- What is Crypto Farming?

- How Does Crypto Farming Work?

- 1. Liquidity Provider (LP)

- 2. Lending

- 3. Borrowing

- 4. Staking

- Popular Crypto Farming Protocols

- 1. Curve Finance

- 2. Aave

- 3. Uniswap

- 4. PancakeSwap

- Benefits of Crypto Farming

- 1. Passive Income Generation

- 2. Liquidity Provision and DEX Efficiency

- 3. Attractive High Yields

- 4. Portfolio Diversification

- Risks of Crypto Farming

- 1. Impermanent Loss

- 2. Smart Contract Exploits

- 3. Rug Pulls

- Conclusion

In the dynamic world of crypto farming, also known as yield farming, the principles of yield and liquidity intersect to create new opportunities and challenges within the decentralized finance (DeFi) landscape. Yield farming isn’t just a method; it’s a cornerstone of the DeFi ecosystem, allowing participants to maximize returns by providing liquidity to decentralized protocols.

Imagine contributing pairs of tokens, like Ethereum (ETH) and stablecoins, to liquidity pools that facilitate seamless crypto asset trading, all without traditional order books. This article delves into the mechanics of yield farming, smart contract-based strategies, and popular protocols driving this financial revolution. So, join us on this expedition into the heart of crypto farming, where we demystify the complexities and explore the opportunities that shape this transformative financial frontier.

What is Crypto Farming?

What exactly is crypto farming, you might ask? Well, it’s a sophisticated crypto trading strategy meticulously designed to optimize returns by actively participating in providing liquidity to DeFi protocols. This strategic endeavor unfolds within the dynamic landscape of automated market makers (AMMs), notably prominent platforms like Uniswap and SushiSwap. These decentralized exchanges operate on the innovative concept of liquidity pools, doing away with the reliance on traditional order books in the crypto asset trading realm.

The mechanics of crypto farming involve diligent contributors, known as yield farmers, who deposit pairs of tokens into these liquidity pools, often pairing up Ethereum with a stablecoin, for instance. By pooling together these digital assets, they create a dynamic environment wherein other DeFi enthusiasts can seamlessly swap tokens at their convenience, eliminating the need to wait for a matching counterparty.

As a token of appreciation for their contribution to liquidity, these farmers are rewarded with liquidity provider (LP) tokens, essentially serving as a representation of their ownership stake in the pool’s combined assets. The beauty of this intricate system reveals itself each time a trader utilizes these liquidity pools for token swapping—they incur a transaction fee. The collective brilliance of the protocol ensures that these fees are proportionately distributed among the holders of LP tokens, effectively translating into tangible returns for the yield farmers.

In some instances, DeFi platforms may sweeten the deal by distributing native governance tokens as supplementary rewards to LPs, fostering a vibrant ecosystem that not only encourages active participation but also plays a pivotal role in decentralized decision-making that molds the future trajectory of the protocol. Now, extending the narrative into the vast DeFi landscape, various lending protocols present opportunities for liquidity providers to stake their hard-earned LP tokens.

This additional layer of involvement in the yield farming process opens up avenues for secondary yields, potentially amplifying the overall returns for those participating in DeFi protocols. However, it’s important to note that LP holders must follow a careful process of unstaking their tokens and redeeming them to unlock the accrued yields. Fear not, as this is seamlessly facilitated by the protocol, automatically crediting these hard-earned rewards to the connected crypto wallets of the LPs, completing the intricate cycle of yield farming.

How Does Crypto Farming Work?

Ever wondered about the intricacies of yield farming and how it operates? Well, buckle up for a journey into the fascinating realm of yield farming, a financial strategy that enables investors to reap returns by staking their coins or tokens within decentralized applications (dApps). These dApps encompass a wide array of platforms, ranging from crypto wallets to decentralized exchanges (DEXs) and even extending to decentralized social media platforms.

