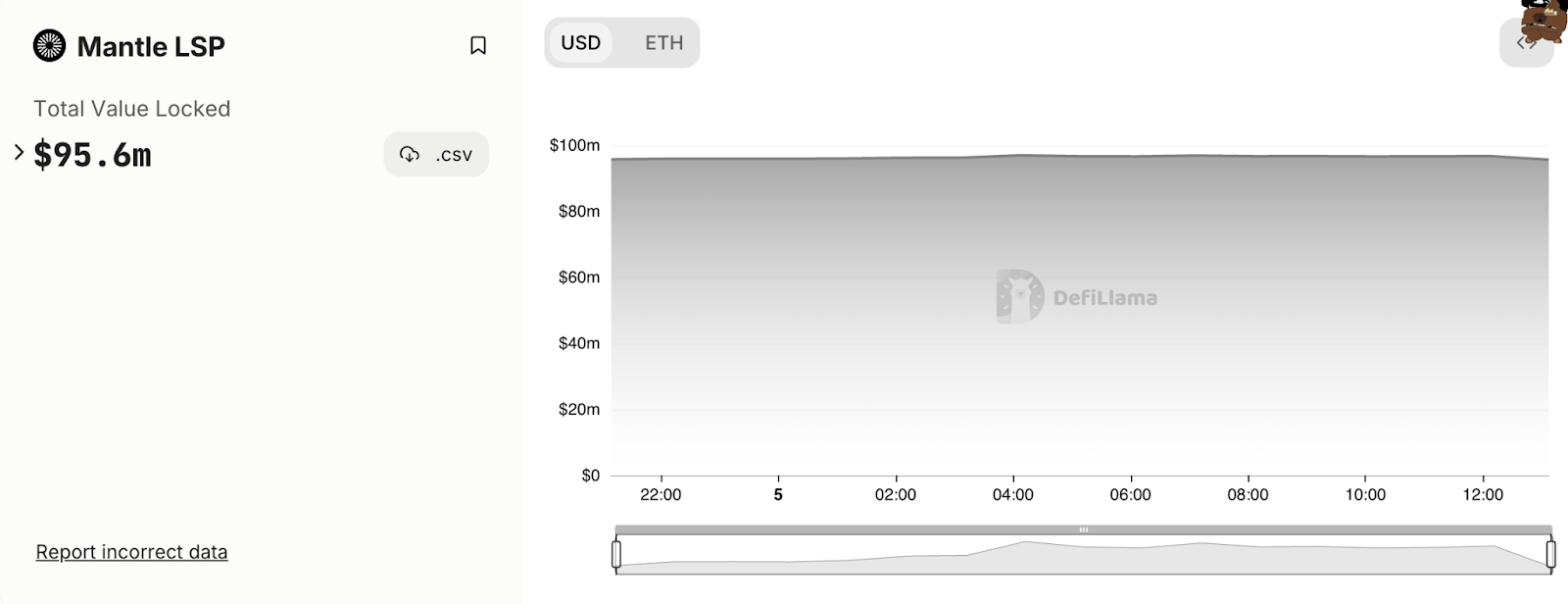

Mantle Liquid Staking Protocol’s (LSP) Total Value Locked (TVL) has almost surged to $100 million within 24 hours of the deployment. It offers native yield for Ethereum (ETH) and stablecoins.

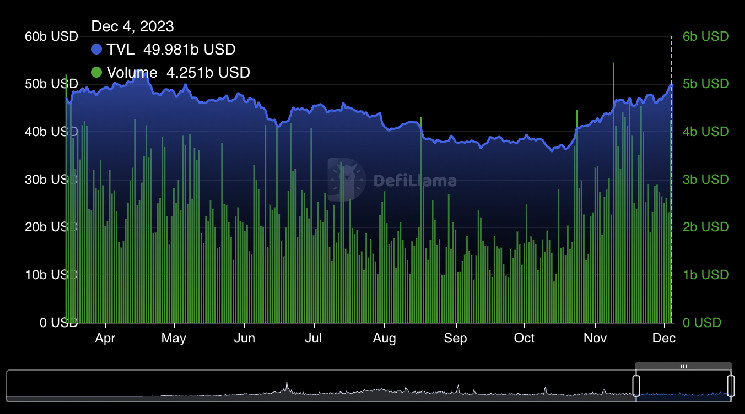

The trend of LSP has become immensely popular in the past couple of years. However, Lido has been the only dominant player in the LSP sector, bringing skepticism about the centralization. Lido has a TVL of $20 billion, approximately 10 times higher than Rocket Pool, the project with the second-highest TVL in the liquid staking category.

Now, new liquid staking projects are emerging, aiming to challenge Lido’s dominance.

