Analytics

cryptonews.com

07 October 2022 11:55, UTC

Reading time: ~6 m

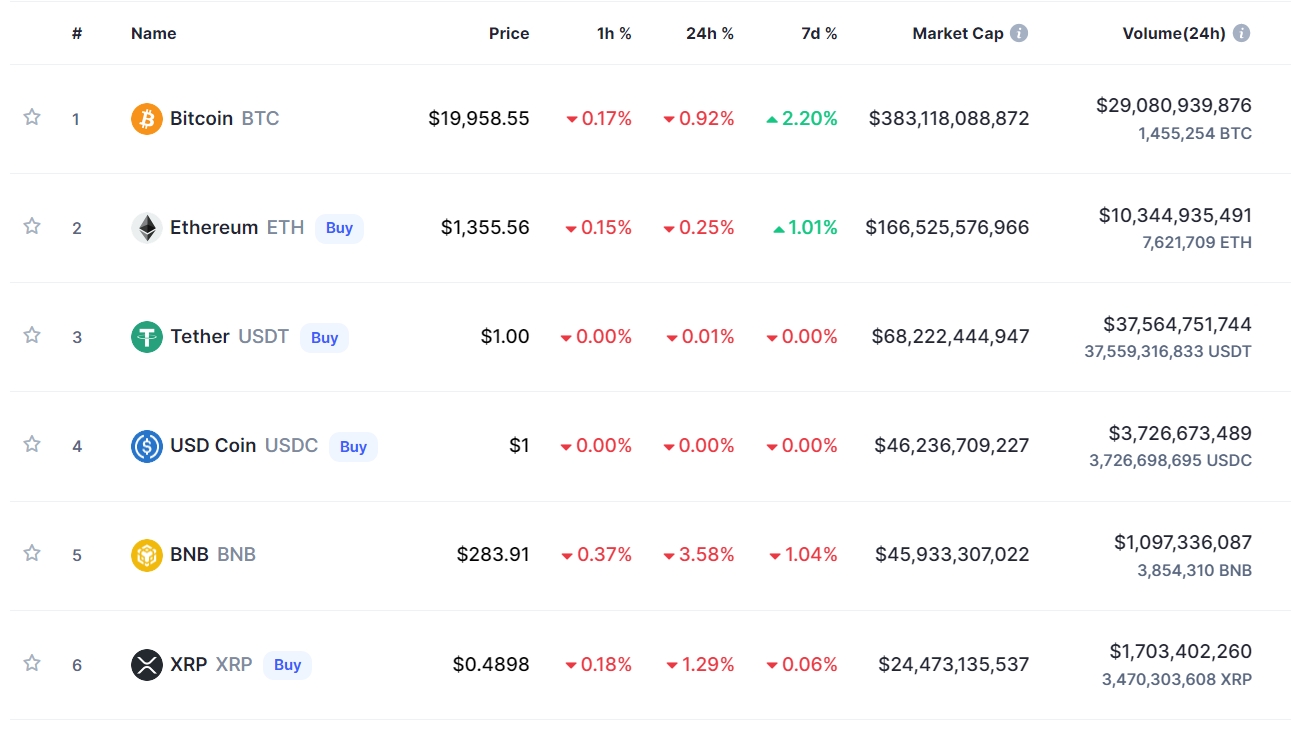

XRP continues to be a favorite for investors and traders and continues to be among the most traded coins by volume.

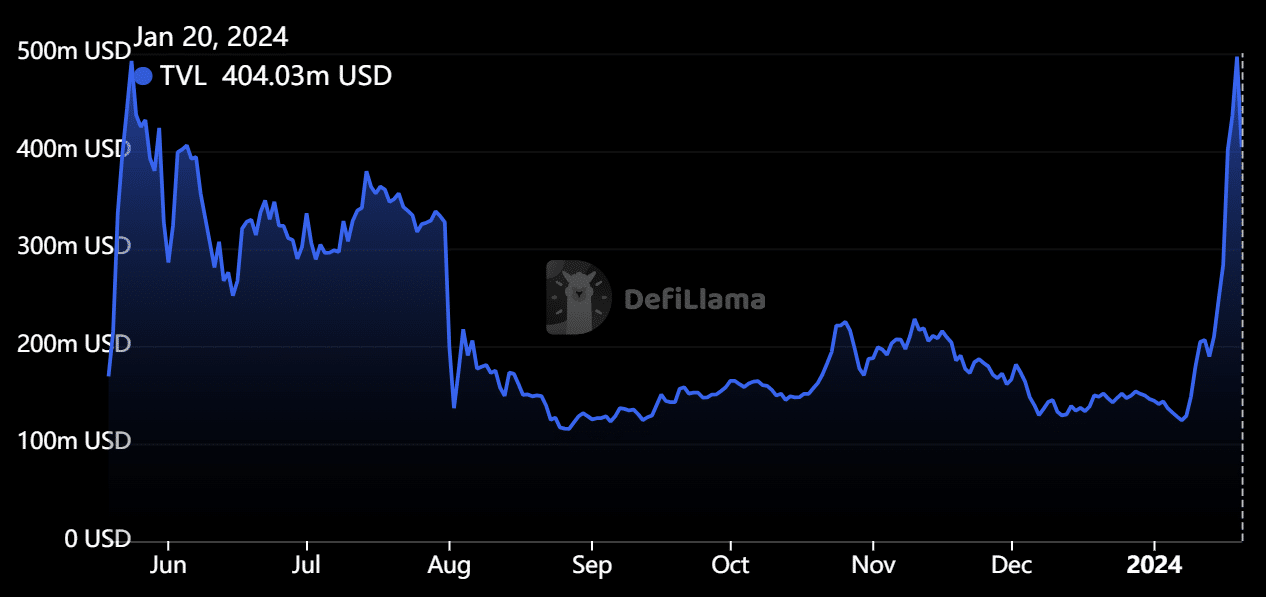

Although volume in the last 24hrs was down 25% compared to the 24hrs before, XRP trails only Bitcoin, Ethereum, and the three-largest stablecoins (USDT, USDC, BUSD) with $1.7 billion in volume.