The essence of crypto farming lies in utilizing DEXs to engage in activities such as lending, borrowing, or staking coins, effectively capitalizing on interest gains and capitalizing on market price fluctuations. At the core of this financial landscape are smart contracts, ingenious pieces of code that automate and execute financial agreements seamlessly between two or more parties. Now, let’s delve into the diverse types of crypto farming strategies:

1. Liquidity Provider (LP)

Picture this – users contribute pairs of coins to a DEX, thereby injecting liquidity into the trading ecosystem. In return, exchanges impose a modest fee for swapping these two tokens, and guess who gets a piece of that pie? That’s right, liquidity providers! As an added bonus, these fees may sometimes be disbursed in the form of newly minted LP tokens, adding an extra layer of reward for their contribution.

2. Lending

Holders of coins or tokens can take on the role of lenders by entrusting their crypto to borrowers through the magic of smart contracts. The beauty of this lies in the interest earned from the loans extended, creating an additional avenue for yield generation. In the expansive landscape of crypto farming, this lending facet adds a dynamic layer, allowing participants to diversify their yield-generating strategies and contribute to the vibrant ecosystem of decentralized finance.

3. Borrowing

Now, farmers can spice things up by using one token as collateral to secure a loan in another. In a clever twist, they can then utilize the borrowed coins for yield farming, all while retaining their initial holdings. This dual-pronged approach allows farmers to potentially witness an increase in the value of their original assets over time while simultaneously earning yield on the borrowed coins.

4. Staking

Staking, a practice with dual facets in the DeFi universe. Firstly, in proof-of-stake blockchains, users are incentivized with interest to pledge their tokens, thereby enhancing network security. The second dimension involves staking LP tokens earned from supplying liquidity to a DEX. This strategic move enables users to double-dip in the yield pool, earning rewards for supplying liquidity in LP tokens, which can then be staked to yield even more returns.

Popular Crypto Farming Protocols

Now that you’ve gained insights into the intricacies of crypto farming and its operational dynamics, let’s delve into an exploration of the premier yield farming protocols that dominate the DeFi landscape. These protocols exemplify the cutting-edge of yield generation in the crypto space, offering investors diverse opportunities to maximize returns through strategic participation in the decentralized ecosystem.

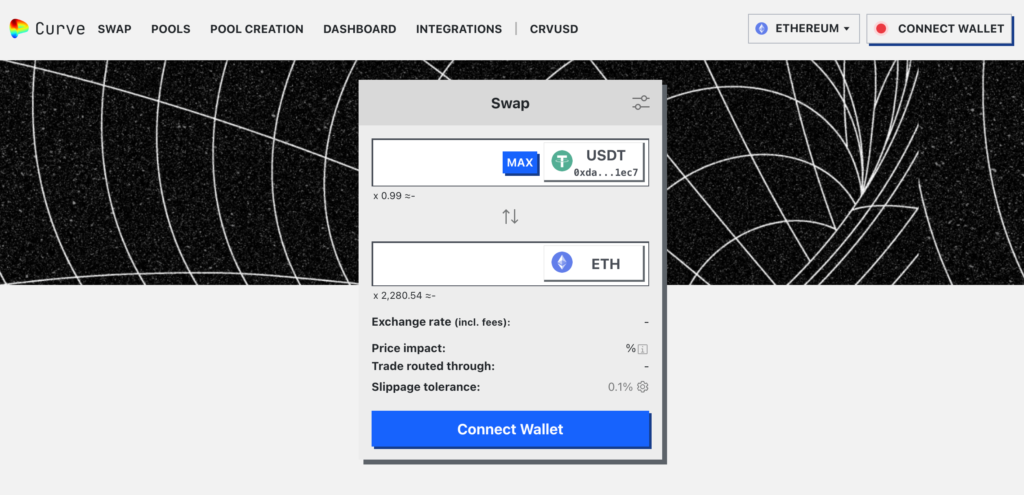

1. Curve Finance

Curve stands out as the foremost DeFi platform, boasting an impressive total value locked of nearly $19 billion. Distinguishing itself with a proprietary market-making algorithm, the Curve Finance platform maximizes the utilization of locked funds, surpassing all other DeFi platforms. This strategic approach proves advantageous for both swappers and liquidity suppliers engaged in the platform’s ecosystem. At the core of Curve’s appeal is its extensive array of stablecoin pools, featuring attractive APRs intricately tied to fiat cash.

