XRP recently experienced a massive bounce back to its local high of approximately $0.54. This sharp increase in value comes as the cryptocurrency market begins to recover, with investors returning to the market and considering XRP as a viable option for gaining exposure to the crypto space.

Furthermore, the growing optimism surrounding the potential positive resolution of Ripple’s case against the U.S. Securities and Exchange Commission (SEC) in 2023 has fueled this recent price surge, as it could set a precedent for other digital assets.

The cryptocurrency market has been recovering from a period of turbulence, with many top coins like Bitcoin and Ethereum regaining the $30,000 and $2,000 thresholds, respectively. This market rebound has led to an influx of investors seeking opportunities in digital assets, and XRP has emerged as one of the preferred choices. As a result, the recent bounce back to the local high of $0.54 indicates renewed interest in XRP and increased confidence in its potential.

Moreover, the ongoing legal battle between Ripple and the SEC has been a significant factor influencing XRP’s price performance. A favorable resolution to the case could have a significant impact not only on XRP but also on the broader cryptocurrency market. The case’s outcome may set a precedent for other digital assets, clarifying the regulatory landscape and potentially paving the way for increased mainstream adoption.

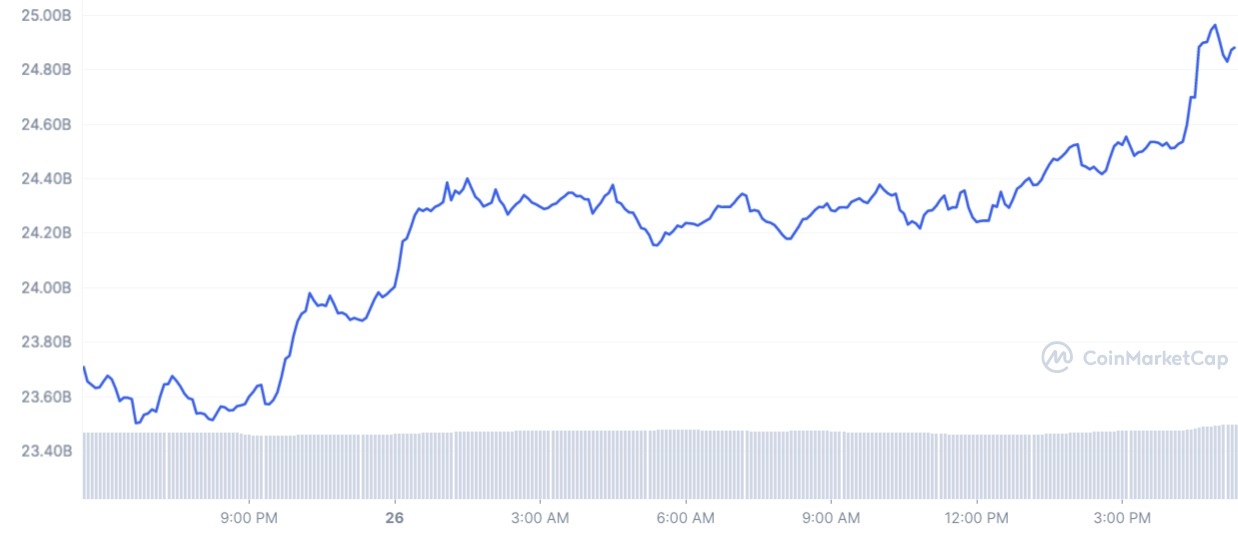

Market is euphoric

The cryptocurrency market has entered a state of euphoria following the recent Shanghai Ethereum update, which enabled staking withdrawals and attracted a massive influx of nearly $100 billion to the industry – contrary to the expectations of some analysts who believed that this update might deter investors.

However, it is essential to remain cautious, as the potential for rapid outflows fueled by additional withdrawal pressure from staking contracts, which still outweigh inflows, could impact the market.

The Shanghai Ethereum update has allowed validators to withdraw their staked ETH and take control of their funds, which might have attracted more investors to the market as the staking becomes more accessible and convenient.

This euphoric response, however, comes with a note of caution. Despite the overwhelming inflow of capital, there is still the possibility of rapid outflows from the market due to additional withdrawal pressure from staking contracts. As more ETH is unlocked, this could lead to increased selling pressure, which might cause a drop in Ethereum’s price and potentially impact other digital assets as well.

Arbitrum overcomes troubles

Arbitrum’s native token, ARB, has witnessed a remarkable performance in the current market rally, soaring by 20% and continuing its upward trajectory. The token has emerged as one of the top-performing assets on the market, solidifying its position within the top 10 cryptocurrencies. This impressive growth comes despite recent controversies surrounding the Arbitrum community and the allocation of additional tokens by the foundation.

ARB’s exceptional performance is attributable to various factors, including the growing interest in Layer 2 scaling solutions that aim to reduce congestion and high fees on the Ethereum network.

However, the recent rally has not been without its challenges. The Arbitrum community faced internal strife when the foundation allocated and used additional tokens in its favor before a vote on the matter was concluded.

This move sparked concerns among community members and raised questions about the project’s governance structure. Despite these troubles, the token’s strong performance seems to indicate that the market remains bullish on ARB and its potential to drive the Layer 2 scaling ecosystem forward.

Sourced from u.today.

Written by Arman Shirinyan on 2031-10-21 09:38:07.