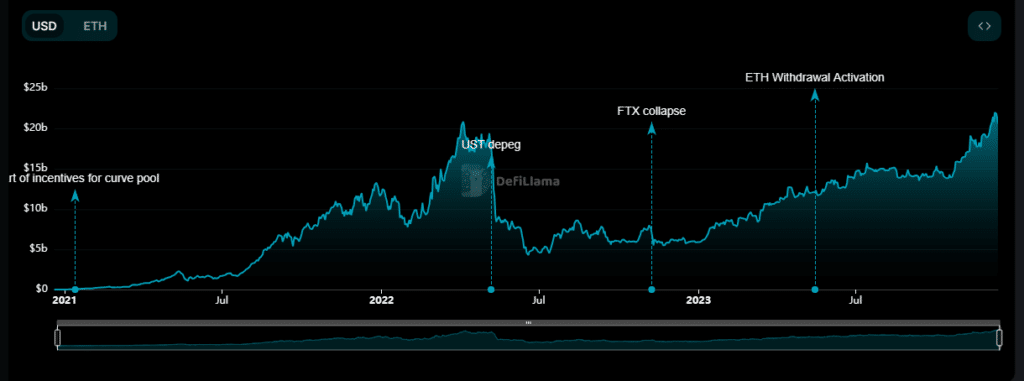

The total value of assets locked on decentralized finance (DeFi) protocols based on Avalanche has reached a 9-month high amid the market rally of the AVAX token.

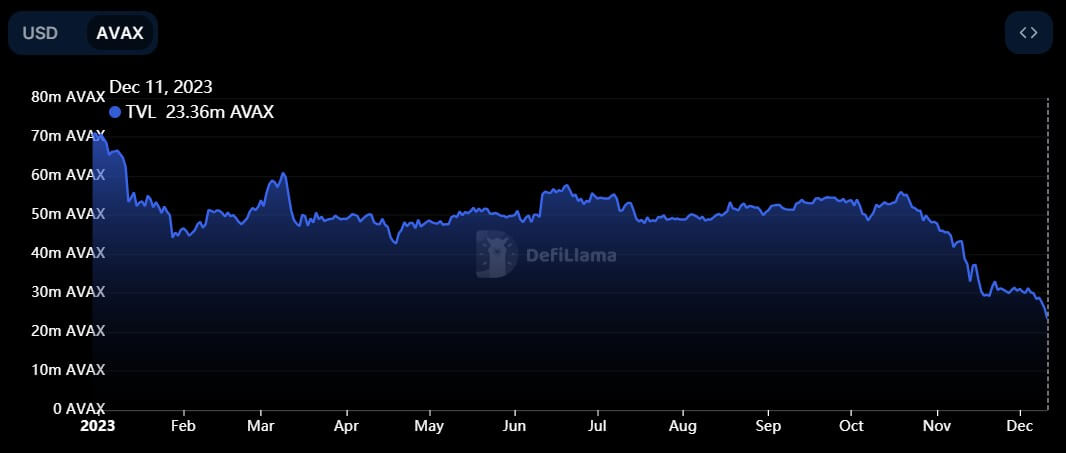

Interestingly, the increase is coming when the number of locked AVAX tokens has been at its lowest since August 2021. Over the past month, the network users have withdrawn more than 15 million AVAX tokens from protocols on the network despite the increasing dollar value of the assets.

DeFiLlama data shows that Avalanche’s TVL currently sits at around $875 million, representing a 66% increase within the last three months and its highest level since March. This also places the network among the top 10 blockchain networks by TVL.

Avalanche’s thriving ecosystem

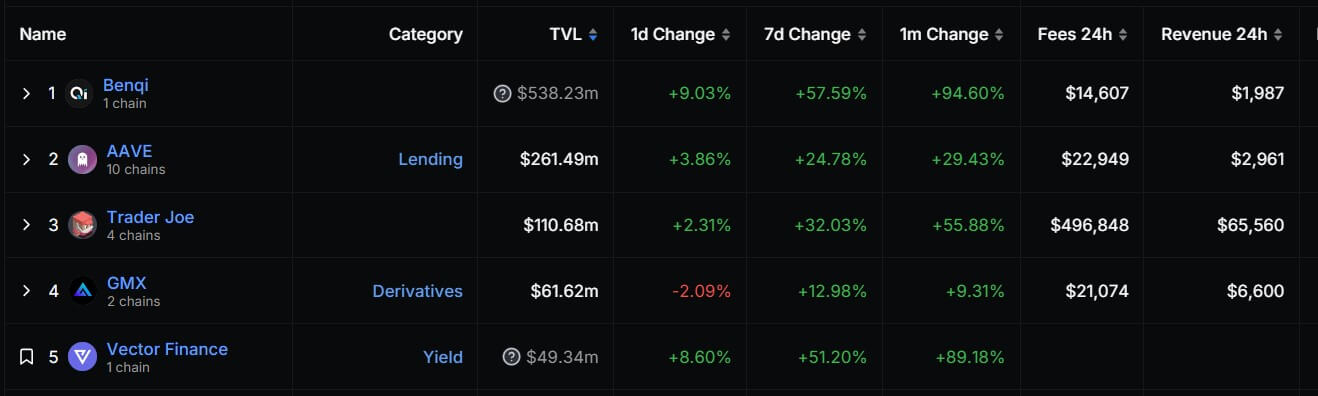

As per data from DeFiLlama’s dashboard, Benqi emerges as the leading DeFi protocol on Avalanche. Benqi operates as a non-custodial liquidity market protocol, enabling users to stake and lend their digital assets to earn interest.

