DeFi

crypto.news

03 March 2023 10:16, UTC

Reading time: ~4 m

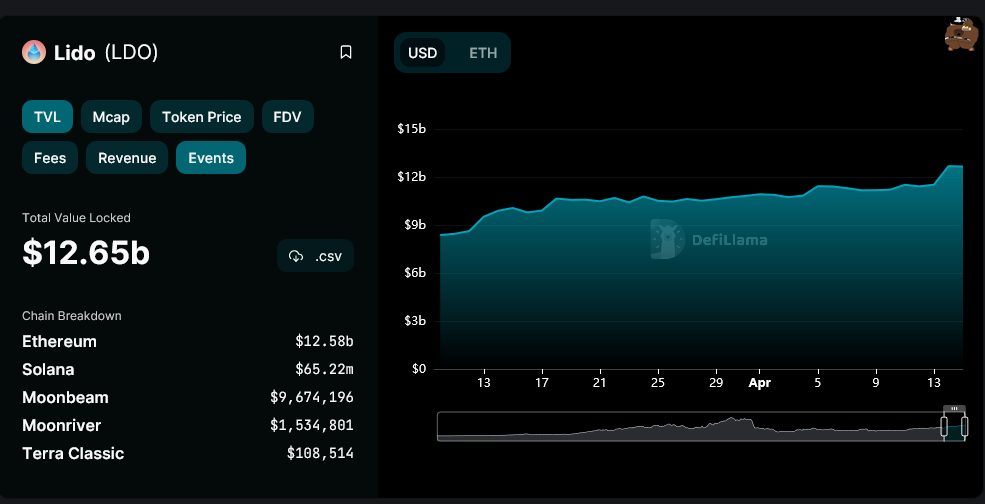

In the last bear market, the decentralized finance (DeFi) market encountered challenges sustaining its growth as investors shifted towards conventional financial avenues. The total value locked (TVL) fell by approximately 62% from its peak in 2021. If critical changes are not implemented, analysts predict a grim outlook. Accordingly, to regain the trust of its users, DeFi should prioritize rewarding its users.

Why a reward-based economy is key to resurrecting DeFi

Many projects have struggled to attract users and investors as DeFi slips into a lull, thanks partly to the sluggish economy and a slew of insolvencies in crypto. One way of rectifying this situation is if protocols incentivize clients through staking, liquidity provision, or other means.

By offering rewards, platforms can create a virtuous cycle of user engagement and liquidity that can help sustain growth over the long term. Additionally, incentivizing users will address the issue of centralization that plagues many DeFi platforms. By distributing rewards to users, projects can ensure that control remains in the hands of a diverse group of stakeholders rather than being concentrated by a few large investors or developers.

Moreover, DeFi projects must also ensure that their reward systems are transparent and fair. In this system, users should clearly understand how rewards are distributed and how to earn them. Projects that prioritize rewards can help build trust with their user base and create a more resilient DeFi ecosystem.

An offering that satisfies these prerequisites is Fludity Money. The protocol allows users to earn rewards by wrapping their stablecoins, which are then used for lending on monetary markets like AAVE and Compound. The rewards offered are dynamic and depend on the blockchain’s variables.

Everything changed when the Atlantis submerged pic.twitter.com/J8N9PposMU

— Fluidity – (🌊,💸) (@fluiditymoney) February 22, 2023

Projects associated with higher transaction volumes and TVL tend to yield greater rewards. By incentivizing user participation and creating a sense of investment in the platform’s success, Fluidity Money encourages a community-driven approach to financial transactions in DeFi.

Existing bottlenecks are being addressed

Several solutions have recently come to the forefront to help alleviate the inefficiencies associated with the DeFi market’s existing reward structure, especially regarding the reward ratio fluctuations. One is the Atlantean Embassy, an initiative launched by Fluidity to bring partners together to increase market volume and drive utility-based incentives for its associates.

The Atlantean Embassy offers a five-tier reward framework, which splits yield-bearing transactions between the sender and receiver on an 80-20% split. For example, when a user makes a trade, they get 80% of the yield generated from the transaction, while the remaining 20% is deposited into the liquidity pool. Without LP tokens to claim the 20% yield, it can become a resource for bots. However, because of the whitelisted treasuries of Embassy members, transactions in Fluid’s token pool can be leveraged to create new revenue streams.

Additionally, members of the Atlantean Embassy have access to the “Subnautical Subsidy,” a passive income opportunity generated from the 20% yield gained from non-Embassy pools. The Embassy fosters collaboration between different protocols, providing unique interactive community activities, resulting in added exclusive rewards.

The Future of DeFi

As individuals across the globe increasingly adopt decentralized technologies, the development of the DeFi market has brought about a significant change in how investors perceive finance and money.

DeFi provides a novel economic structure that harnesses the potential of blockchain technology, creating a financial ecosystem that is more inclusive, transparent, and accessible to all.

Through the removal of existing obstacles within this realm, such as the lack of sustained, long-term benefits, the DeFi sector is poised to expand and advance, leading the way toward a financial system that is more decentralized and equitable. This, in turn, will make high-quality financial tools more affordable, efficient, and attainable for individuals, regardless of their economic status or geographical location.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

Sourced from cryptonews.net.