Maintaining a commitment to high APRs, ranging from 1.9% for liquid tokens to an impressive 32%, Curve ensures an enticing environment for users. The stability of stablecoin pools is notably secure, provided the tokens maintain their peg, thus mitigating the risk of impermanent loss. This resilience stems from the relative stability of token values within these pools, preventing drastic alterations in comparison to each other.

While Curve excels in minimizing impermanent loss, it is essential to acknowledge the inherent risks associated with DEXs, including potential temporary losses and smart contract vulnerabilities. To further enhance its ecosystem, Curve introduces its native token, CRV, serving a dual purpose as a governance token for the Curve DAO. This token not only bolsters the platform’s decentralized decision-making but also adds an additional layer of participation and engagement for the community of Curve users.

2. Aave

Aave stands tall as one of the preeminent stablecoin yield farming platforms, commanding an expansive user base with a staggering value locked exceeding $14 billion and an impressive market capitalization surpassing $3.4 billion. The platform’s robust ecosystem is complemented by its proprietary native token, AAVE, strategically designed to incentivize users to actively engage with the network.

This token not only serves as a testament to Aave’s commitment to fostering user participation but also bestows exclusive benefits, ranging from fee savings to the coveted power of governance voting. In the intricate landscape of crypto farming, collaboration among liquidity pools is a common phenomenon, enhancing the overall efficiency and profitability of participants.

A standout example within the Aave ecosystem is the Gemini dollar, which boasts a deposit APY of 6.98% and a borrow APY of 9.69%. As the highest-earning stablecoin available on Aave, the Gemini dollar beckons yield farmers with a lucrative opportunity to capitalize on its impressive APY rates, further solidifying Aave’s position as a frontrunner in the realm of stablecoin yield farming.

3. Uniswap

Uniswap is a leading DEX system, pioneering a revolutionary approach to token exchanges by eliminating the need for trust in transactions. The innovative mechanism involves liquidity providers investing an equivalent value in two tokens to establish a dynamic market within the platform. Subsequently, traders gain the ability to seamlessly exchange tokens by leveraging the liquidity pool created.

In appreciation of their crucial role, liquidity providers are rewarded with fees derived from the trades executed within their respective pools. Uniswap has rapidly ascended to the zenith of popularity in the world of trustless token swaps, thanks to its frictionless and user-friendly design. This exceptional feature has positioned Uniswap as a go-to platform, particularly in the context of high-yield agricultural systems where users seek seamless and secure token exchanges.

Adding to its allure, Uniswap introduces its proprietary governance token, UNI, which plays a pivotal role in the decentralized autonomous organization (DAO) overseeing the platform’s governance. This token not only underscores Uniswap’s commitment to community participation but also empowers users to actively contribute to the decision-making processes that shape the future trajectory of the platform.

4. PancakeSwap

PancakeSwap operates under a framework akin to Uniswap, but with a distinctive twist—this DEX runs on the Binance Smart Chain (BSC) network rather than Ethereum, providing users with an alternative ecosystem. Beyond its core functionality, PancakeSwap introduces gamification-focused features, adding an extra layer of engagement for its community.

In addition to facilitating BSC token exchanges, PancakeSwap offers a diverse array of attractions, including interest-earning staking pools, non-fungible tokens (NFTs), and even an intriguing gambling game that challenges players to predict the future price of Binance Coin (BNB). Despite its unique offerings related to crypto farming, PancakeSwap shares common risks with Uniswap, including the potential for impermanent loss due to significant price fluctuations and the inherent risk of smart contract failures.

To enrich user engagement, PancakeSwap introduces its native token, CAKE, a versatile asset that not only functions within the platform but also carries the power to influence decision-making through voting on proposals that shape the platform’s evolution. This dual functionality underscores PancakeSwap’s commitment to fostering a vibrant community actively involved in steering the course of its development.

Benefits of Crypto Farming

Yield farming emerges as a multifaceted and advantageous financial strategy, offering participants the opportunity to not only generate yield but also actively contribute to the evolution of decentralized finance ecosystems. Here’s an in-depth look at the benefits that make crypto farming an enticing proposition:

1. Passive Income Generation

One of the standout advantages of crypto farming lies in its ability to transform idle holdings into a source of passive income. Instead of merely holding assets, users can actively engage in yield farming, putting their holdings to work. Through this dynamic participation, users stand to reap rewards in the form of additional tokens and fee income, all achieved without the need for active trading.