Mantle LSP Aims to Offer 4% APY Native Yield

On Monday, the Ethereum Layer 2 solution Mantle announced the deployment of its permissionless, non-custodial Liquid Staking Protocol, Mantle LSP. The protocol promises a 4% APY native yield through Ethereum’s proof-of-stake (PoS) participation.

Read more: Top 7 High-Yield Liquid Staking Platforms To Watch in 2024

Similar to Lido’s stETH, Mantle LSP has mETH as a “value-accumulating receipt token” of the protocol. Within 24 hours of the deployment of Mantle LSP, it has almost hit a TVL of $100 million.

Mantle LSP TVL. Source: DefiLlama

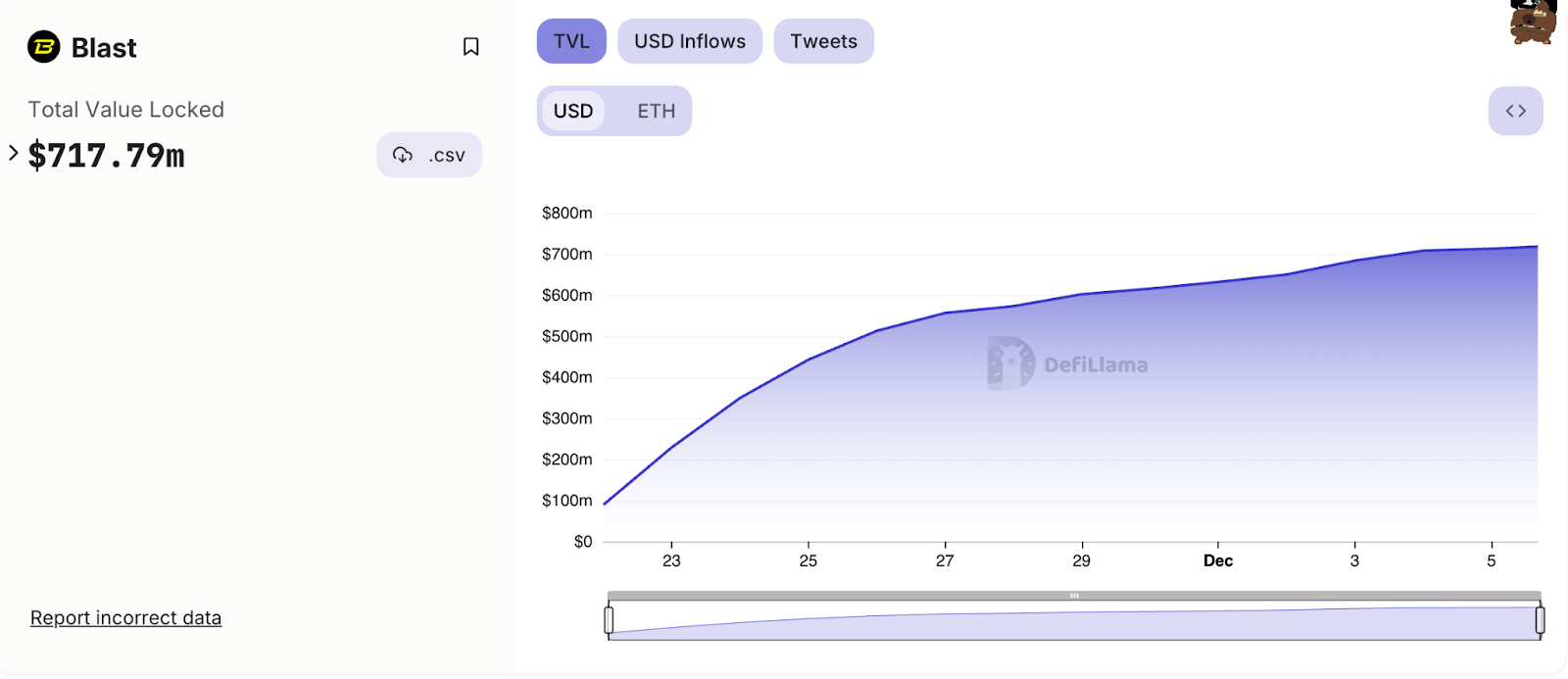

Along with Mantle LSP, many new protocols offering native yields have emerged. For instance, in November, Pacman, the founder of Blur, announced a Layer 2 protocol, Blast, offering native yields for ETH and stablecoins.

It instantly became the center of community attention, as the community members expected an airdrop. As of writing, Blast has a TVL of over $700 million.

Read more: What Is Mantle Network? A Guide to Ethereum’s Layer 2 Solution

Blast TVL. Source: DefiLlama

Sourced from cryptonews.net.