- Bitcoin went down 5% in 30 minutes and traded as low as $21,970 in the early hours of Friday.

- Other coins like Ethereum (ETH), Polygon (MATIC), Dogecoin (DOGE), and Solana (SOL) also plummeted.

- The dump might be associated with crypto bank Silvergate’s worrying statement on Thursday.

The crypto market has suffered a sharp selloff across all major crypto assets following worrying news about crypto bank Silvergate.

Bitcoin (BTC) plummeted 5% in 30 minutes early Friday morning and traded as low as $21,970 and $1,544, respectively, according to data from CoinGecko. The largest cryptocurrency had lost around $23 billion in market cap.

BTC is currently trading at $22,420. Ethereum (ETH) also went down 5% to $1,544. It’s now trading at $1,570.

Bitcoin (BTC) price chart. Source: CoinGecko.

Other coins like Polygon (MATIC), Dogecoin (DOGE), and Solana (SOL) also dumped from 4% to 7%. The total crypto market cap currently stands at around $1.08 trillion.

The cascading liquidations across all cryptocurrencies exacerbated the sudden price decrease. According to data from CoinGlass, the crypto market saw $243.5 million liquidated in the last 24 hours alone.

The sharp selloff might be related to crypto-friendly Silvergate’s statement on Thursday that it’s unsure whether it can continue operating.

Silvergate Crisis Continues

On Thursday, the crypto industry went into panic mode when Silvergate, one of the few crypto-friendly banks in the market, issued a worrying statement about its future.

Silvergate said it’s evaluating its “ability to continue as a going concern” and delayed its annual report to the U.S. Securities and Exchange Commission (SEC).

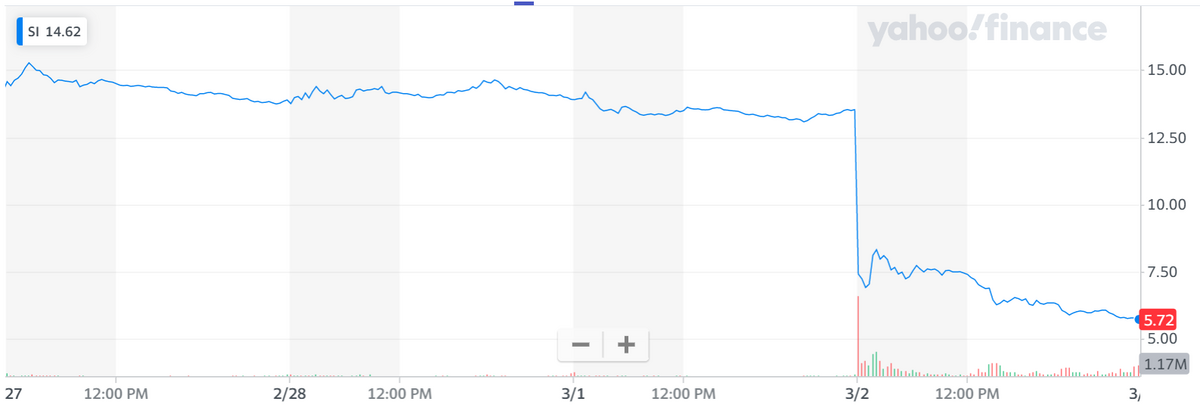

The shares of Silvergate immediately tanked and closed 57.72% lower on Thursday. SI is currently trading at $5.72 with a market cap of $181 million.

Silvergate (SI) price chart. Source: Yahoo! Finance.

Following the news, a flurry of crypto companies issued statements regarding their exposure to and relationship with Silvergate. Coinbase announced it is cutting ties with Silvergate and moving its banking operations to Signature Bank. The exchange said it has “de minimis corporate exposure to Silvergate.”

Circle, the issuer of the stablecoin USDC, also said that it’s in the process of “unwinding certain services with [Silvergate] and notifying customers.” Galaxy and Paxos also said they’re cutting ties with Silvergate, and Tether assured that it had no exposure to the bank.

On the Flipside

- The sudden dump in crypto prices might also be related to the higher-than-expected inflation prints in the U.S. and Europe.

Why You Should Care

Silvergate is one of the leading crypto-friendly banks in the world. The worrying news around its ability to continue operating might mean a further price decrease.

Read more about Silvergate:

Is Troubled Crypto Bank Silvergate Set to Follow in FTX’s Footsteps?

Sourced from dailycoin.com.

Written by on 2023-03-03 11:45:00.