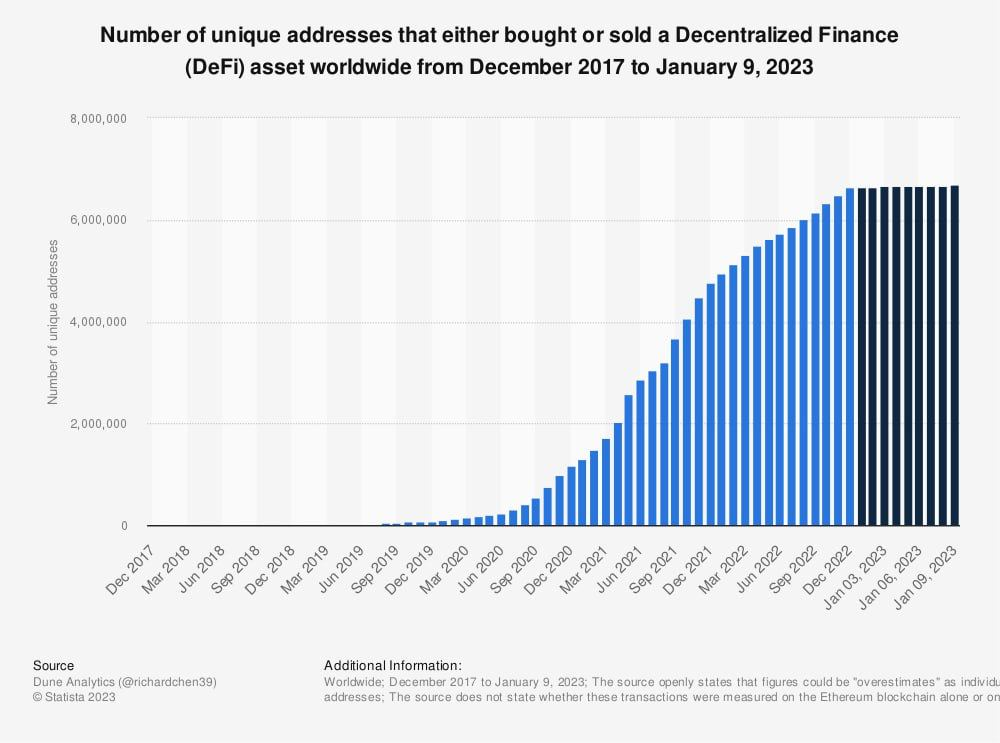

DeFi

The total value locked (TVL) in decentralized finance (defi) has fallen below the $40 billion mark for the first time since the first week of Feb. 2021. On Dec. 17, 2022, the TVL in defi is roughly $39.53 billion after dropping more than 4% in value during the past 24 hours.

Value Locked in Defi Drops Below $40 Billion

The value locked in defi protocols has dropped below the $40 billion region for the first time in 675 days, or since the first week of Feb. 2021. At that period in time, it was the first time the TVL in defi reached the $40 billion mark after climbing from the $1 billion zone a year prior in Feb. 2020.

With the aggregate locked in defi today at $39.53 billion, statistics show that Makerdao commands the largest TVL this weekend and dominates by 14.91%. Makerdao’s TVL is around $5.89 billion and during the last week, it has shed 6.88% in value. In terms of value-locked data, Makerdao’s TVL is followed by Lido, Curve, Aave, and Uniswap respectively.

Most of the value locked today is held on Ethereum as there’s $23.06 billion in value locked in ETH-based defi apps, which represents 58.33% of the aggregate locked. Ethereum’s TVL is followed by Tron, Binance Smart Chain, Arbitrum, Polygon, Avalanche, Optimism, Fantome, Cronos, and Solana.

The entire lot of smart contract protocol tokens today has lost 7.5% in value against the U.S. dollar, equating to a total of $240 billion. Out of the top ten smart contract protocol tokens, BNB saw the largest weekly decline as it has lost 17.6% during the past seven days. Ethereum Classic (ETC) suffered a loss of 16.3% during the past week and Tron suffered the least with a 2.2% loss over the last seven days.

Sourced from cryptonews.net.