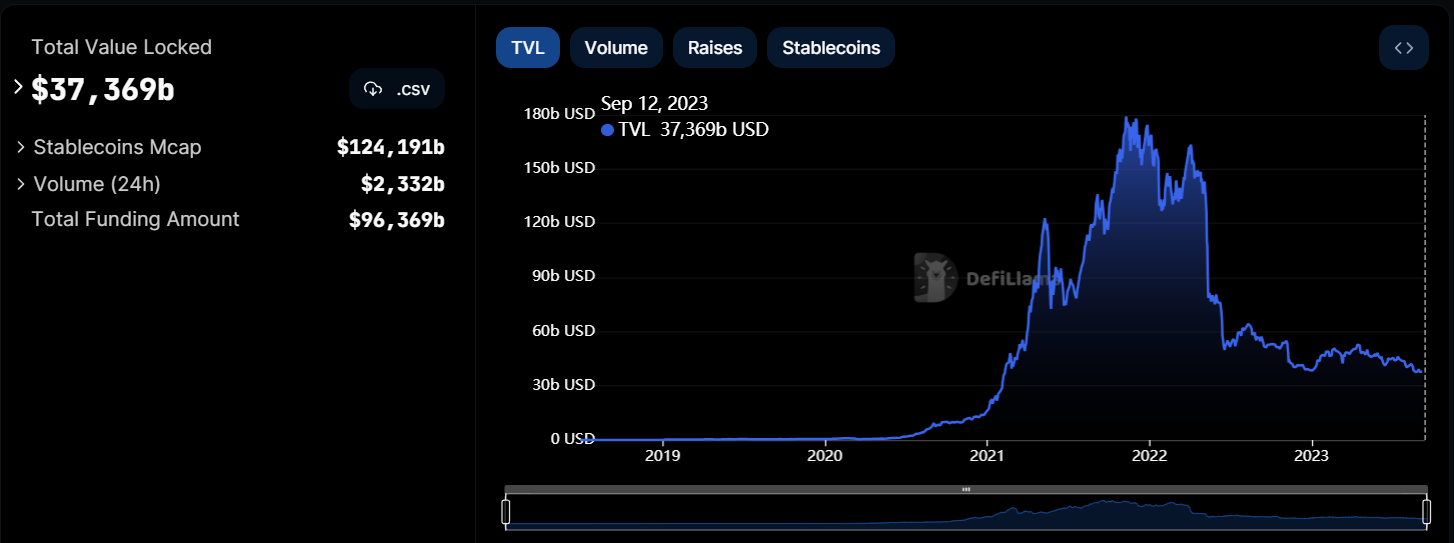

In an era when DeFi offers opportunities to foster more inclusive markets, deliver enhanced risk management and improve price discovery, the CFTC’s self-proclaimed enforcement campaign against DeFi is a step in the wrong direction. Its stance on DeFi threatens to force innovation offshore, undermining US competitiveness and leadership across the global financial system.

The recent CFTC cases against Opyn, ZeroEx (0x) and Deridex are emblematic of the issues with this new enforcement-first approach.

Ironically, just days after a federal judge dismissed a civil claim against DeFi software developer Uniswap Labs for the actions of a third party, the CFTC announced enforcement actions against these three DeFi protocol operators.

The enforcement actions come even after a federal judge reasoned in the Uniswap case that it wasn’t possible to hold a DeFi platform at fault for the actions of its users, reasoning that it was akin to “attempting to hold an application like Venmo or Zelle liable for a drug deal that used the platform to facilitate the fund transfer.”

