FTX (FTT) has filed for Chapter 11 bankruptcy, the company announced in a statement on Friday morning. Its founder and CEO, Sam Bankman-Fried, has resigned and been replaced by John J. Ray III.

The bankruptcy involves companies that go under FTX Group, including FTX.com, Alameda Research, FTX US, and another 130 closely tied firms. Former CEO Bankman-Fried claimed that FTX US was solvent up until the very end.

The bankruptcy excludes LedgerX LLC, the subsidiary known as FTX Derivatives, FTX Digital Markets Ltd., FTX Australia Pty Ltd., and FTX Express Pay Ltd.

FTX believes that many of its employees will stay with the company to assist it in its operations during the bankruptcy proceedings. However, entire teams, including legal and others, have already left the firm.

“The FTX Group has valuable assets that can only be effectively administered in an organized, joint process. I want to ensure every employee, customer, creditor, contract party, stockholder, investor, governmental authority and other stakeholder that we are going to conduct this effort with diligence, thoroughness and transparency,” newly appointed CEO Ray III said in a statement.

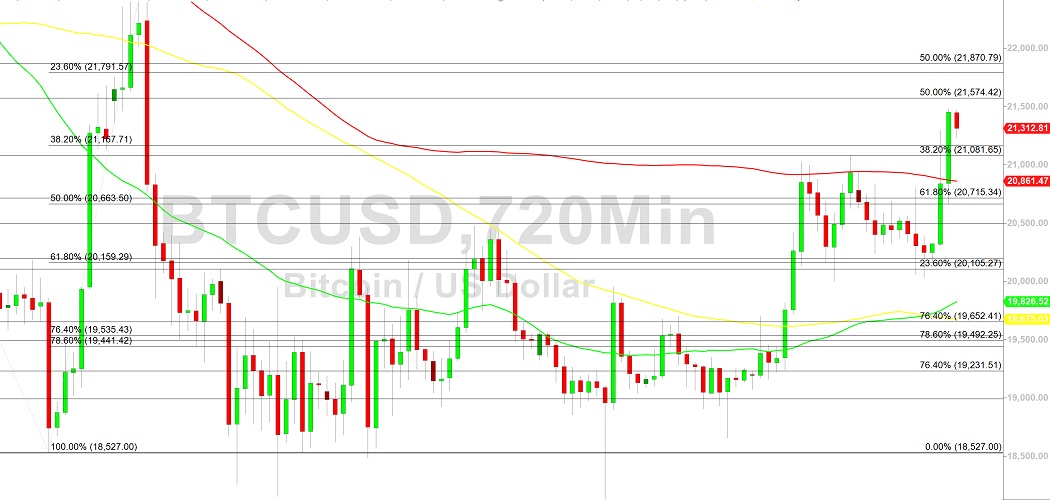

The FTT token plunged 64% on the news and is currently trading at $1.60, according to data from TradingView.

FTX’s bankruptcy comes after Binance CEO Changpeng Zhao announced earlier this week that Binance was going to unload its share of FTT tokens that it got as an early investor in the exchange.

Hours later Binance announced it had signed a non-binding letter of intent (LOI) to acquire FTX, but ultimately withdrew from the deal citing “mishandled customer funds and alleged U.S. agency investigations.” TRON’s crypto billionaire Justin Sun tried to step in and help, but to no avail.

Later reports revealed that FTX had sent about $10 billion of user deposits to its sister crypto trading firm, Alameda Research, which used the funds to engage in risky trades.

Bankman-Fried claimed up until the last moments before the big revelations that FTX.com and FTX US were “fine” and had sufficient liquidity to honor user withdrawals.

Bankman-Fried launched FTX in 2019 after he left, at least officially, his crypto trading firm Alameda Research. Dubbed as the JPMorgan of crypto, Bankman-Fried was known for his bailouts of failed crypto projects, lobbying for regulation, and effective altruism.

Sourced from dailycoin.com.

Written by

by Rue Abernai on 2022-11-11 19:00:35.