- The first quarter of 2023 has seen an active and eventful period for the XRP Ledger.

- XRP’s financial performance has outshone the overall crypto market cap increase.

- The XRPL ecosystem has evolved with the introduction of NFT transactions and successful sidechain deployments.

In the realm of the XRP Ledger (XRPL), the initial quarter of 2023 has exhibited substantial activity, as per a recent report by Messari. From a surge in daily active addresses and transactions to an impressive price rise, significant developments and prospects beckon within the XRPL ecosystem.

Deflationary Pressure Contributes to XRP Price Increase

Crucial indicators have illuminated a surge in activity within the XRPL. With data revealing a remarkable 13.9% surge in daily active addresses, coupled with a solid 10.7% rise in daily transactions.

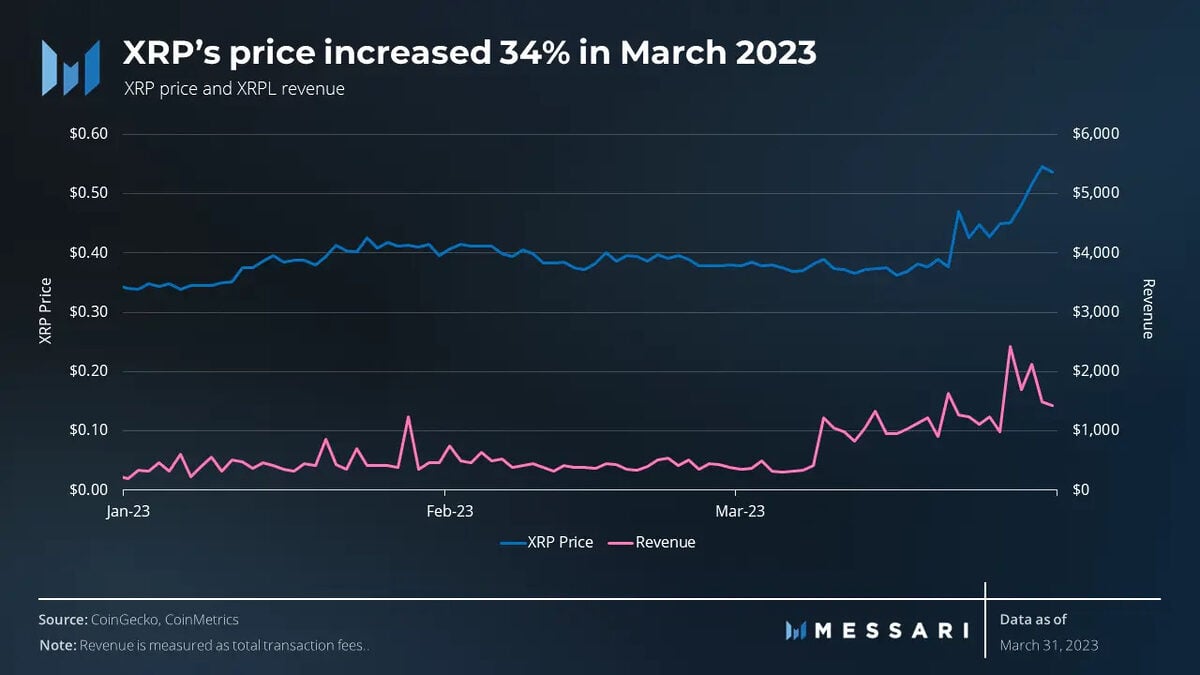

However, the true standout achievement lies in the extraordinary ascent of XRP’s price, which skyrocketed by an impressive 55.5%, leaping from $0.35 to $0.54. This exceptional surge can be attributed to the favorable updates emerging from the ongoing legal clash between Ripple and the Securities and Exchange Commission (SEC).

The financial performance of XRP has experienced a notable upswing, surpassing the overall increase in the total crypto market capitalization. XRP’s market cap escalated significantly by 59.9%, leaping from $17.4 billion to $27.8 billion.

This substantial surge can be attributed to a positive development in the SEC case against Ripple, which served as a significant catalyst, leading to two substantial price surges in March.

Notably, the transaction fees within the XRPL ecosystem, which are burned, have exerted deflationary pressure on the total supply of XRP, thus counterbalancing the inflation rate and contributing to the price surge.

