Teahouse Finance was founded in 2021 to address the tough, concentrated liquidity provision dilemma. In basic words, the concentrated liquidity issue arises when liquidity providers are permitted to choose a certain price range for providing liquidity in order to be more purposeful and strategic in how they supply liquidity.

This capability was brought to the DeFi world with the March 2021 release of Uniswap V3. Teahouse Finance was aware of the possible issue with concentrated liquidity early on and intended to be the first to overcome the complex challenge.

Teahouse smart contracts employ dynamic algorithms to handle customers’ assets on their behalf, similar to an investment portfolio, with the bonus that users may enter/exit on a weekly basis.

Techniques use a variety of inputs, including market volatility, to dynamically alter liquidity pool ranges and hedge positions in order to maximize trading fees while limiting temporary loss.

In addition to liquidity, the company has created seven DeFi strategy vaults across several chains to assist people and companies in conveniently investing and becoming more lucrative on Web3. Initially restricted to Teahouse NFT holders, the company released its first publicly available liquidity provision strategy in January of this year, with an average APR of 54.37%.

Teahouse co-founder and CEO Fenix Hsu stated:

“With the recent collapse of trust in CEXes due to underhanded dealings by ex-industry-leaders like FTX, it is now more critical than ever to provide secure and transparent investment options that reside on-chain. We continue to focus on solving the hardest challenges, educating the community, and building an awesome ecosystem with our partners.”

In addition to its primary goal of democratizing DeFi via initiatives like Perpetual Protocol and Chainlink, Teahouse Finance plans to launch its enterprise-ready B2B offering, Teahouse Private Vaults, in Q2.

These unique vaults, with specific smart contracts for each investment, are managed by Safe’s multi-sig wallets, gated by NFTs, and safeguarded by action filters that allow only certain transactions to occur. Teahouse Private Vaults are intended for Web3 projects searching for a secure location to HODL or keep their assets and conventional enterprises interested in diversifying into cryptocurrency.

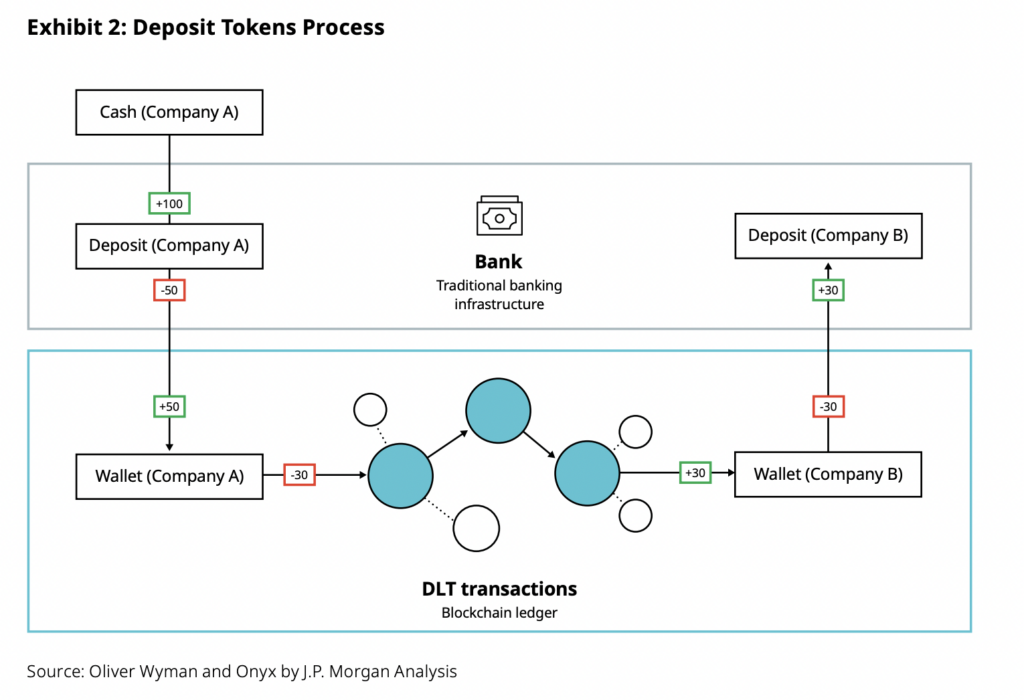

Teahouse employs off-chain algorithms that communicate with the main TeaVault through smart contracts. The TeaVault, constructed on modular vaults dubbed “atomic vaults” that communicate with distinct DeFi protocols, holds the user assets on-chain.

According to the project team, the $5 million will be spent on numerous vault products now under development.

The company’s DeFi interaction filters protect all transactions made possible by these vaults, and only those pre-approved are carried out automatically by smart contracts. These interactions are managed by the HighTableVault, which also handles network fees and incentive payments.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Sourced from cryptonews.net.