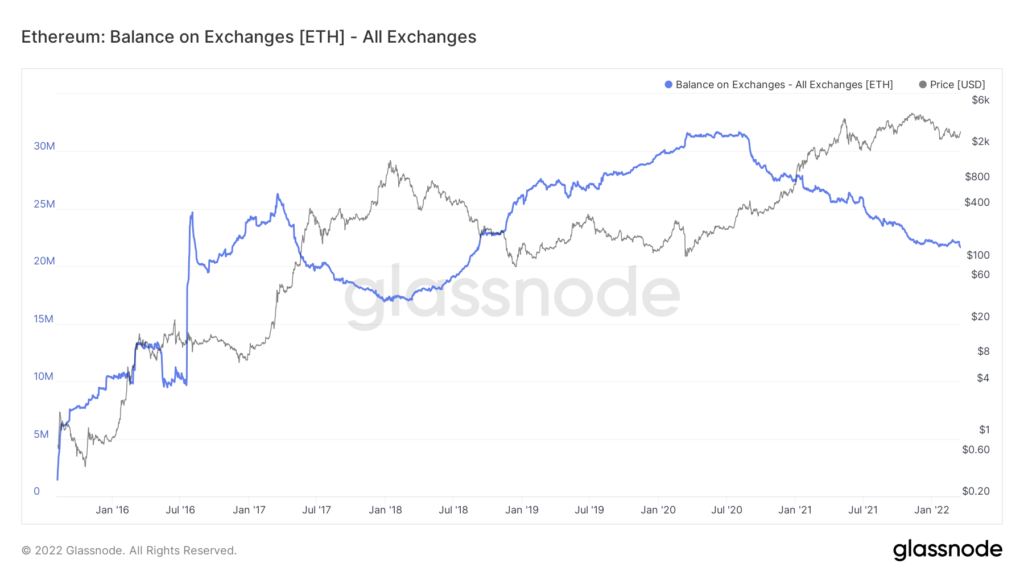

According to a Santiment report of March 18, 2022, ETH has recorded the lowest exchange balance since 2018. About 550K ETH has left the exchanges year-to-date, reducing the balance on exchanges to 21.72 M, the lowest value since 2018.

Ethereum Sees Significantly Reduced Exchange Balances

The tokens leaving exchanges show an increase in traders’ willingness to hold their coins more as the integration of the POS mechanism approaches for the summer. The current balances are almost a third lower than June 2020’s record high of 31.68 ETH.

A glassnode report shows that ETH is registering a reduced number of coins on the exchanges which signifies an increasing will of investors to hodl. ETH also expects a POS upgrade coming summer, which may be why it has reduced balances on crypto exchanges.

The current balance of 21.72M is the lowest since 2018, showing that investors are also regaining confidence. Parallel to reduced balances on the exchanges, ETH has posted the highest weekly outflow since October.

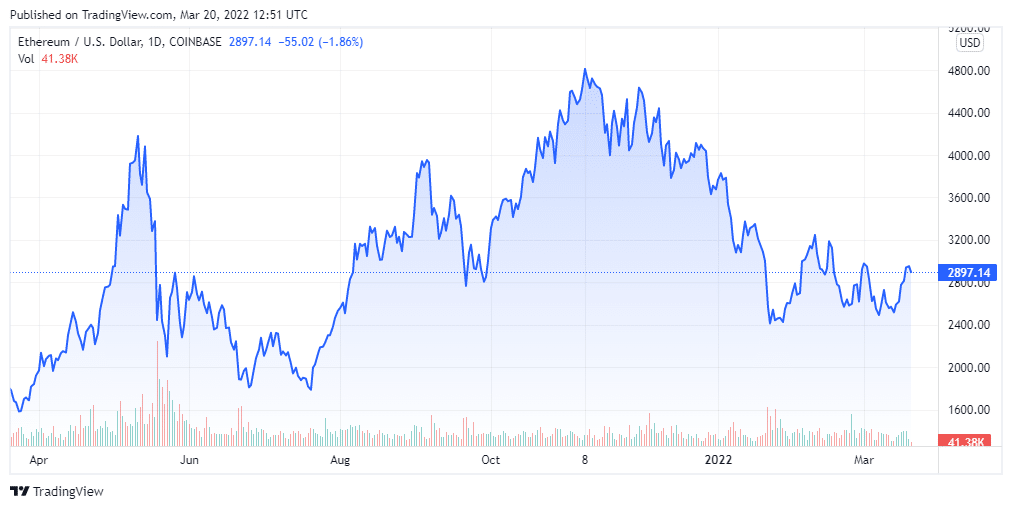

It is also showing signs of rebounding its price after a rally of about 17% over the past seven days to about $3K on March 18.

Ether Registers Highest Weekly Outflow Since October 2021

Ethereum has posted exciting development this week after harboring over 30% of all withdrawals from exchanges this year. The report shared by IntoTheBlock explains that over 180K ETH left the exchanges on March 15, bringing the weekly outflow to over $500M on March 18.

A chainalysis report also showed that ETH tokens could have left exchanges at around 120K coins per day over the week. That is a bullish signal as moving away of coins from the exchanges shows preparation to hodl and limit the supply.

The coin has also posted a massive 15% price rise in ten days after its network detected the increased outflow from centralized exchanges. This week’s increased outflow of ETH from exchanges coincided with about 190K coins moving to Lido’s stETH staking pool.

Lido offers non-custodial staking services that allow users to stake their coins more flexibly than Ethereum 2.0 Beacon Chain, which allows only staking 32 coins or in multiples of 32.

Ethereum Continues to Test the Market for a Price Rebound

Even though the dip that began in November is still haunting the crypto market, ETH is continuously showing signs of rebounding. Its signs indicate that the bulls are gaining a hedge over the bears as more people are willing to buy in, and investors are willing to stake and hodl longer.

Over the past week, ETH has registered a price rise of about 17% to trade at around $3K on March 18. However, a new rally seems far from sight as the coin is struggling to maintain its stronghold with its trend forming a symmetrical triangle. The coin will most likely register lower prices over the following days or weeks. At the time of writing, it was down to $2.897K.

Since the market is volatile, it is subject to significant changes, and the coin may post different results, which is why its best to DYOR before investing.

Sourced from crypto.news.

Written by Samuel Mbaki Wanjiku on 2022-03-20 21:00:00.