A $35 Trovio DeFi Fund has been launched by Trovio Group, the top hybrid asset manager in Asia Pacific and an architect of technological solutions. This was made possible with the support of Yield App, a major global FinTech firm and digital wealth platform.

The Trovio DeFi Fund allows institutional investors to deploy their money in a way that will generate returns inside the DeFi ecosystem, and it does so by catering to wholesale investors.

Based on Yield App’s objective, the team is of the opinion that all people should have equal access to the most lucrative earning options. Notably, unlocking the full potential of digital assets and combining them with the most lucrative possibilities that are now accessible all around the globe is the company’s aim.

In order to do this, the company offers a cutting-edge digital wealth platform and a cryptocurrency application that bridges the gap between centralized and decentralized forms of money in the most user-friendly manner possible.

The Chief Investment Officer of Yield App, Lucas Kiely, said:

“Through this partnership with Trovio, we are making the internally tried and tested DeFi strategy that has powered Yield App’s return-generating engine available to a wider audience of wholesale investors.”

He continues by saying:

“The expertise of Yield App in the DeFi space combined with Trovio’s long and successful track record within the digital asset industry, makes this the best-placed team in the market to take advantage of the opportunities available in DeFi, while maintaining a strict focus on capital preservation throughout.”

The following is a quote from Tim Frost, Chief Executive Officer of Yield App:

“We are proud to bring the cutting-edge expertise of our world-class DeFi risk management team and our industry-leading proprietary risk model to Trovio, a leading asset manager in the digital asset space. This exciting partnership presents an unprecedented opportunity to explore the synergies between our two businesses and we look forward to collaborating with Trovio on this offering.”

Enabling a Wide Range of Potential Investment Options in Defi

The asset management team manages the generated fund at Trovio in partnership with the highly experienced DeFi risk management team at Yield App. The fund places a significant emphasis on the preservation of capital. It uses various proprietary tools to capture and analyze sentiment to shield the portfolio from the effects of market volatility.

The fund can develop a universe of DeFi investment possibilities using these techniques, which are subjected to stringent risk assessment.

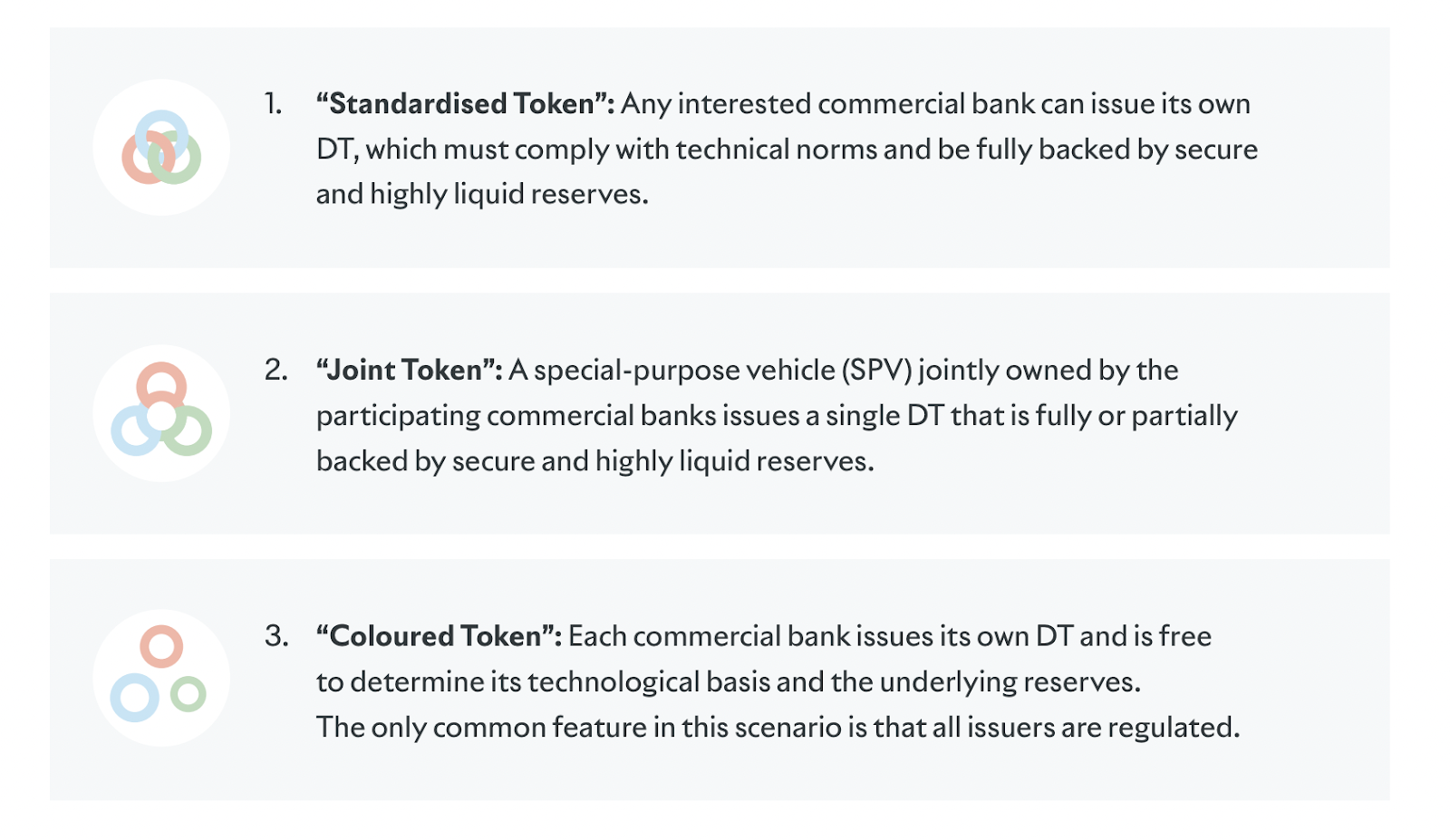

The internal proprietary risk model focuses on four security assessment pillars (smart contract, platform, counterparty, financial and credit risk). It uses a sum of 135 measured variables compiled from historical data to analyze all aspects of risk exposure. These pillars are smart contract, platform, counterparty, financial and credit risk.

Trovio believes that the development of commerce brought about by digitalization, data capture, and decentralization poses challenges to several sectors, hence offering possibilities for investors, leaders, and stakeholders.

In addition, the Trovio Group was established in 2017, and since its inception, it has been working to reimagine the global economic landscape with its current markets and infrastructure.

The Chief Executive Officer of Trovio Group, Jon Deane, stated:

“Trovio has spent the last five years building a market-leading asset management solution for digital native assets. Today we are excited to announce the launch of the Trovio DeFi Fund in partnership with Yield App, an institution that we have worked closely with during this period. Yield App brings a wealth of experience in managing risks in decentralized finance, and we look forward to continuing to grow this partnership, providing recognizable institutional investment products aligned with best-in-class risk management and governance processes, to our investors.”

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Sourced from cryptodaily.co.uk.

Written by Adrian Barkley on 2022-11-02 21:30:00.