2. Liquidity Provision and DEX Efficiency

Yield farming plays a pivotal role in enhancing the efficiency of decentralized exchanges by facilitating liquidity provision. Users who engage in crypto farming contribute liquidity to these platforms, thereby reducing slippage during trades. This critical function is integral to the seamless operation of the decentralized finance ecosystem, as it ensures smoother and more efficient token exchanges.

3. Attractive High Yields

A compelling facet of crypto farming is the potential for high yields, often surpassing those offered by traditional financial instruments. In the diverse landscape of DeFi projects, users encounter platforms that present alluring yield opportunities. Depending on prevailing market conditions, participants in crypto farming can potentially earn substantial returns on their capital, making it an enticing prospect for those seeking attractive and dynamic investment avenues.

4. Portfolio Diversification

Beyond the financial returns, yield farming offers participants the opportunity to diversify their portfolios. Engaging in different farming strategies across various protocols allows users to spread their risk and explore diverse avenues for yield generation. This inherent flexibility provides a valuable means of risk mitigation within the ever-evolving DeFi ecosystem.

Risks of Crypto Farming

It is essential to recognize that while the potential for attractive yield farm returns is enticing, it does not come without its share of risks and challenges. It is imperative for all crypto traders to carefully evaluate and understand the primary risk inherent in the pursuit of farming yields on decentralized exchanges. Let’s delve into the nuanced landscape of risks associated with crypto farming:

1. Impermanent Loss

Due to the mechanics of liquidity pools, providers of liquidity may find themselves earning a reduced return on their deposited assets compared to simply holding them without participating in a liquidity pool. This challenge is commonly referred to as impermanent loss and is frequently a consequence of heightened volatility in the cryptocurrency market.

It is important to recognize, however, that impermanent loss is often a potential loss that remains unrealized. It only transforms into an actual loss if the liquidity provider chooses to redeem their LP tokens when the value of their deposited tokens is lower. In certain instances, liquidity providers may find it advantageous to wait, allowing transaction fees or staking rewards to counterbalance any losses, or to observe whether asset prices recover over time as market volatility subsides.

2. Smart Contract Exploits

Smart contracts serve as critical segments of computer code, facilitating the autonomous operation of DeFi platforms by eliminating the need for human intermediaries. However, these software programs, in certain instances, may harbor bugs or vulnerabilities that malicious actors can manipulate and affect crypto farming platforms. Such programming flaws can result in financial losses or the manipulation of rewards.

The Solana wormhole exploit exemplifies the severe consequences of a smart contract vulnerability. A hacker identified a bug allowing them to mint 120,000 wrapped wormhole Ethereum (whETH) without providing any collateral. Subsequently, the hacker effortlessly exchanged the tokens for ETH, accumulating a total of $320 million. While independent code audits can mitigate these risks, it’s important to note that some vulnerabilities may still evade detection.

3. Rug Pulls

A DeFi rug pull is a deceptive practice within the DeFi domain where unscrupulous individuals establish a new project or protocol featuring its own proprietary token. These individuals set up a liquidity pool for the new token, maintaining control over a significant portion of its circulating supply. Within the pool, the native token is paired with a more widely accepted cryptocurrency like ETH or a stablecoin.

The perpetrators entice users to contribute to the liquidity pool and acquire their crypto token by introducing the popular crypto token into the pool to displace their project’s token. Ultimately, once the pool reaches a certain size, the founder(s) deluge the liquidity pool with their reserve of native tokens and withdraw all of the popular cryptocurrency. This maneuver drives the value of the project’s native token to zero, rendering it worthless for all holders while the perpetrators abscond with the valuable cryptocurrency.

Conclusion

As we reflect on the journey through the intricate world of crypto farming, it is evident that this dynamic strategy is not merely a trend but a fundamental aspect shaping the future of decentralized finance. With its potential for innovation, diversification, and community-driven governance, crypto farming stands as a testament to the resilience and adaptability of the DeFi ecosystem. As the landscape continues to evolve, crypto farming remains at the forefront, inviting participants to actively contribute to and benefit from the ongoing transformation of the financial paradigm.

Sourced from cryptonews.net.