Defense lawyer James K.Filan shares the recent update in the Ripple SEC lawsuit. The XRP price is trading at $0.88 after skyrocketing more than 50% in the last seven days. XRP is set to mark the seventh consecutive day in the green after rebounding from lows of $0.58 on Feb. 3.

#XRPCommunity #XRP Ripple lawyers’ advice on digital tokens set for unsealing in key SEC case https://t.co/vzEXhKvBhv

— James K. Filan ???? (@FilanLaw) February 8, 2022

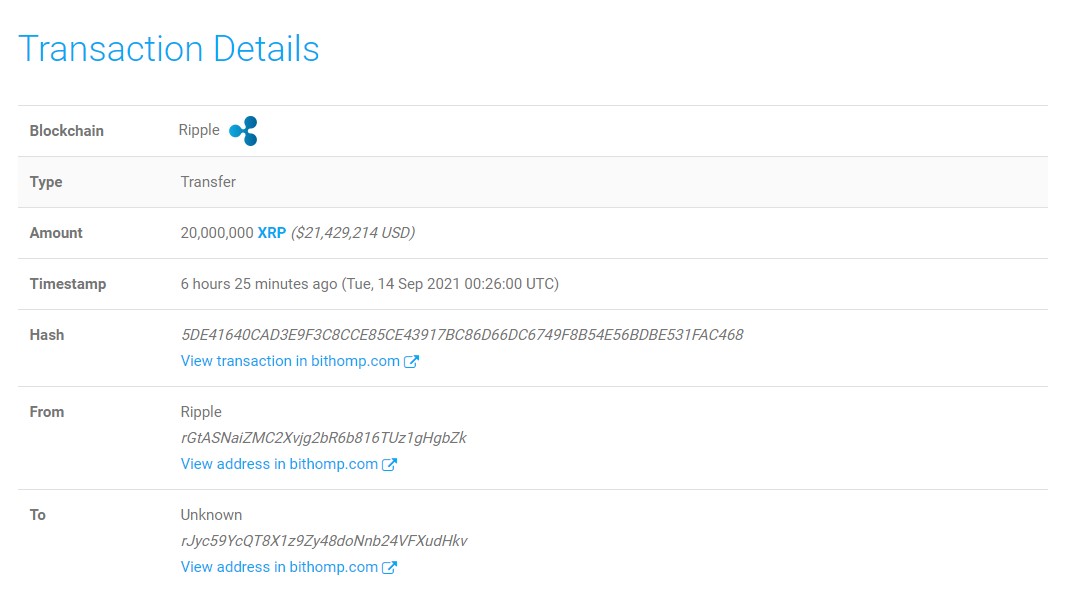

The description of the advice Ripple received from its outside counsel in 2012 memos may soon be made public, thanks to a recent judgment by U.S. District Judge Analisa Torres of Manhattan. Ripple requested legal advice from an unnamed global law firm in 2012 as it considered launching a new digital coin. Ripple also received two documents from the law firm that looked at the legal concerns that could arise as a result of the launch.

The legal advice contained in the two memos, according to Torres, must be unsealed and made public by Feb. 17.

In an email statement, Ripple general counsel Stuart Alderoty said that when the documents are released, they “will show that in 2012 Ripple received a legal analysis that XRP was not an investment contract or security.”

Some analysts believe that recent developments in the Ripple v. SEC litigation might suggest that the case may be resolved shortly, which might lead to a further surge in the price of XRP.

XRP price action

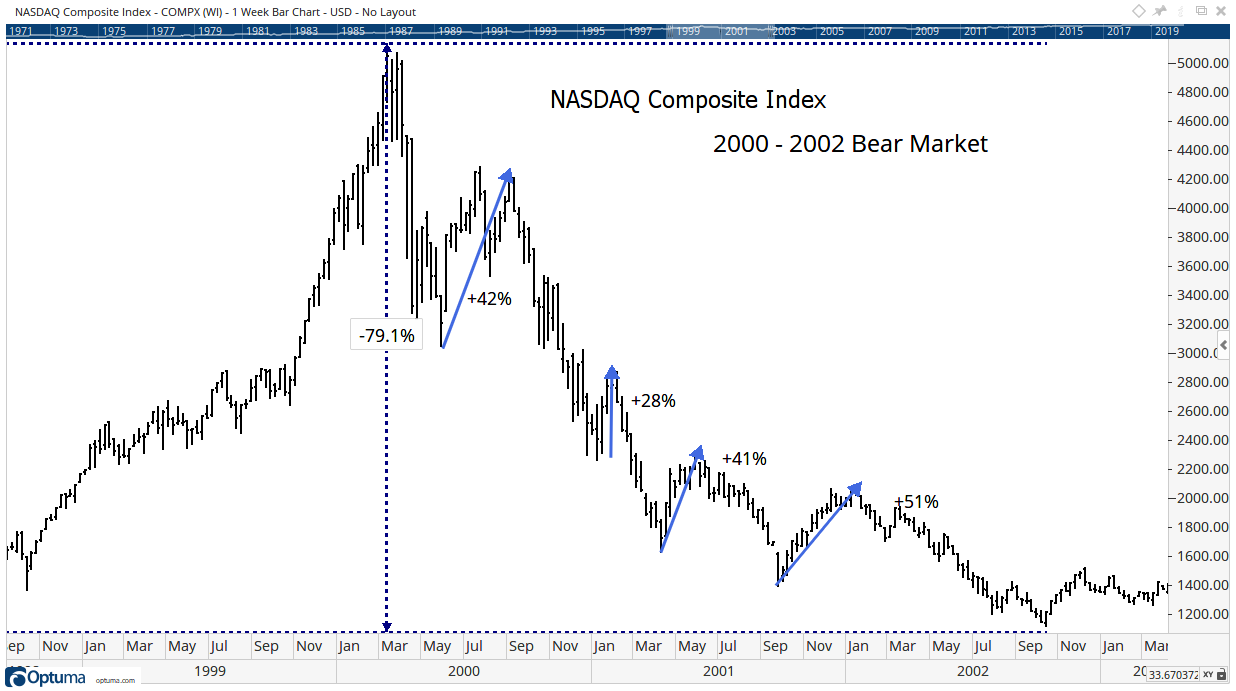

On Feb. 8, Ripple’s XRP crossed the daily MA 50 at $0.75, reaching highs of $0.91. The previous resistance has now converted into support, with $0.96 and $1 as the next significant levels to watch.

The daily RSI has reached the overbought territory at over 70 points. There is still room to go higher, but it is critical to use extreme caution at current levels. It appears that XRP might surpass $1 before any serious resistance. On the road there, there could be some short-term pullbacks, but overall price activity remains bullish.

Sourced from u.today.

Written by Tomiwabold Olajide on 2023-08-03 02:41:32.