Mantle EcoFund has successfully deployed $10 million in investments across six prominent DeFi projects within the Mantle Ecosystem, namely Merchant Moe, INIT Capital, Butter, Renzo, MUFEX, and TsunamiX. The fund operates with a substantial capital pool of $200 million under the management of Mirana Ventures.

—

This significant achievement follows the completion of the initial capital call, and Mirana Ventures is gearing up for a second capital call of $30 million as outlined in MIP-24. The infusion of fresh funds into these DeFi projects solidifies Mantle EcoFund’s commitment to nurturing innovation and growth within the Mantle Ecosystem.

The six DeFi projects, each bringing its unique strengths to the ecosystem, include:

Merchant Moe, an automated market maker (AMM) decentralized exchange (DEX);

INIT Capital, introducing a “Liquidity Hook” money market;

Butter.xyz, a Mantle-native DEX focusing on trend-driven opportunities;

Renzo, an EigenLayer liquid restaking hub;

MUFEX, a multichain decentralized perpetual exchange; and TsunamiX, a gamified margin trading and spot DEX.

These investments empower Mantle EcoFund to offer liquidity support, aligning with Mantle Governance MIP-26 guidelines.

The provision allows for a combined liquidity support of up to 60 million USDx (stablecoins), 30,000 ETH, and 120 million $MNT for EcoFund-backed decentralized applications (dApps).

