Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

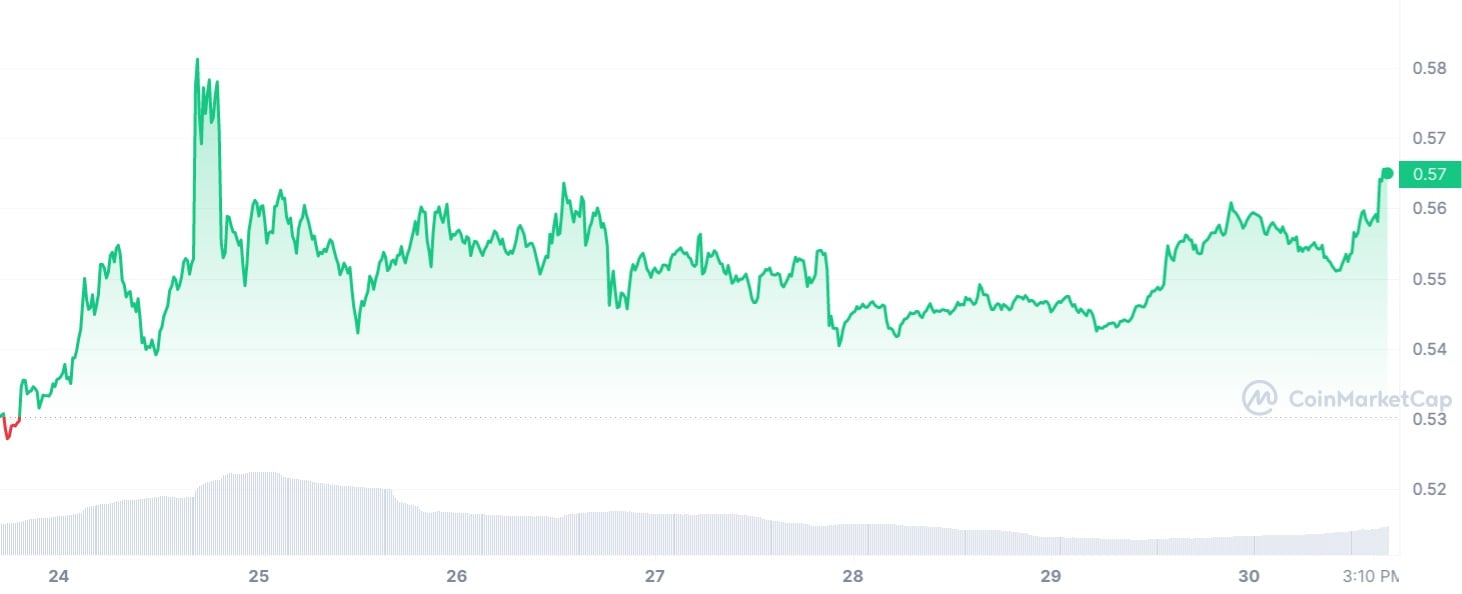

In the ever-volatile world of crypto, last week witnessed a remarkable 6.44% surge in XRP prices, peaking at $0.585 per token before experiencing a 4.8% retreat from its weekly high.

This sudden price upswing marked the highest level XRP has reached since mid-August, rekindling investor interest and reviving the market’s inherent volatility.

