As discussions surrounding the decentralization of the XRP Ledger resurface, a recent claim made by an enthusiast has sparked renewed debate within the community. The focal point of this discussion revolves around the role of the XRPL Foundation (XRPLF) in defining validators within the default Unique Node List (dUNL), a widely relied upon list of XRP Ledger nodes.

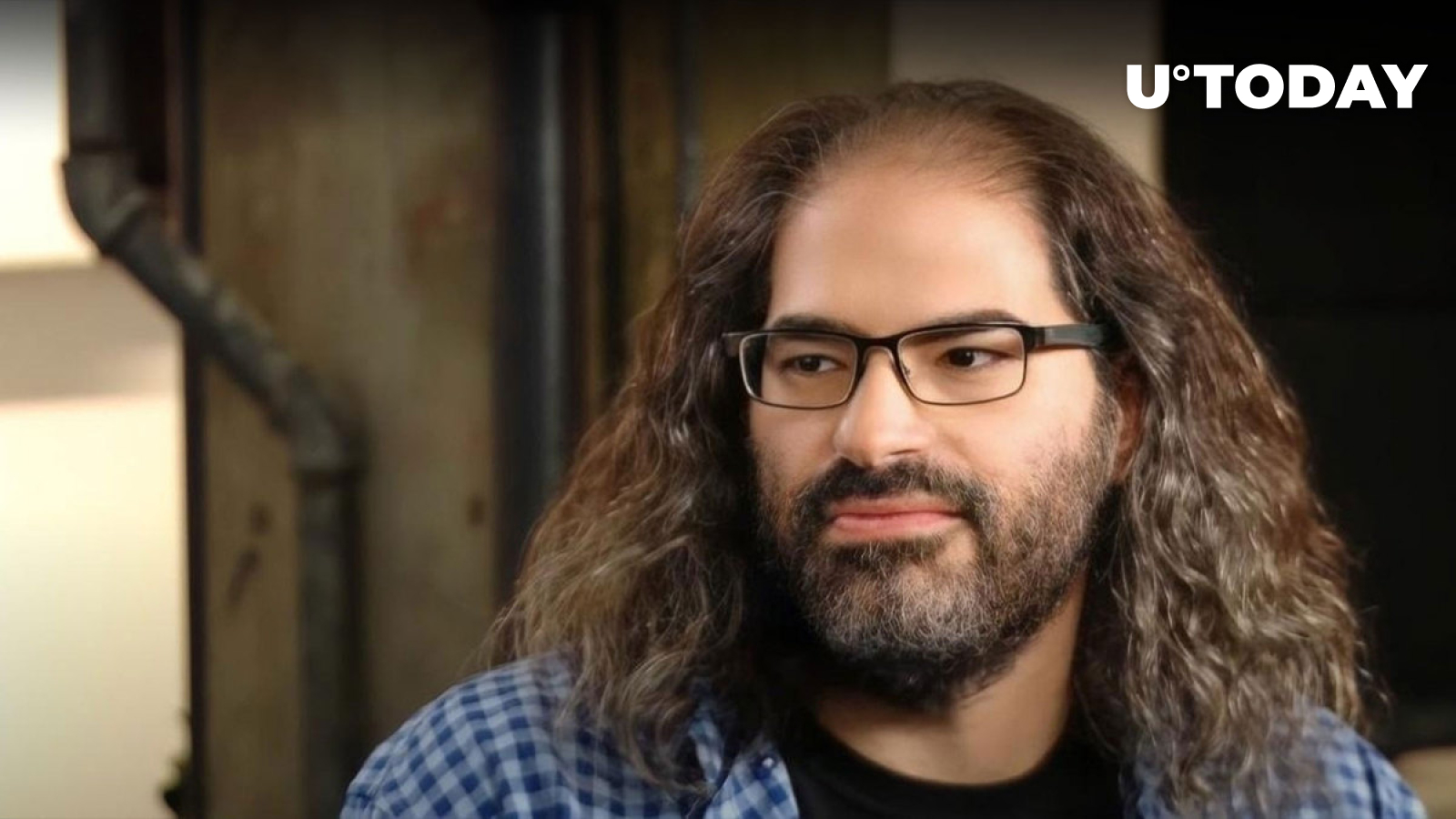

In response to these claims, David Schwartz, XRPL architect and current Ripple CTO, addressed the issue. He emphasized that XRPLF does not possess the authority to dictate who can or cannot operate a validator on the ledger. He underscored the importance of decentralization by stating that if the foundation had such powers, he would never argue in favor of XRPL’s decentralization. He asserted that individuals are not obliged to abide by XRPLF’s decisions if they disagree with them.

Schwartz further elaborated that in the event of any genuine disputes over network governance, interested parties would be required to develop their own code that enforces their preferred stance. This flexibility lies at the core of XRP Ledger’s design, as it enables the changing of dUNL with a simple one-line alteration. Currently, the majority of UNL providers follow the foundation’s recommendations due to the absence of significant governance disputes, concluded the developer.

Importantly, Schwartz emphasized that XRPL validators lack meaningful control or decision-making authority. They are not financially compensated, which is minimizing conflicts unless there are rule disagreements, he argued.

While concerns have been raised about the centralized nature of the blockchain due to the predominance of Ripple and XRPL Foundation validators within the dUNL, Schwartz’s response reinforces the view that the influence is not absolute.

Sourced from u.today.

Written by Gamza Khanzadaev on 2031-10-21 09:38:07.