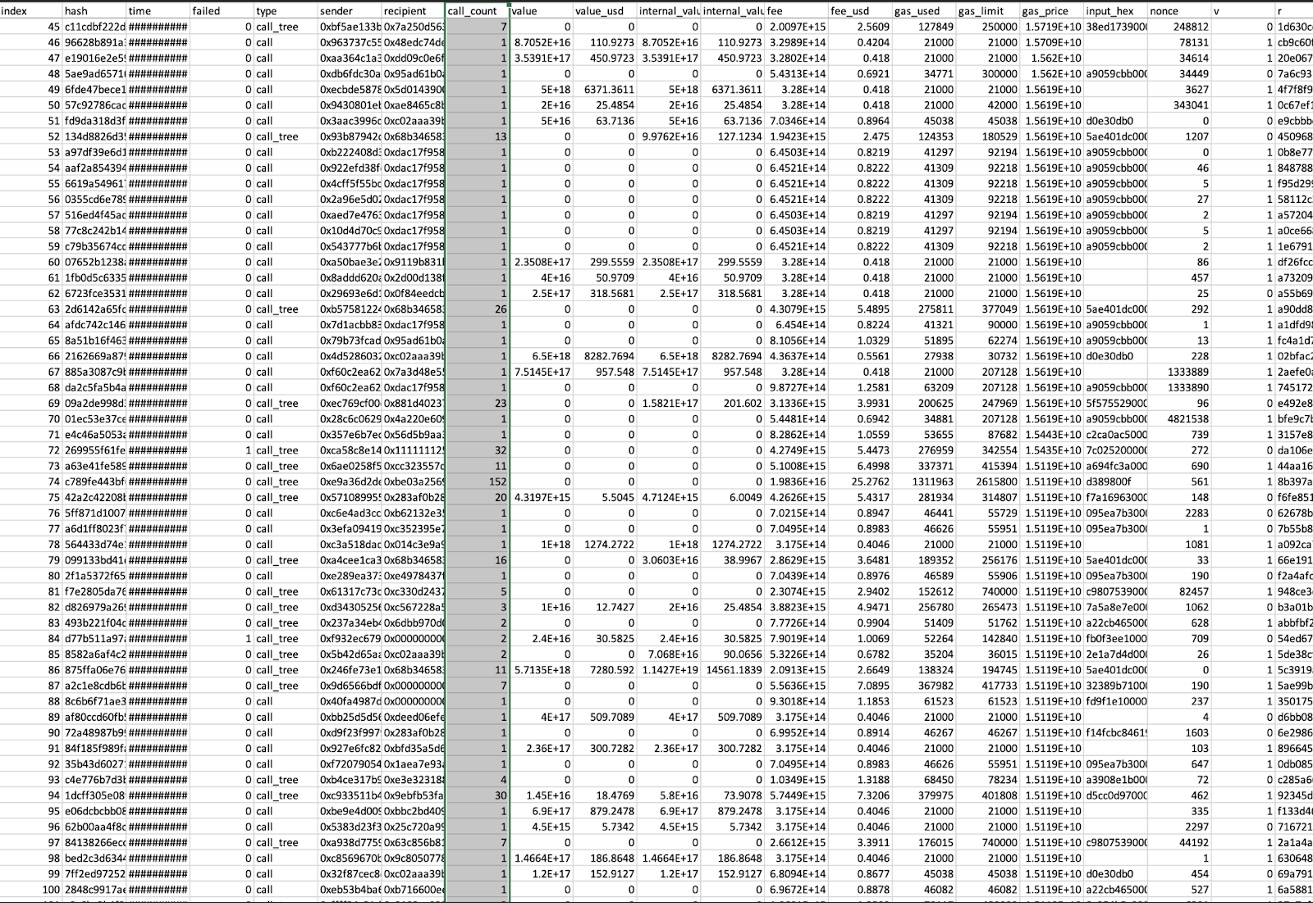

But in the CFTC’s new cases, the agency held 0x responsible for tokens issued by a third party that represented levered positions. The CFTC’s orders also conflated the activities of software development and protocol operational control. Additionally, Opyn had also already blocked US intellectual property addresses, but the CFTC alleged that those steps were insufficient.

Importantly, a dissent by the CFTC’s own Commissioner Summer Mersinger notes that an “enforcement first” approach does not provide guidance for how a DeFi protocol could comply with legacy regulatory requirements, which are designed for centralized, intermediated entities.

In sum, the CFTC’s new, current reasoning could arguably sweep DeFi and other developer activity into the CFTC’s jurisdiction. And as software clearly cannot comply with outdated legacy rules, this move could effectively end DeFi in the US.

Today, legacy market structure and regulation is simply not keeping up with innovation. Intermediaries, required by current CFTC regulation, are withering. Like it or not, the risk management realities of markets that function 24 hours a day, seven days a week have arrived, but aging technology and regulation have failed to keep up. Income inequality plagues our financial system, and failure to adapt to recent technological realities is leaving US market participants behind, unable to hedge risk.

Some of our best and brightest entrepreneurs have sought to solve these problems by developing new decentralized, open source DeFi protocols that can actually promote global financial stability and enable equitable access to safe and affordable financial services: two core bipartisan principles highlighted in the Biden Administration’s “Executive Order on Ensuring Responsible Development of Digital Assets.” The lifeblood of our economic future — our innovators — should be welcomed, encouraged and defended, not banished or scared away to foreign jurisdictions.

Questions continue to swirl over whether regulatory agencies currently have the authority to regulate cryptocurrency markets, based on recent case law and the Major Questions Doctrine. However, it’s already clear that the ideal solution would be for Congress to pass proactive, nuanced legislation that actually empowers and enables the CFTC to engage in what it does best — principles-based rulemaking — that could help cutting edge technologies, like DeFi, achieve their promise.

However, in the absence of this hypothetical legislation, the CFTC should immediately end its self-proclaimed campaign against DeFi and take the following steps:

- Engage its five advisory committees and seek guidance and insight from members and the general public on effective and principles-based DeFi regulatory design.

- Cease enforcement actions against protocol developers for writing code and engaging in other core software development activities, while providing fair and reasonable guidelines on the demarcation between software development versus protocol control.

- Dedicate its precious resources to rooting out perpetrators who engage in fraud, manipulation and abuse, consistent with its current legislative mandate.

- To the extent the CFTC has clear legislative authority to ban certain activities, it should provide transparent and reasonable geofencing guidelines.

- Through LabCFTC, or via new regulatory sandboxes as proposed by Commissioner Caroline Pham, the CFTC should bring together top DeFi and industry professionals, offer safe harbor and encourage innovation and experimentation — without fear of reprisal.

- The CFTC should work with other government agencies to better protect and defend US crypto entrepreneurs from hostile state sponsored attacks and hacking activity.

The CFTC should be promoting leadership in technology and encouraging economic competitiveness. A new and uncharacteristic approach of “regulation by enforcement” will have catastrophic consequences and cause irreparable harm to the US economy for generations to come. There is a better way.

Christopher Perkins is President of CoinFund, a web3 focused registered investment advisory. He is also a member of the CFTC’s Global Markets Advisory Committee and its Digital Asset Markets Subcommittee.

Sourced from cryptonews.net.