Centralized crypto exchanges have played an important role in the development of the global crypto markets. Read on to learn what centralized exchanges are, how they work, and discover the pros and cons of using them.

What Is a Centralized Exchange?

A centralized crypto exchange (CEX) is a platform where you can trade cryptocurrencies. The exchange acts as an intermediary between buyers and sellers, matching up trades in a centralized orderbook.

Centralized crypto exchanges use a business model that is similar to that of traditional online brokerages, which is why they are so popular, especially among new crypto investors. They have the same look and feel as the online trading platforms that equity and forex traders are already used to.

In addition to offering easy access to the crypto markets, leading CEXs are often regulated and adhere to strict compliant rules, making them safer platforms to trade on. Moreover, centralized exchanges typically also offer a range of other crypto-powered financial products and services – ranging from crypto cashback cards to crypto savings accounts – to provide an end-to-end experience for crypto traders and users.

Crypto is money – let`s use it!

You can use CryptoWallet to buy, sell, and trade crypto.

Sign up today

How Do CEXs Work?

Centralized exchanges provide an order book to process buy and sell orders posted by traders. An order is a request to buy or sell a digital asset at a certain price. Exchanges aggregate these orders and match the corresponding buy and sell orders using a matching engine.

To start trading, most CEXs will require you to verify your identity and complete KYC/AML background checks. The severity of this depends on regulatory compliance laws from one jurisdiction to another.

Next, you need to fund your account by depositing crypto or fiat currency into the platform wallet. On some trading platforms, you can also link your credit card to the exchange in order to purchase cryptocurrencies.

Then, you can buy the digital currency or token you would like by placing an order. Exchanges typically offer a range of order types, such as a limit order, a market order, and a stop-loss order. Once your order has been filled, you will receive the cryptocurrency you have purchased.

Finally, transfer your purchased cryptocurrency into a crypto wallet that you control. While exchanges have security protocols in place to ensure the safety of user funds, they hold the private keys to the funds you store with them. In most cases, that will mean that in the case of bankruptcy, the exchange can use your crypto to pay creditors, leaving you crypto-less.

The Difference Between Centralized and Decentralized Exchanges?

Now, let’s take a look at how centralized exchanges differ from, decentralized exchanges (DEX). The table below presents a clear outline of the differences between CEXs and DEXs.

| Criteria | Centralized Exchanges (CEX) | Decentralized Exchanges(DEX) |

| Custody of Assets | To start trading, you have to deposit your crypto onto the exchange, which will take custody of your asset. | You retain full control of your assets and only have to connect your wallet to start trading on the decentralized exchange. |

| Decentralization | Operates according to a centralized model, where an organization controls the exchange. | There is no central organization running operations. Instead, it is run by smart contracts. |

| Liquidity | The presence of institutional investors, and operating in a structured and (often) regulated environment attracts a large user base that brings high liquidity. | A handful of leading DEXs have substantial liquidity. The remainder, very little. |

| Regulations | Some CEXs are regulated. | DEXs are currently not regulated. |

| Accessibility | This mostly depends on the policies set by the controlling organization. Not everyone can trade on a CEX because users typically have to complete an ID verification process. | Available to all. No ID checks are needed. |

The Pros & Cons of Centralized Exchanges

The advantages of trading crypto on centralized exchanges include:

- More secure environment due to regulations and some form of consumer protection policies.

- Since transactions are processed by a single central entity, transactions are quick and cost-efficient.

- Most exchanges nowadays also have reimbursment funds in case of hacks.

The disadvantages of trading crypto on decentralized exchanges are:

- Lack of transparency concerning operations.

- They hold custody of user funds, making them susceptible to hacks, which can potentially lead to loss of user funds.

- They can be a target for censorship by regulators or hostile governments, and user funds can even be seized.

- CEXs are prone to technical issues that may lead to significant downtime.

- In the case of bankruptcy, exchanges may use user funds to repay creditors.

The Risks of Trading on a CEX

The biggest risk of trading on a CEX is the threat of losing your assets stored on the platform.

Some of the most significant exchange hacks in history happened to centralized exchanges such as Mt. Gox in 2014 and Bitfinex in 2019. In both cases, millions of dollars were t in customer funds were lost.

Over the last few years, however, crypto exchanges have taken measures to better protect users against hacks. For example, they have set up reimbursement funds to make users whole in case of a hack.

Having said that, the risk of losing your funds stored on a CEX remains because in the case of a bankrupty, the operating entity may end up using your funds to repay creditors as part of their bankruptcy proceedings.

Crypto investos should, therefore, always transfer the cryptocurrency they purchases on an exchange off the platform and into a personal wallet to which only they hold the private keys.

FAQs

Are centralized crypto exchanges safe?

Centralized crypto exchanges require users to undergo KYC, and many of them have AML policies mandated by financial regulators. As a result, trading on CEXs can be considered safer than on DEXs as nefarious trading is typically limited.

However, you should never store your digital assets on a centralized exchange as you could lose your funds in the case of a hack or an exchange bankruptcy.

What is an example of a CEX?

Who is the biggest crypto exchange?

Binance is the world’s largest cryptocurrency exchange.

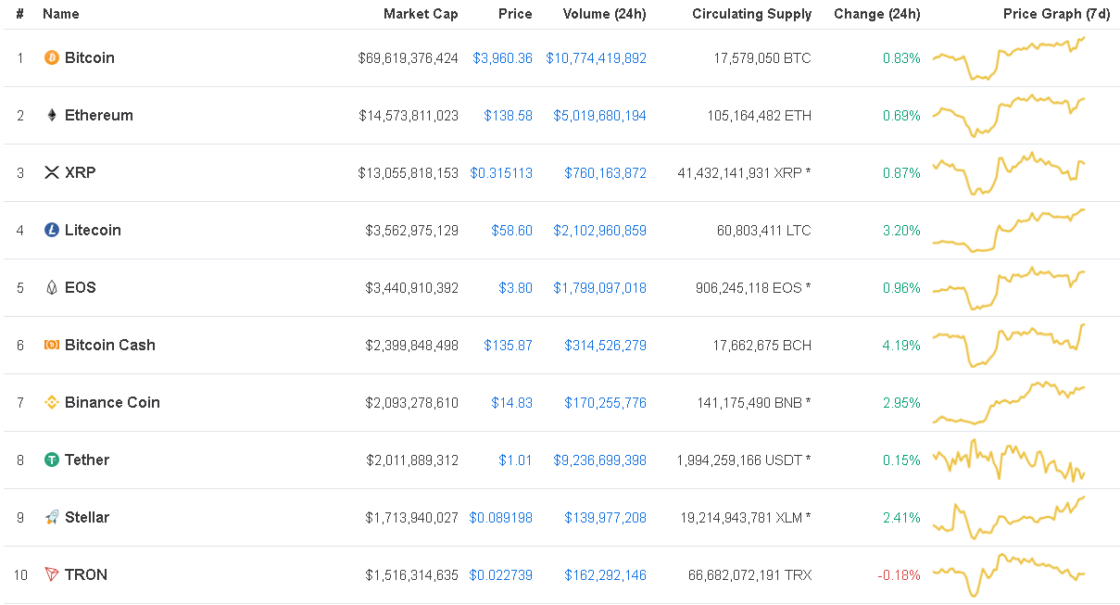

Sourced from crypto.news.

Written by Alex Lielacher on 2022-08-22 02:00:00.