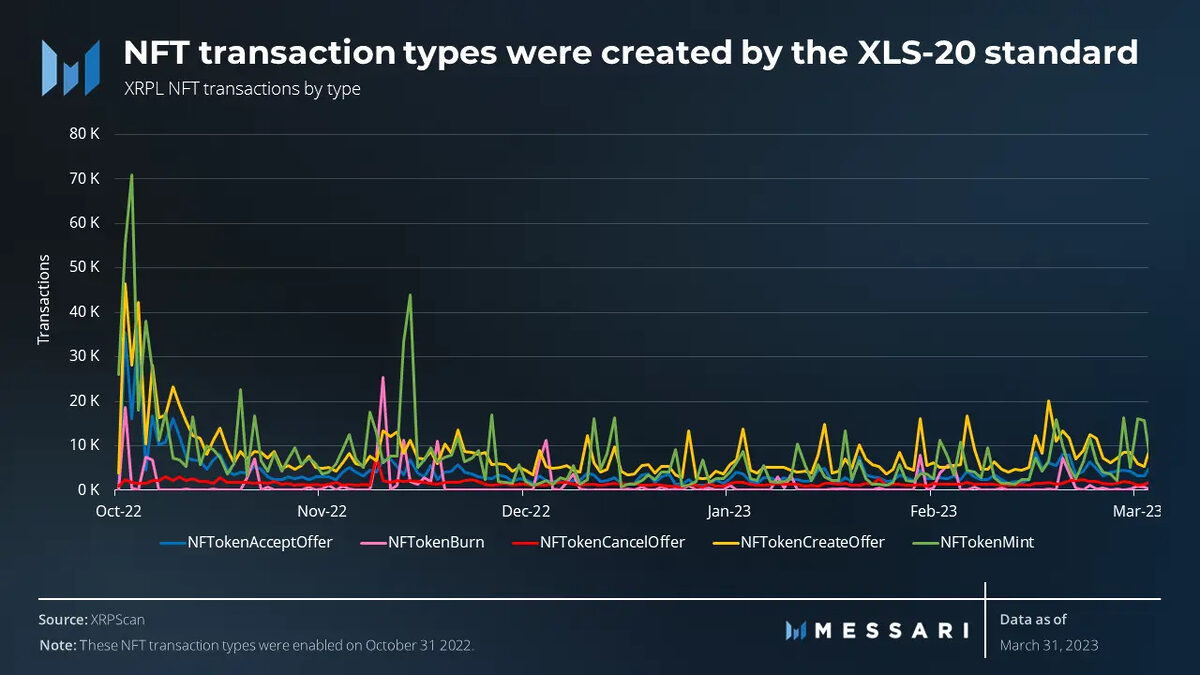

The Q1 report accentuates the evolution of the XRPL ecosystem. Introducing NFT (non-fungible token) transactions, the XLS-20 standard has solidified its position by establishing five new transaction types, alongside proposing an additional five.

Despite a slight decline in NFT activity compared to the previous quarter, Q1 still witnessed an impressive 436,000 NFT mints and the acceptance of 277,000 NFT offers. Furthermore, the Coreum and Flare Network sidechains, specializing in interoperability and decentralized data, have reached their mainnet stage.

XRPL developers have their sights firmly set on the domains of NFTs, the metaverse, and smart contracts, including the introduction of Futureverse’s Root Network, Hooks, and an Ethereum Virtual Machine (EVM) sidechain.

On the Flipside

- Despite the surge in XRP’s price, it’s important to note that the cryptocurrency market remains highly volatile, and past performance does not indicate future results.

- While the XRP Ledger developers have outlined ambitious plans for the future, the implementation and success of future projects remain to be seen.

- The slight decrease in NFT activity compared to the previous quarter raises questions about the long-term sustainability and mainstream adoption of NFTs within the XRPL ecosystem.

Why This Matters

Ripple’s impressive surge in activity, price, and market capitalization demonstrates its resilience and potential, positioning it as a key player in the market. This success boosts investor confidence in XRP and highlights the broader potential for blockchain technology and decentralized finance.

To learn more about Ripple CEO‘s critique of US regulations and the challenges they pose, read here:

Ripple CEO Slams U.S. Regulations: “U.S. Has Made It as Confusing as Possible”

To delve into Ripple and Metaco’s collaboration to conquer the crypto custody market, read here:

Ripple and Metaco Join Forces to Conquer Crypto Custody Market

Sourced from dailycoin.com.

Written by on 2023-05-19 12:00:00.