As Russia continues to wave its war wand on Ukraine, analysts claim it’s time for Gold holders to shift to bitcoin. For a while now, the bitcoin vs. Gold debate has ‘awned’ the tongues of financial advisors, but is now the time to take a closer look at the flagship cryptocurrency asset?

Russian Ruble Tumbles, But Do the Soviets Choose BTC or Gold?

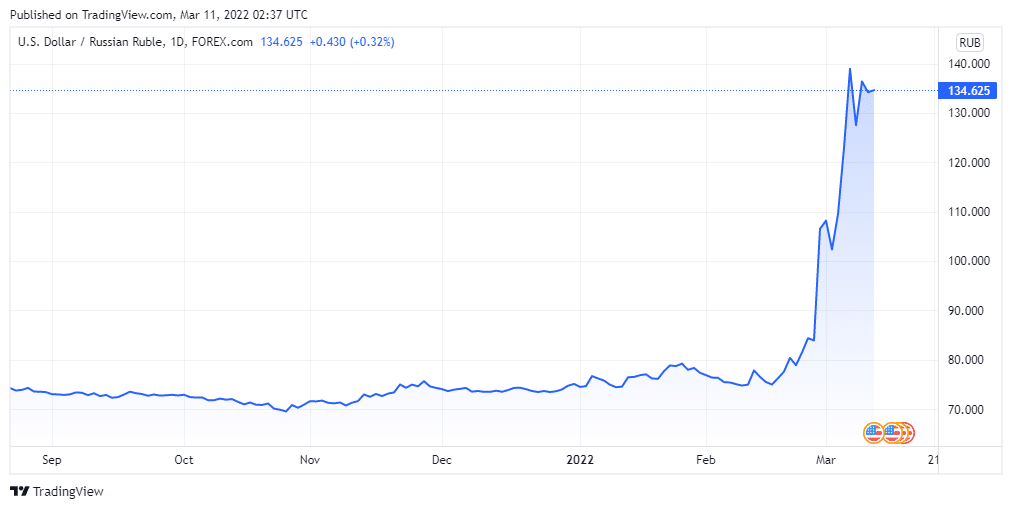

About ten days ago, the Western countries issued strict sanctions to the Russians, following the country’s choice to attack Ukraine. The move impacted Russia’s currency, Ruble, which took a nosedive against the U.S. dollar and bitcoin. A sad tale blew its wind over the Russian economy, which forced the hand of the state’s government to double its key interest rate.

With the situation in mind, it is almost reflex for residents of Mother Russia to look towards other assets like Gold and BTC. When the Ukraine-Russian tussle commenced, Gold was selling at $1,889 per troy ounce. Currently, the shiny metal is going for $1,997 per troy ounce. Although the variation is not much, at least it is not treading the falling spree of the Ruble.

On the other hand, at the start of the Russian invasion, bitcoin was trading at around $37.6K. At the time of writing, BTC was selling at $39.1K, about a 3% differential. The percentage could seem small, but the growth in terms of money is approximately $2K.

Analysts could take a sit-down to compare the two, but the tale now stands that cryptocurrencies are giving stockholders a run for their money, Gold included. However, the price volatility of assets like BTC has made many skeptical of joining the digital currency bandwagon. Countries’ sanctions on Russia are sneakily pushing many to find ways to move their cash, and without doubt, digital currencies could emerge as the go-to option.

Cryptocurrencies Imbalance, But the War Signals Better Days

Although cryptocurrencies might be outperforming stocks at the moment, not all digital currencies have been on the upside. The crypto market, in general, is still trying to pick up the pace that it had at the start of the financial year 2021. Ethereum, the second cryptocurrency by market capitalization, has failed to reach its all-time high value of above $4K, struggling to cap its 90-day high of $3.2K.

However, with currencies like the ruble falling, financial enthusiasts could shift their focus on crypto. According to a financial analyst at GlobalBlock, the ongoing war has led to a spike in the number of transactions involving the swap of rubles to BTC. In a recent interview, an analyst named Marcus Sotiriou said,

“We can definitely see that some Russians are using bitcoin as a hedge and to protect their savings. This bolsters the idea that bitcoin can act as digital gold.”

One of the primary reasons why people could turn consider BTC is inflation. And as it stands, inflation is hitting both Ukraine and Russia. For crypto enthusiasts, it could be a green light for buying crypto as constituents of both countries look towards ditching their native currencies, looking for other options.

Sourced from crypto.news.

Written by Adam Robertson on 2022-05-02 17:51:22.