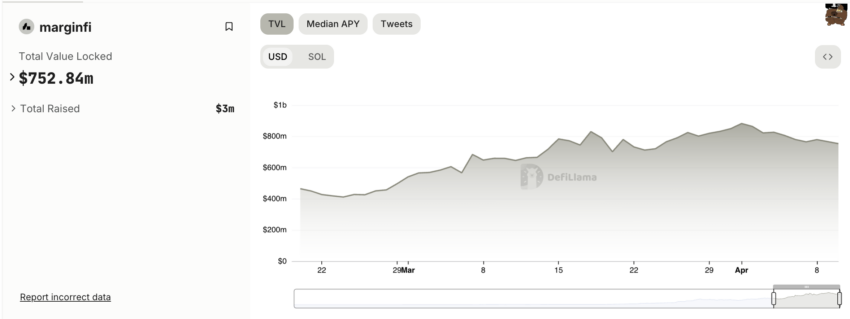

This is quite relevant in the DeFi environment as it was essentially going on a downward trend since late April 2022.

TVL in the crypto market

TVL in crypto refers to the Total Value Locked, which is the total value measured in dollars of all tokens that are locked in decentralized finance protocols.

Obviously most of this TVL is locked within smart contracts on Ethereum, although to date almost 45% is on other chains. Among them, there are also layer-2 solutions on Ethereum, such as Polygon, Abritrum, Optimis, and Base, on which altogether there is another 5%. So combining Ethereum and its layer-2s, it’s a TVL of more than 60%.

Since it is measured in dollars obviously its value also varies just as the market prices of the tokens locked in the DeFi protocols change, which is probably why it fell so much in 2022, and has been rising again in recent weeks.

The 2022 crash

For the same reason, the absolute peak was reached in November 2021, when DeFi’s total TVL came close to $180 billion.

As soon as the speculative bubble began to deflate the TVL fell, all the way below $130 billion.

But with the implosion of the Terra/Luna ecosystem, whose protocols were among the key players in decentralized finance, a real collapse occurred between May and June last year, apparently ending in the second half of June below $50 billion.

Although in July and August it seemed to recover a little, starting in the second half of the month it instead began to fall again, returning to $50 billion.

With the failure of FTX there was a second collapse, bringing the TVL below even below $40 billion by the end of 2022.

As recently as a few weeks ago, 2023 had seen an initial rebound through April, but this was followed by a second long decline that culminated on 13 October at $35 billion. At that point compared to the 2021 highs, the loss had been 80%.

The recovery in recent weeks

As of 21 October there may have been a turnaround.

In fact, DeFi’s TVL first rebounded to 40 billion on 24 October and then also to nearly 44 billion on 5 November.

With the recent boom in Ethereum, which is back near annual highs, it is also back above 46 billion.

Although the current level is similar to July’s, it is still well above the $38 billion at the beginning of the year.

So not only has it recovered all the losses it accumulated in 2023, but it has even returned to the levels of November 2022, shortly after the FTX bankruptcy.

These are still very low levels when compared to those of the last three years, not least because it was actually back to almost 53 billion in April.

The current $46 billion is a far cry from April’s $53 billion, while instead, for instance, the current price of ETH is perfectly in line with that of the April peak.

However, at least the downward trend that began in late April seems to have ended on 21 October, and this is already news given how things have been going for the past year and a half. Moreover, the $49 billion June 2022 target is not far off.

What is the crypto TVL composed of

The TVL calculation includes all tokens that are locked in any DeFi protocol.

Generally it is mostly ETH and stablecoins such as USDT and USDC that are locked in smart contracts on DeFi protocols, but for example Polygon’s MATIC is also part of the most locked tokens.

However, the ranking is literally dominated by ETH, partly because the current main protocol for TVL, Lido Finance, is precisely a protocol that allows ETH to be staked.

The composition of DeFi’s TVL varies, but ETH always remains the undisputed leader in this area. The major stablecoins are also widely used.

This makes it clear that as the market value in US dollars of ETH varies, so does the total TVL of DeFi, and this is probably mainly why there has been a significant uptick in recent weeks.

It is also worth noting that smart contracts generally allow the withdrawal of locked funds to any user at any time, and this certainly had no small influence on the 2022 collapse.

Certainly the single most influential thing has been the implosion of the market value of Luna and UST (now LUNC and USTC), but the loss of value of ETH over the course of the year has also been a big influence.

Sourced from cryptonews.net.