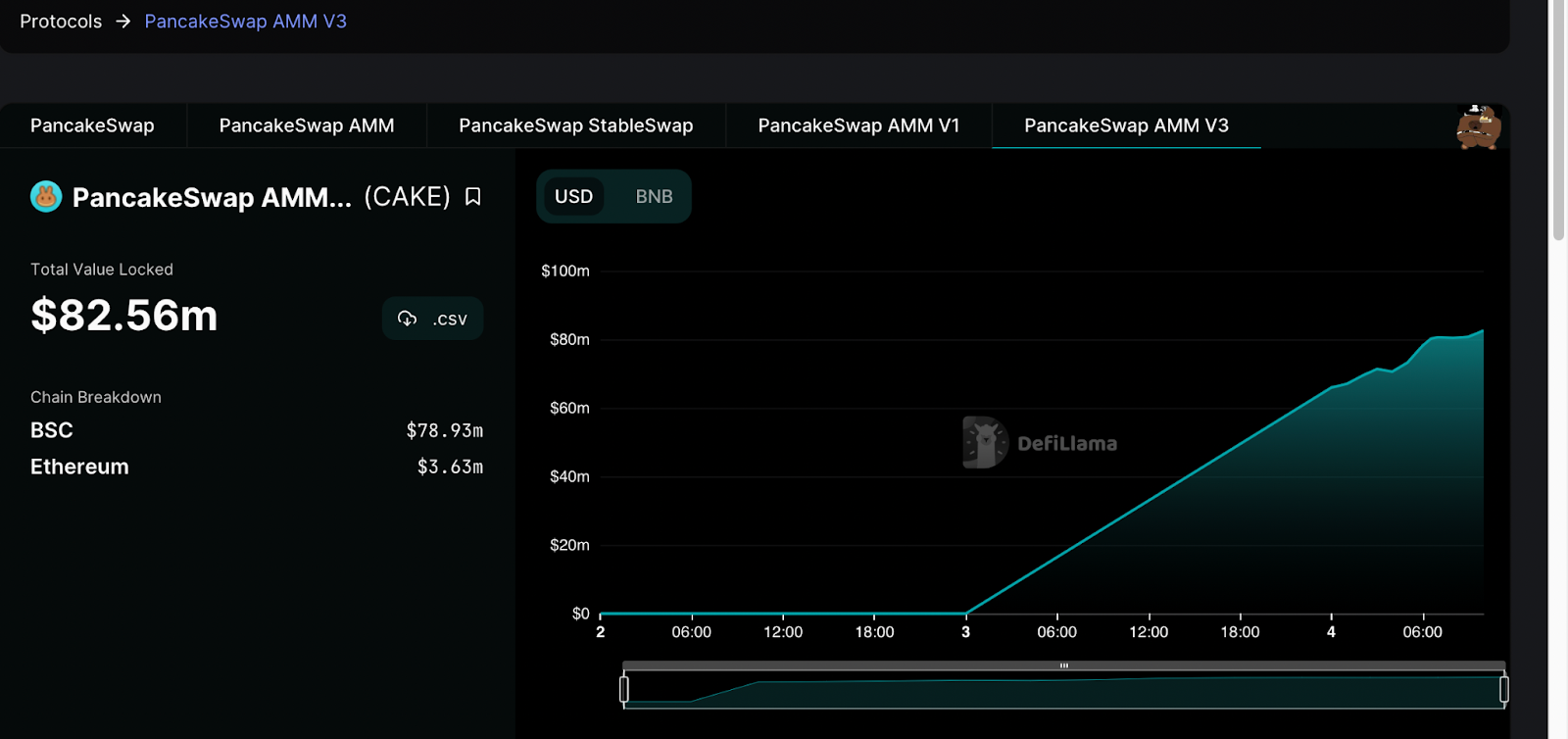

The six selected projects are integrating $mETH, the value-accumulating receipt token of Mantle’s liquid staking protocol Mantle LSP — currently the fifth LSD by TVL according to DefiLlama, and $mUSD, the rebasing wrapped version of Ondo Finance’s tokenized bearer note $USDY.

This integration offers native yield backed by real-world assets such as U.S Treasury bills and bank demand deposits, reinforcing Mantle Ecosystem’s position as a yield powerhouse with best-in-class native yield through LSP and RWA.

Merchant Moe, the AMM DEX by Trader Joe’s team, has quickly gained traction with 4.7k active users on launch day and $25 million TVL within the first week. INIT Capital’s “Liquidity Hook” money market facilitates seamless lending, borrowing, and yield strategies — while Butter.xyz caters to self-identified degens, providing opportunities for trend-driven speculation.

“Mantle’s team has built an amazing ecosystem with both unique innovators and veteran protocols. In the month since Butter’s launch, we’ve seen increasing momentum each day. 2024 is going to be the year of Mantle.”

@butterbagel_, CEO of Butter

Renzo, EigenLayer’s liquid restaking hub, has attracted $75 million in its first month. MUFEX, a decentralized perpetual exchange, and TsunamiX, a gamified margin trading DEX, bring chains and gamification into the CEX experience.

The adoption of $mETH and $mUSD by these projects is seen as a positive development, offering users enhanced benefits and contributing to Mantle Ecosystem’s reputation as a leading yield powerhouse. These projects join Mantle EcoFund’s existing portfolio projects, including LiquidX, Valent, and Range Protocol.

“We are thrilled to see new ecosystem allies such as Merchant Moe, INIT Capital, Butter, Renzo and MUFEX integrate $mETH and $mUSD,” said David Toh, partner of Mirana Ventures, Mantle EcoFund’s operator.

“The adoption of these yield-bearing instruments offers great benefits and rewarding experience to users, and further bolsters Mantle Ecosystem’s status as a yield powerhouse that is home to best-in-class native yield.”

David Toh, Partner of Mirana Ventures

The move is anticipated to provide a rewarding experience to users while reinforcing Mantle Ecosystem’s position as a hub for best-in-class native yield.

—

About Mantle EcoFund

Mantle EcoFund is an ecosystem venture fund established by the Mantle community through DAO governance to help fuel the growth of Mantle. The fund aims to catalyze and manage a capital pool of $200 million, and be the “first money” into high quality and innovative early-stage projects building within Mantle Ecosystem. Mantle EcoFund is one of the largest ecosystem funds of its kind in the space. Projects looking to build on Mantle are encouraged to reach out to Mantle EcoFund at https://www.mantle.xyz/ecofund.

About Mantle

Mantle Ecosystem comprises an Ethereum layer 2 (L2) — Mantle Network, a decentralized autonomous organization (DAO) — Mantle Governance, one of the largest on-chain treasuries — Mantle Treasury, and an Ether (ETH) liquid staking protocol — Mantle LSP: all built on Ethereum. Mantle token ($MNT) is the unified product and governance token of the ecosystem.

Mantle’s first core product is Mantle Network, an Ethereum L2. Mantle Network strives to be compatible with the Ethereum Virtual Machine (EVM). Mantle Network’s modular architecture separates transaction execution, data availability, and transaction finality into modules — which can be individually upgraded and adopt the latest innovations.

Mantle Network is the first L2 to partner with ETH restaking protocol EigenLayer for the data availability module. By adopting a rollup architecture, Mantle Network is secured by Ethereum. As the world’s first DAO-spawned L2, Mantle Network is pioneering a vision for the mass adoption of token-governed technologies.

Mantle token ($MNT) powers Mantle Network as its native gas token and ecosystem growth token, and serves as the governance token of Mantle Governance. All future Mantle products will likewise be initiated by the Mantle token holder community through vote and powered by Mantle token.

Sourced from cryptonews.net.