According to recent data unveiled by Messari, the decentralized social media platform Friend.tech, boasts the inflow of a staggering 300k unique users, boosting user activity. Eliminating the possible uncertainties on the sustainability of the platform, despite its stable user activity and rising daily revenue, Messari research analyst Ally Zach dived deeply into Friend.tech’s potential for future growth.

1/ @friendtech has onboarded over 300k unique users since launch, but is the platform’s growth sustainable?

🧵 pic.twitter.com/0iBU8cgJOH

— Ally Zach (@0xallyzach) October 6, 2023

Though Friend.tech’s weekly chat retention outpaces traditional social networking platforms, the average weekly trading retention has declined from 22% to a mere 5% over the course of time. According to the researcher, users should spend money “to test out a chat, subject to 10% tax on entry, and another 10% if the chat doesn’t work out”. Attributing the platform’s decline in trading retention to the minimal online business discussions and interpretations, Zach commented, “This could be a result of FT [Friend.tech] not being well suited for passive content consumption”.

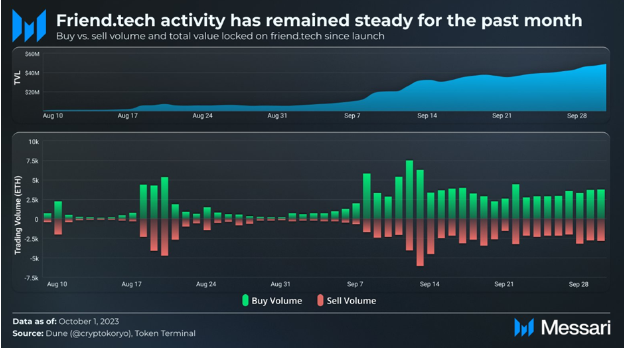

However, the analyst reiterated that the users’ participation in the leisure chats is consistent compared to the inconsistent trading deals, considering the appreciable chat retention. Despite the overall trading retention challenges, the platform has witnessed a substantial hike in trading activity in the month of September, reaching an all-time high in TVL of $50 million.

Source: Messari

In addition, Messari reinforced its bullish outlook on Friend.tech’s potential growth, unveiling the massive $320k average daily revenue fees, which is 6 times OpenSea’s current daily revenue. Narrating the platform’s appreciable TVL that has outdone major DeFi players, Messari cited,

FT has outpaced DeFi majors like Lido, Maker and Aave in daily rev/tvl since launch by a factor of over 100…Revenue / TVL indicates both an optimized business model execution while also acting as a predictive indicator of a platform’s ability to generate sustainable revenue.

In conclusion, the Messari researcher illuminated the promising nature of Friend.tech, taking into account several metrics. However, maintaining the momentum is crucial, though the current performance foreshadows a promising future.

General Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.

Sourced from cryptonews.net.