Messari, a leading platform for providing market intelligence, has identified a drop in the staking momentum of Curve Finance. Messari noted via a Twitter post that Curve Finance has also suffered a reduction in incentives and yield, despite having a high Total Value Locked (TVL).

Liquid staking protocols use DEX liquidity pools for fast LST/ETH swaps.@Curvefinance lost momentum with reduced incentives and lower yields despite having high TVL.

To fill the void, specialized DEXs with lower capital requirements are becoming more popular. pic.twitter.com/MKWX6XtITu

— Messari (@MessariCrypto) July 5, 2023

The market intelligence platform further revealed that liquid staking protocols now use decentralized exchanges (DEX) liquidity pools for fast LST/ETH swaps. As a result, DEXs with lower capital requirements are growing in popularity.

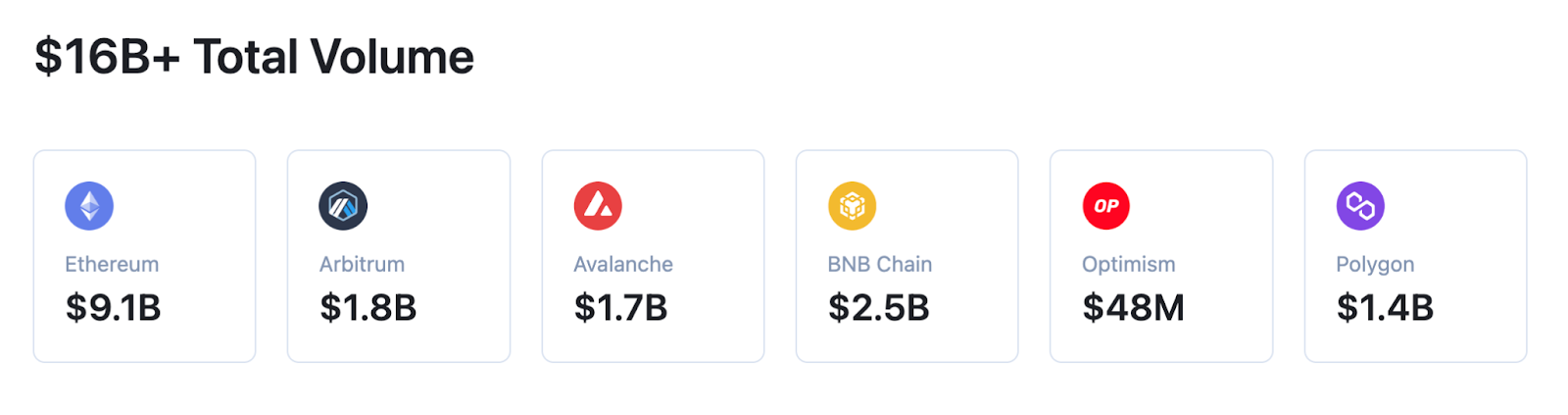

A screenshot shared by Messari in the referenced tweet shows that from August 2022 to June 2023, the stETH-ETH pool yield’s TVL on Curve Finance dropped from over 1 million ETH to about 300,000 ETH. During the same period, the Annualized Pool and Staking Yield of the digital asset dropped from more than 7% to just above 2%.

The stETH staking yield had varying results for the period under observation. Messari data showed that the stETH staking yield’s TVL in August 2022 was over 500,000 ETH. That value has increased slightly to about 600,000 ETH. Similarly, the annualized pool and staking yield for the same digital asset increased from below 4% to a little over 4% from August 2022 to June 2023.

With the data revealed by Messari, the market intelligence platform inferred that the reduction in the annualized pool and staking yield on Liquid Staking Tokens (LST) is responsible for the migration of users away from Curve Finance.

Curve Finance responded to Messari’s post with a tweet that referenced an older tweet. However, the content of the tweet was irretrievable at the time of writing because the author already deleted it.

Sourced from cryptonews.net.