Market intelligence platform IntoTheBlock has conducted a comprehensive analysis, shedding light on current trends and token performances. The 7-day average transaction analysis has unveiled intriguing insights, showcasing the dominance of Uniswap in the DeFi space. Maker and Aave closely trail Uniswap, while 0x is an outlier with significantly fewer daily transactions.

Another pivotal observation by IntoTheBlock revolves around the Total Value Locked (TVL) in DeFi protocols, which has recently hit a 2.5-year low. This downtrend is rooted in a series of events that led to a negative feedback loop within the ecosystem.

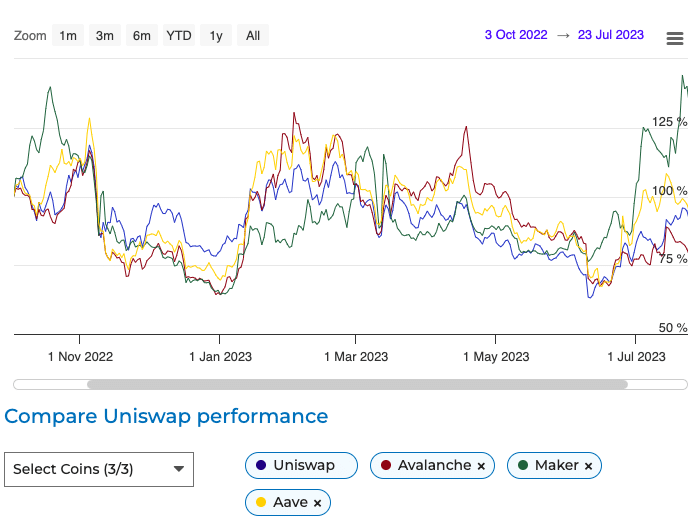

DeFi Movers: Uniswap, Maker, and Avalanche

Uniswap price a cornerstone of the DeFi space, is currently trading at at $4.57 with a 24-hour trading volume of $91 million. While it witnessed a minor 2.33% decline in the last 24 hours, its significant impact on the DeFi ecosystem remains undisputed.

Uniswap comparison with AAVE, MAKER, AVAX Source: Coingape

Maker, a substantial player in the DeFi sector, is trading at $996.75. Despite a recent 5.93% dip in the last 24 hours, Maker’s influence in the market is undeniable. With AAVE price at $56.28, Aave has experienced a slight 0.99% decrease in the last 24 hours. Its unique approach and growing ecosystem contribute to its standing in the market.

DeFi Comeback? Fluctuating Transaction Trends and Promising Signs

With a steep 80% drop in 2022, plummeting token prices set off a chain reaction that impacted yields, eroding the perceived value of DeFi protocols. Coupled with a waning appetite for speculative investments, the current TVL slump is unsurprising, marking its lowest point since 2021.

The market analysis unveils intriguing transaction trends, with a noticeable spike evident at the start of the current month. This surge is far from coincidental, as the data uncovers a sustained trend following a significant upswing observed in June. The robust transaction levels witnessed in this period underscore the growing adoption and resilience of certain DeFi assets.

Sourced from cryptonews.net.