BTC/USD Climbs Above 20836: Sally Ho’s Technical Analysis – 6 November 2022

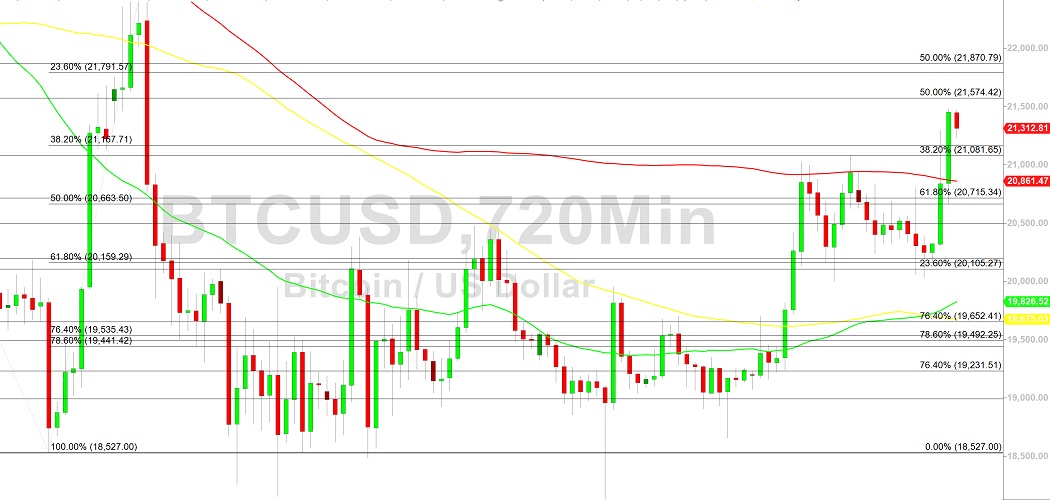

Bitcoin (BTC/USD) sought to add to recent upside progress early in the Asian session as the pair recently traded as high as the 21478.80 area, its strongest print since mid-September and a test of the 50% retracement of the broad depreciating range from 25214.57 to 18131. Stops were elected above the 20836.92 area during the ascent, a level that represents the 38.2% retracement of the same depreciating range. Additional upside retracement levels in depreciating ranges from the 48240, 32371, and 25214.57 levels include the 22508, 23542, 23579, 23698, 25236, 25251, and 26931 areas.

BTC/USD bears observe larger Stops accumulating below the 17803, 17701, 16966, and 16503 areas, significant technical levels related to historical upside pressure around the 3858 and 9819 levels. Additional significant technical areas on the downside include the 16990.14, 14500.15, and 10432.73 areas. Stops are also accumulating below the 19711 and 19355 areas. Traders are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bullishly indicating above the 100-bar MA (hourly) and above the 200-bar MA (hourly).

Price activity is nearest the 50-bar MA (4-hourly) at 20506.95 and the 50-bar MA (Hourly) at 20311.73.

Technical Support is expected around 16990.14/ 14500.15/ 10432.73 with Stops expected below.

Technical Resistance is expected around 25256.96/ 27455.20/ 32383.96 with Stops expected above.

On 4-Hourly chart, SlowK is Bullishly above SlowD while MACD is Bullishly above MACDAverage.

On 60-minute chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

Disclaimer: Sally Ho’s Technical Analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Sourced from cryptodaily.co.uk.

Written by Sally Ho on 2022-11-05 17:00:00.