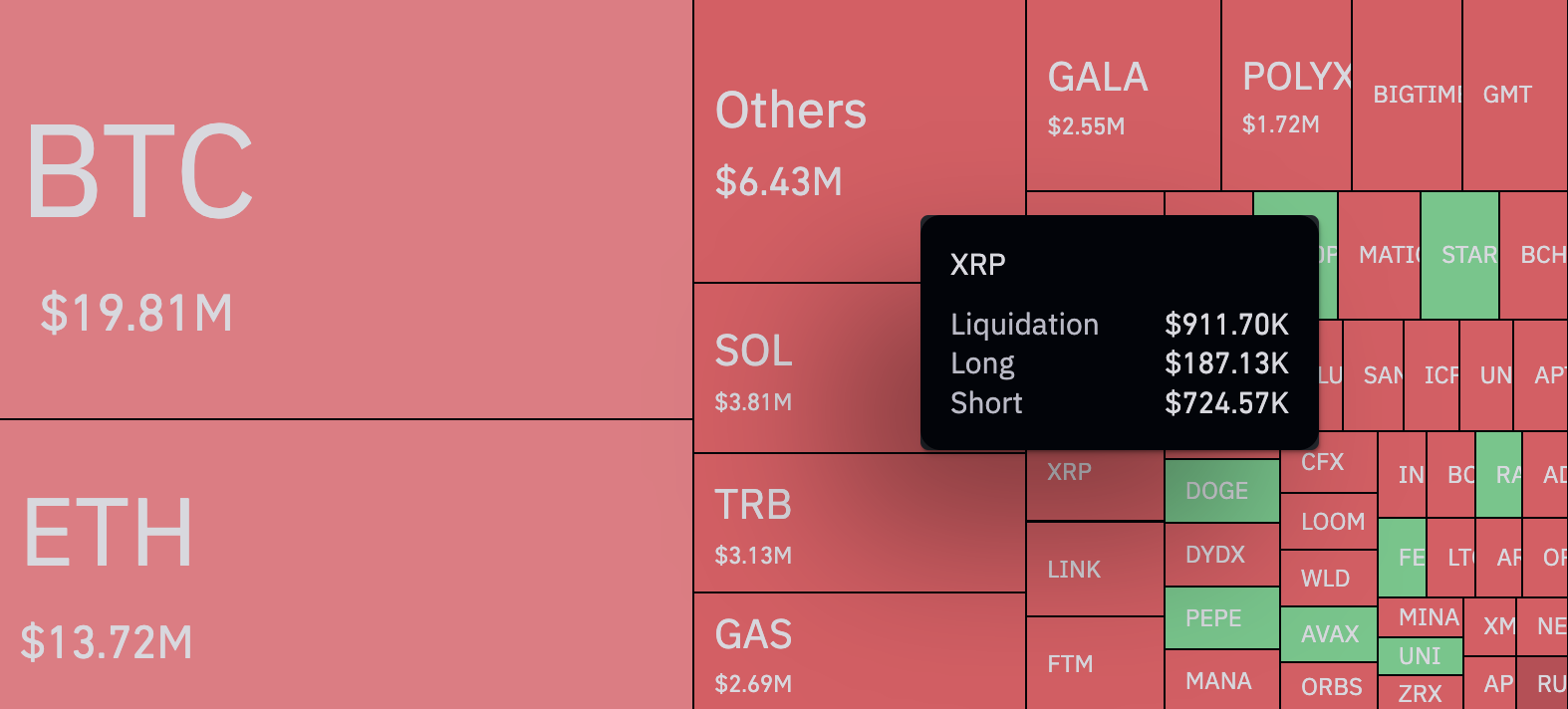

Amid this resurgence of activity, the spotlight has fallen squarely on the behavior of the so-called “bears” in the XRP market. Over the past 24 hours, this group of traders and investors has emerged as the dominant force, eclipsing “bulls” by an astonishing 387%.

This divide is made evident by staggering numbers to back them up: short positions worth $724,500 were liquidated by the bears, while their bullish counterparts saw only $187,000 in liquidations. This stark contrast resulted in nearly $1 million worth of total liquidations for both long and short positions within a single day.

But what does this data reveal about the market sentiment? It suggests that the bears are driven by an unwavering conviction that XRP’s bullish momentum is a mere trap, leading them to make substantial bets against the cryptocurrency’s future.

This growing greed among bearish investors is spurring them to take significant risks, and the consequences are evident in the increasing number of liquidated short positions.

The pivotal question now remains: will the dominant performance of XRP bears be enough to suppress the token’s price ascent? It is uncertain, as it is possible that the bulk of short positions has already been liquidated, potentially forcing the bears to step back and rethink their strategy in the face of this severe financial setback.

Sourced from u.today.

Written by on 2023-12-05 15:40:33.