DeFi

www.coindesk.com

16 May 2023 08:58, UTC

Reading time: ~2 m

Decentralized finance (DeFi) credit marketplace Atlendis Labs has deployed its upgraded version on the Polygon blockchain’s mainnet, with payment service provider Banxa being the first borrower, the protocol announced in a press release.

The upgrade allows borrowers the option for early repayment before maturity or to roll over a part of the outstanding credit, introduces compliance options for pools to be permissionless or permissioned through know-your customer (KYC) checks and increases due diligence on borrowers.

Known as a popular on- and off-ramp service between fiat money and cryptocurrencies, Banxa will open a stablecoin credit pool of $2 million of Tether’s USDT. The firm will be the single borrower of the pool and will use the credit line to support its liquidity needs of growing daily transaction volumes.

The development comes as crypto-native platforms are increasingly offering traditional financial investments – so-called real-world assets (RWA) – such as private credit using blockchain technology and smart contracts, enabling speedier underwriting process and transactions. Tokenization of RWAs have become one of the hottest investment trends in crypto this year, driven by the collapse of DeFi lending and attractive yields in the real economy as central banks around the globe hiked interest rates to combat inflation.

Read more: Tokenization of Real-World Assets a Key Driver of Digital Asset Adoption: Bank of America

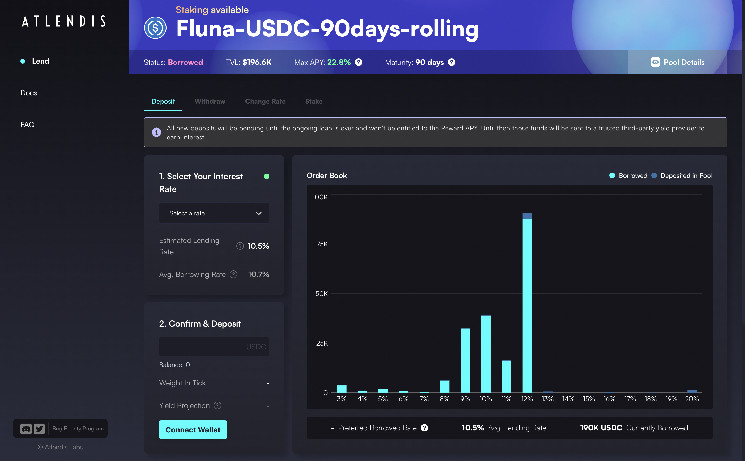

The Paris-based Atlendis offers revolving credit lines to small and medium-sized businesses and fintech firms using the protocol’s liquidity pools, where prospective lenders can deposit stablecoins to earn a yield. The protocol lets liquidity providers set a desired interest rate on their deposits with a built-in lending rate order book. If an investor’s interest rate position is filled, the protocol lends out the fund as a loan, otherwise it is deposited to DeFi lender Aave to earn a yield.

The new Banxa pool is the first of several new credit pools with fintech firms within the next few months, Alexis Masseron, chief executive officer of Atlendis, told CoinDesk.

Sourced from cryptonews.net.