The protocol’s TVL recently crossed the $500 million threshold, accounting for over 50% of the blockchain network’s total TVL.

Other top DeFi protocols on Avalanche include AAVE, Trader Joe, and GMX, with their TVLs currently at $254 million, $110 million, and $61 million, respectively.

Besides that, decentralized exchanges (DEX) trading volume on Avalanche has also been growing lately. DeFiLlama data shows that the metric improved by 193% during the past week to $1.3 billion. If this trend persists, the network will be on track to beat the $2.7 billion total volume recorded in November.

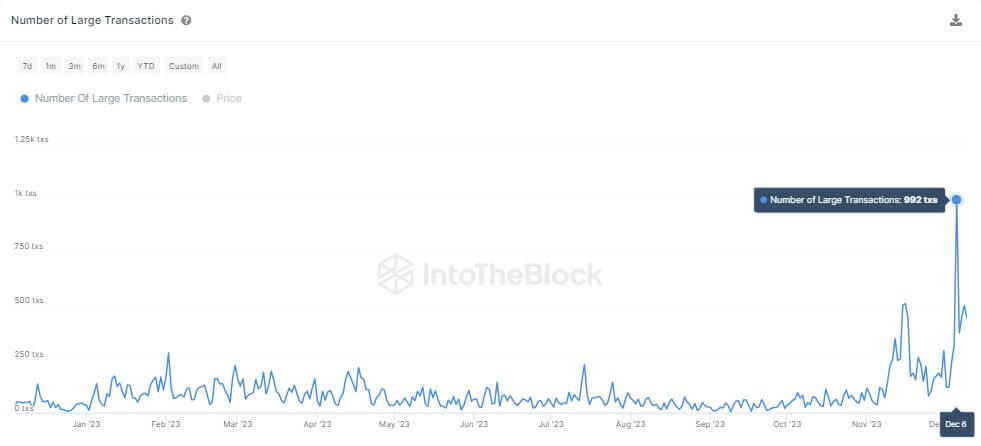

Intotheblock data further shows that AVAX transactions surpassing $100,000 reached nearly 1,000, signaling a bullish trend for the network. Nevertheless, this figure remains below the levels witnessed during the peak of the previous bull market.

Additionally, Avalanche’s thriving gaming ecosystem is beginning to attract more attention and accolades from the crypto community.

AVAX price rises

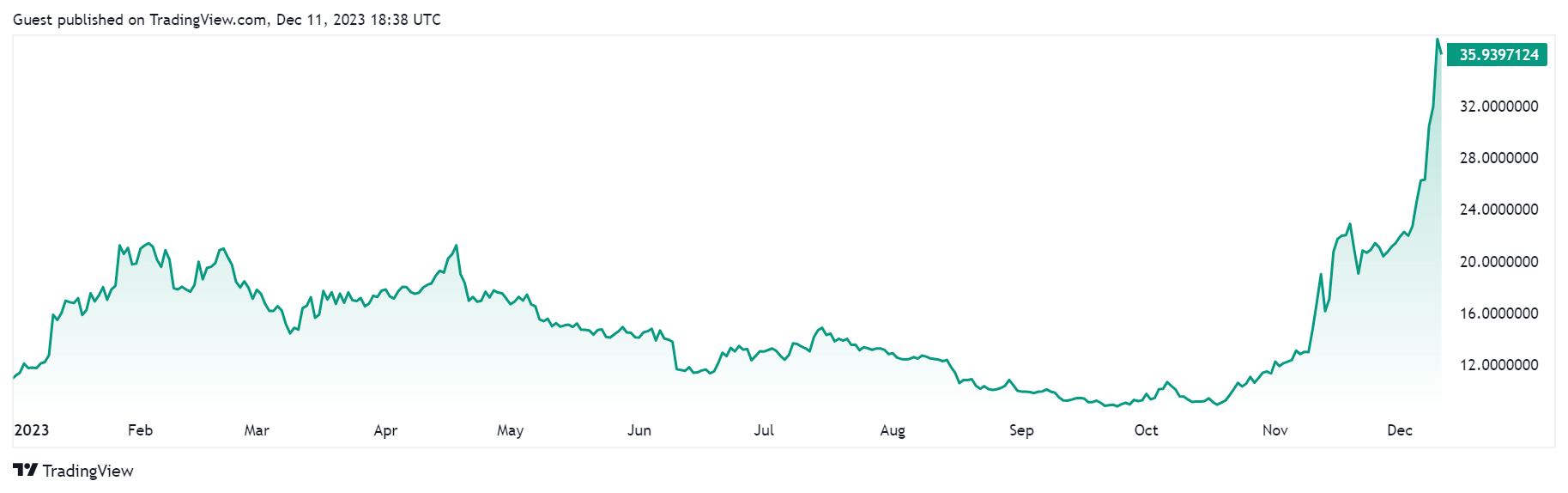

Meanwhile, the notable growth in Avalanche’s TVL primarily stems from the substantial surge in AVAX’s price.

Despite a general decline in the cryptocurrency market today, AVAX stands out with a 7.4% gain that helped it print a yearly high of $36, marking its best price performance since May 2022.

Over the past 30 days, CryptoSlate’s data shows a 108% rise in the token’s value, with a 64% increase recorded in the past week alone.

Sourced from cryptonews.net.