MakerDAO, a blockchain protocol, is strategically positioning itself as a frontrunner in the real-world assets (RWA) sector, gaining significant attention within the crypto industry in recent times.

“MakerDAO has strategically diversified its revenue by incorporating US Treasury bonds into its portfolio,” the recent report states.

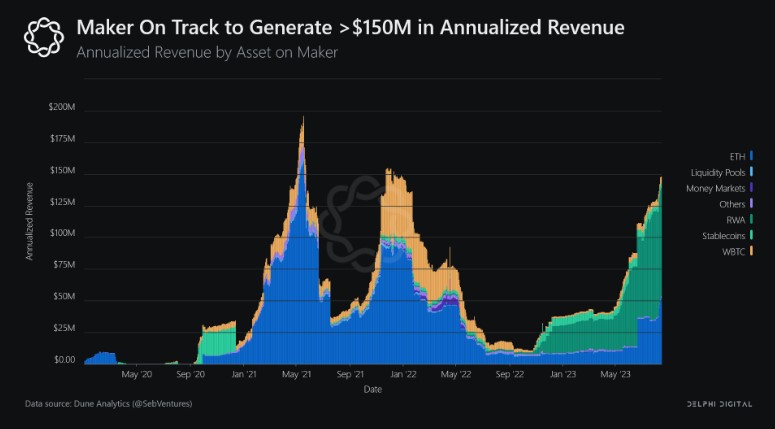

RWA is a Large Portion of Maker DAO Income Stream

A recent report indicates that Maker DAO’s choice to invest in US Treasuries in June 2023 appears to be yielding positive results. It positions Maker at the forefront of the real-world assets (RWA) sector.

RWAs represent on-chain counterparts of physical world or traditional finance assets, encompassing a broad spectrum ranging from real estate and bonds to invoices.

“It is this strategy that has fueled positive price movement for MKR, leading yearly returns amongst top RWA protocols. It is also no surprise that MKR comes out on top in terms of average transaction volumes, reaching a daily average volume of $94.5M during the second week of January.”

Maker asserts that its inclination towards RWA has bolstered the risk profile of its collateral assets.

“This move has not only enhanced the stability of its income streams, generating over $100 million in annualized revenue but also improved the risk profile of its collateral assets,” the report notes.

According to a report in July 2023, MakerDAO earned 80% of its fee revenue from RWA.

However, on its website, Maker breaks down its collateral RWA into four sections: Cashlike, clean money, miscellaneous, and physically resilient. These four sections emphasize the assumption that there will be a significant crackdown on the use of RWA in crypto in the future.

“Physically Resilient RWA are real-world assets that cannot easily be seized. A DAO like Maker can retain some level of technical sovereignty over such assets,” it states.

Read more: RWA Tokenization: A Look at Security and Trust

RWA Tokenized Treasuries

Meanwhile, last year, RWA’s shined even throughout the bear market.

Furthermore, BeInCrypto reported in September 2023, that tokenized treasuries have seen a 450% growth since the start of 2023. This contributes significantly to the $1.66 billion added last year.

A recent Chainlink report suggests that enabling blockchain for assets currently outside the digital asset ecosystem. This will enhance financial systems, offering improved liquidity, increased transparency, and reduced systemic risks.

Read more: What Is The Impact Of Real World Asset (RWA) Tokenization?

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Sourced from cryptonews.net.