DeFi

www.coindesk.com

27 January 2023 12:28, UTC

Reading time: ~2 m

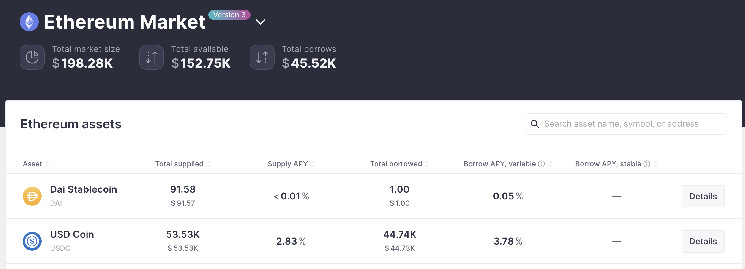

Decentralized lending and borrowing protocol Aave has deployed its third version on the Ethereum network following unanimous support for a governance proposal.

The Aave V3 upgrade will focus on mitigating user risk and improving capital efficiency (High Efficiency Mode) when staking or borrowing correlated assets like stablecoins and liquid staking derivates (LSDs). Liquid staking derivatives are derivative contracts that allow users to retain liquidity of an asset whilst staking it for a reward.

High Efficiency Mode, also called eMode, allows users to capitalize on the highest borrowing power out of their collateral for correlated assets. Users can now leverage larger amounts of assets like wstETH (wrapped staked ethereum) and stake it on the Ethereum blockchain for rewards.

The upgrade is also focused on gas optimization, with Aave stating that it will reduce gas costs across all functions by 20%-25%. Gas is a transaction fee on Ethereum that is paid to validators.

The Aave protocol has $4.56 billion in total value locked (TVL), an increase of 23.37% over the past 30 days, according to DeFiLlama.

The Aave token (AAVE), which can be used as collateral on the platform, is trading at $86.73, little changed in the past 24 hours.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Sourced from cryptonews.net.