Its short-term prospects could see the coin go as high as $0.60-$0.70 – as CryptoNews reported on Thursday – but it’s the coin’s long-term potential that has investors excited.

As everyone in the crypto space knows, XRP’s parent company Ripple has been locked in a near two-year battle with the US Securities and Exchanges Commission (SEC).

Despite the long court case, XRP has remained in the top 10 by market cap given the strength of its underlying technical fundamentals.

If Ripple wins its court case, it appears primed to be adopted on a mass scale at an institutional level – not only by businesses but even by central banks and governments.

A win in court would not only trigger mass adoption but mass investment into XRP that would see the coin go parabolic and likely beat its January 2018 all-time high of $3.84.

Ripple winning SEC Court Case?

It is impossible to know how the Ripple vs SEC court case will actually turn out, but there have been several hints in recent weeks and months that hint the case is going their way.

At the end of September, a US District Judge, Analisa Torres, allowed Ripple to use comments made by former senior SEC employee William Hinman to be used in their case.

Hinman’s comments, made via email in 2018 while he was employed as the Corporation Finance Division Director, allegedly describe ether (ETH) as not a security as, like Bitcoin, it is “sufficiently decentralized.”

The SEC previously objected to the documents being used, citing that they are irrelevant to the case as they were made by a former employee and did not necessarily represent the views of the entire organization.

Additionally, they asserted attorney-client privilege that protects internal speech communications.

The emails are a cornerstone of Ripple’s defense and critical evidence in their case to prove that XRP, like ETH, is not a security.

The judge allowing Ripple to use them was seen as a huge win for the crypto firm.

The case is also edging closer to the finish line after both sides agreed to a summary judgment, meaning a verdict could be reached almost at any time – and almost certainly in the next 12 months.

In mid-September Ripple CEO Brad Garlinghouse also gave an interview to CNBC and appeared confident the judgment would go in his favor.

He said: “You have to remember that 99.9% of XRP trading has nothing to do with Ripple the company. So when you talk about, okay XRP is a security, I go back to something I said years ago when they started: ‘A security of what company? Who is the owner?’

“I think it’s very clear there is no investment contract. If you get past the investment contract, which I think is hard, across the Howey Test, you have to meet all three prongs, and in the case of the XRP case, you can’t meet all three prongs for sure.

“And so we think that the judge will see that the law is very clear, we think that the facts are clear and that this is just a gross overreach of the SEC trying to wrest control of that uncertainty that has existed.”

Garlinghouse added that future court cases will later come to be known as having to pass the ‘Ripple Test’, given this is the first of its kind and destined to be a landmark ruling on crypto regulation.

“I think the ‘Ripple Test’ may be what we look at in the future. There are a lot of facts and circumstances that can be unique, but for Ripple, and what the SEC is trying to do, I do think it’s just the SEC trying to overreach the statute.”

This week Ripple’s lawyers also blasted the SEC’s opposition to the I-Remit and TapJets motions to file amicus briefs.

Their motion read: “If the SEC cannot evaluate the veracity of such claims, then it had no business bringing this litigation in the first place.”

Elon Musk Twitter Deal Good for XRP?

Elon Musk reigniting his $44 billion Twitter deal is also seen as good news for XRP’s price by some.

It is believed that Musk, a known crypto fan and the world’s richest man, will add tipping and payment functions to the social media site should he complete the landmark takeover.

Dogecoin is expected to be the biggest beneficiary, given Musk’s long history with the meme coin, but some are predicting coins such as XRP will also benefit.

CBDCs and Binance Support

As Reuters reported on Thursday, financial messaging system SWIFT finished their eight months of testing for a global central bank digital currency (CBDC).

SWIFT tested a number of different protocols that were unnamed, but XRP and its Ledger was considered to be one of them given its stature as a high-profile CBDC solution.

Binance, the world’s largest centralized exchange, has continued to show support for XRP, with many taking that as a hint that Binance believes Ripple will win the court case.

The exchange added XRP to its ‘Learn & Earn’ section and has also offered the token to its users as a Dual Investment.

XRP Price Prediction

Whether XRP ever reaches $1 or $10 is all dependent on the verdict of the court case vs the SEC.

If Ripple loses it could almost signal the end of the protocol as a legitimate investment.

However, should it win – and there are strong hints that it could – the price will see massive gains.

Not only will a court win see retail investors and crypto enthusiasts flock to buy the coin, Ripple is also one of the best-placed projects to secure mass institutional adoption due to its underlying technical solutions.

A court win not only secures that adoption because of Ripple’s fundamentals but also makes it the first crypto asset that is fully regulated by the US government and court system.

That will only attract further investment from institutions who have previously shied away from adopting blockchain and Web3 technologies.

A court case win means any price is on the table for XRP and it will certainly test all-time highs in the coming years.

While XRP is a hugely appealing coin, diversification in any portfolio is key. Another project that will offer carbon credits and looks set for big gains in the coming months is IMPT, having secured more than $1 million of investment in just three days of presale.

Sourced from cryptonews.net.