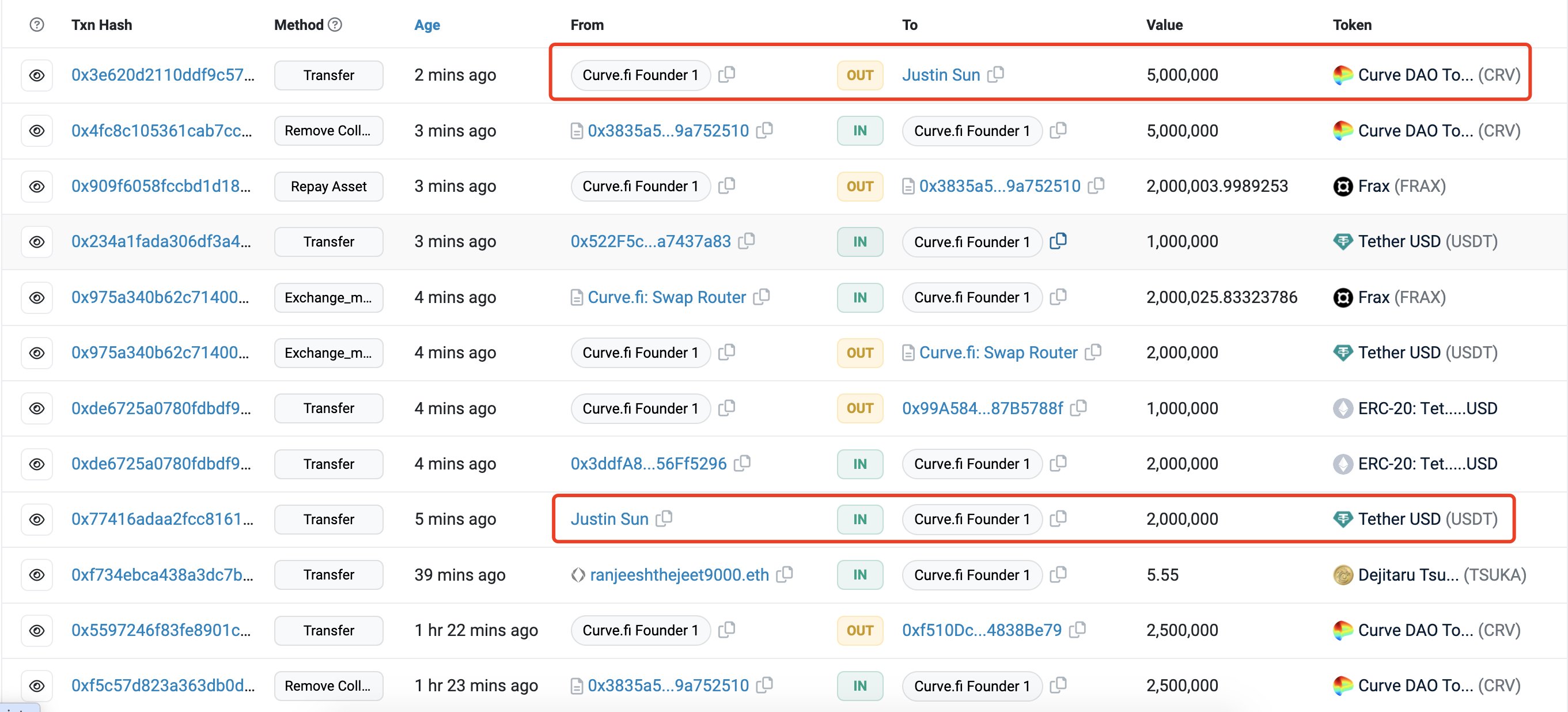

Curve Finance’s founder, Michael Egorov, is facing a lot of debt risks. Due to his 15.8 million FRAX debt and 59 million Curve DAO (CRV) collaterals, Egorov is in a risky position, according to Delphi Digital, a company that conducts market research on digital assets.

1/ Yesterday, several @CurveFinance pools were exploited.

Curve founder, Michael Egorov, currently has a ~$100M loan backed by 427.5m $CRV (about 47% of the entire CRV circulating supply).

With $CRV down 10% over the past 24 hours, the health of Curve is in jeopardy. 🧵⬇️ pic.twitter.com/EKpQCkDs6W

— Delphi Digital (@Delphi_Digital) August 1, 2023

Egorov has a $305 million CRV backing a 63.2 million USDT loan on Aave. His current position is eligible for liquidation at 0.37 CRV/USDT which would require approximately 33% drop in CRV price. Delphi Digital added that he should also pay nearly 4% annual percentage yield (APY) for this loan.

Delphi Digital also mentioned that currently at 100% utilization, the interest rate would double every 12 hours. The interest rate was 81.2% but is expected to increase to reach a 10,000% APY after 3.5 days, which could lead to Egorov’s liquidation. His position’s liquidation price could reach 0.517 CRV/FRAX in 5 days, less than a 10% decrease from current prices.

Egorov had attempted to lower his debt and the utilization rate twice. He repaid a total of 4 million FRAX over the past 24 hours, however, the market’s utilization rate remained at 100%.

On 1 August, Egorov made a third attempt to lower the utilization rate by encouraging liquidity toward the lending market, which could also lower the debt risk. He deployed a new Curve pool and gauge: a 2 pool consisting of crvUSD and Fraxlend’s CRV/FRAX LP token, seeded with 100k of $CRV rewards.

And after four hours of launch, the new pool attracted $2 million in liquidity and the utilization rate decreased to 89%.

Curve’s current situation is the aftermath of a glitch in the programming language that resulted in the exploitation of a number of stable pools. Curve Finance lost more than $47 million and its cryptocurrency fell.

Sourced from cryptonews.net.