International crime-fighting agency Europol has praised blockchain’s security, but also highlighted high criminal activity in decentralized finance.

Europol, the EU law enforcement organization, has published its first European Financial and Economic Crime

Threat Assessment. It describes an in-depth assessment of the threats posed by cybercriminals at the European level.

Besides financial crimes in traditional finance, Europol also addressed in the document the illicit use of cryptocurrencies. Although the agency praised blockchain for its independence and security, Europol criticized decentralized finance (DeFi). The agency believes the lack of crypto regulation “leaves

openings for economic crime since criminals hold illicit assets on DeFi platforms.”

“The use of cryptocurrencies for criminal schemes is also increasing in line with their overall

adoption rate.”Europol

You might also like: DeFi group urges UPSTO to protect crypto from patent trolls

However, Europol pointed out that the illicit use of crypto still represents “less than one percent of the overall transaction volume.” In addition to DeFi, the agency addressed wide-scale scams involving non-fungible tokens (NFTs). Europol says NFTs pose a “significant risk of money laundering due to their instant trading feature across borders.”

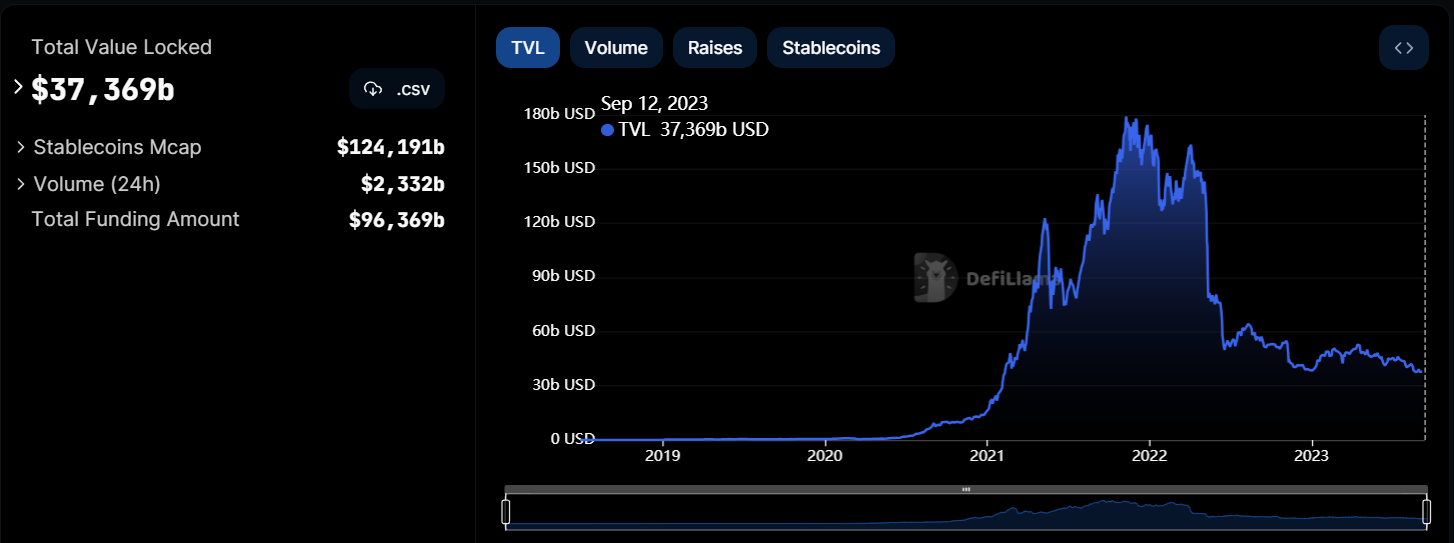

DeFi TVL. Source: DeFiLlama

Although DeFi has become hot for hackers and scammers, on-chain data indicates a steady decline in the total value locked among all DeFi protocols. According to DeFiLlama data, DeFi’s TVL is set at $37.3 billion as of press time, which is near levels last seen in February 2021.

In July, the U.S. Senate proposed a strict bill for DeFi regulation that the crypto community criticized. Shortly after the proposal, the Blockchain Association slammed the new bill, calling it incompatible with the industry as it pressures the DeFi protocols to collect user data.

Read more: Europol, US and Germany make €46m ChipMixer bust

Sourced from cryptonews.net.