Paradigm, which provides liquidity to institutional crypto derivatives traders, is branching into decentralized finance (DeFi) with the addition of Paradex, a decentralized perpetuals platform. Paradex uses the newly announced appchains from scaling solution giant StarkWare, according to a Friday announcement at the StarknetCC event in Paris.

Paradigm, a separate entity from the venture capital firm of the same name, said Paradex is a hybrid derivatives exchange that combines the liquidity and performance of centralized finance CeFi with DeFi’s transparency, trustlessness and self-custody.

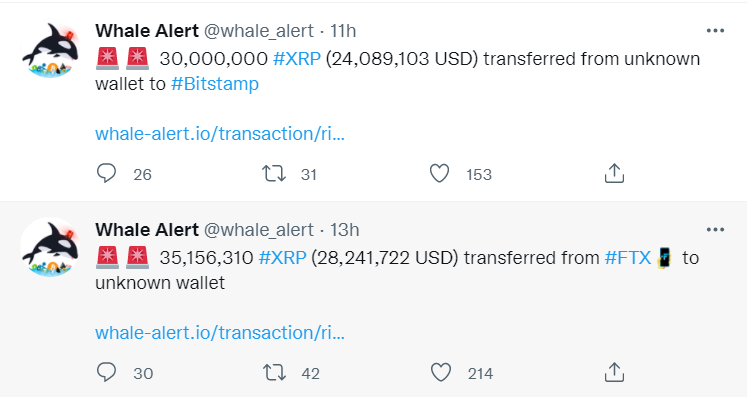

The system was built partly to address the lack of trust in centralized finance following the multibillion-dollar collapse of FTX due to a management-driven liquidity crisis. The exchange also aims to take on the fragmentation across legacy CeFi risk engines (software that analyzes market risks), which impacts capital efficiency and leads to lower liquidity.

Read more: Layer-2 Blockchain Starknet’s ‘Quantum Leap’ Upgrade Goes Live, for Speedier Transactions

Sourced from cryptonews.net.