Tokenized real-world asset (RWA) platform Ondo Finance is expanding beyond the Ethereum mainnet to the Polygon network, the company said Thursday.

The platform has issued its OUSG token, a tokenized version of BlackRock’s short-term U.S. government bond exchange-traded fund, natively on Polygon as part of a “strategic alliance,” according to a press release.

The firm also plans to bring its upcoming yield-generating stablecoin alternative, which is a tokenized money market fund called OMMF, as well as the Ondo-developed decentralized lending marketplace Flux Finance – pending governance approval – to Polygon, Justin Schmidt, president and chief operating officer of Ondo, said in an interview.

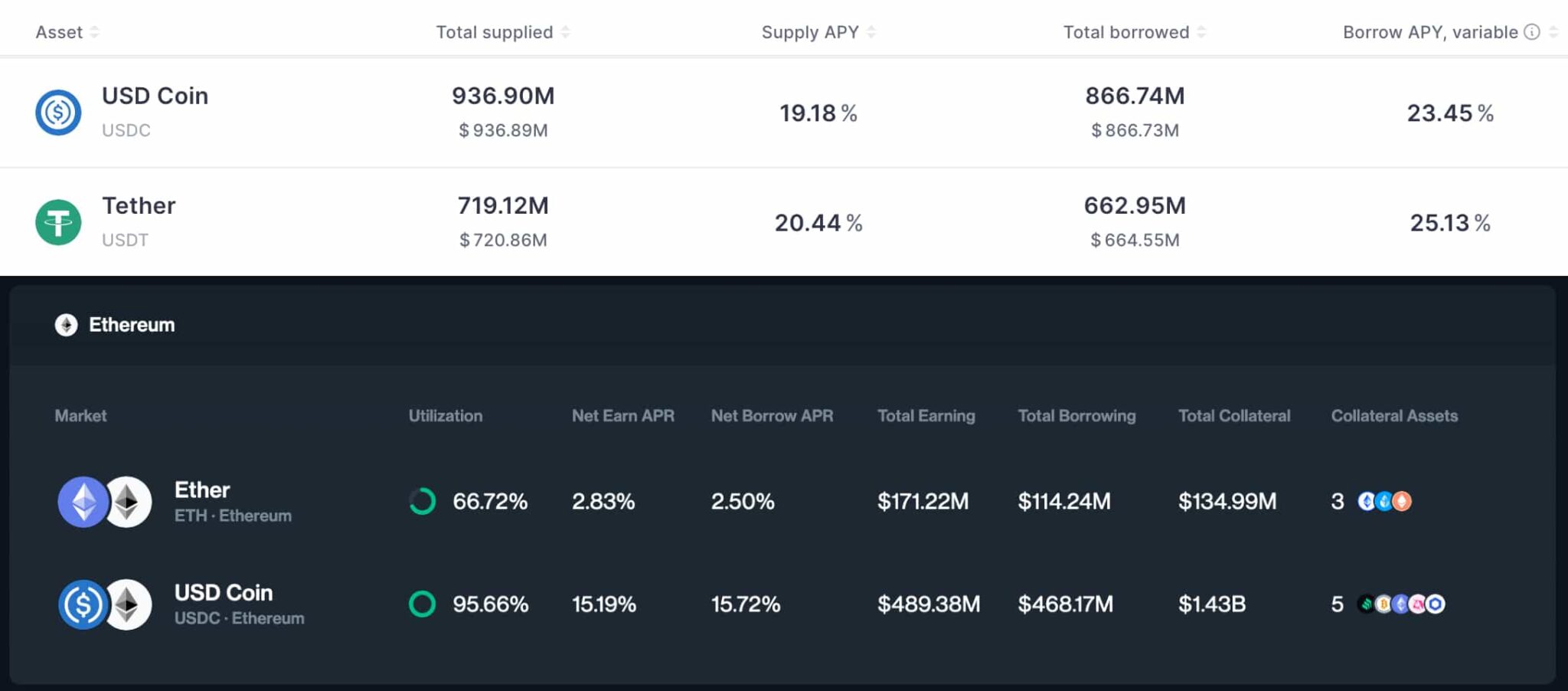

The development comes as demand for tokenized versions of traditional financial instruments such as U.S. Treasurys is growing among investors, as bond yields have surpassed rates in decentralized finance (DeFi) lending markets. Wealth management firm Bernstein forecast that tokenization of RWAs could grow to $5 trillion in market value in the next five years.

Tokenized Treasurys has grown to a $600 million market, with Ondo Finance’s OUSG token claiming a significant share of $134 million since its inception in January. Flux Finance, developed by Ondo’s team and governed by a decentralized autonomous organization (DAO) through community votes, lets investors take out loans by pledging OUSG as collateral. It has $44 million of total value locked on the platform, according to DefiLlama.

Ondo’s move follows asset management giant Franklin Templeton, which made its tokenized Franklin OnChain U.S. Government Money Fund (FOBXX) available on Polygon after releasing it on Stellar in 2021.

Polygon is a layer 2 scaling network of Ethereum that allows users to transact more cheaply and faster than on the mainnet, which is prone to clogging during times of high blockchain activity, while still relying on Ethereum’s security.

“Ondo Finance building on Polygon is a crucial step toward bridging the gap between DeFi and institutional-grade finance,” said Colin Butler, global head of institutional capital at Polygon Labs.

Sourced from cryptonews.net.