- Arbitrum reached record revenue.

- LayerZero airdrop led to increased gas fees.

- Spikes in activity test high-performance chains.

In recent years, there has been a proliferation of so-called high-performance chains. These blockchain networks tout their low transaction costs and scalability, comparing themselves favorably to Ethereum. However, when real-life events test them, they see mixed results. For instance, how the memecoin explosion tested Solana, leading to chronic network congestion.

Most recently, Arbitrum faced a similar challenge, struggling to handle the massive increase in transactions due to the chaotic yet widely anticipated LayerZero airdrop.

Arbitrum Gas Fees, Revenue Surges Amid LayerZero Airdrop

Arbitrum network, an optimistic Layer 2 rollup for Ethereum, faced a significant test of its capabilities. On Wednesday, June 20, the network saw a major increase in gas fees, largely due to congestion driven by the widely anticipated LayerZero airdrop event.

LayerZero, a cross-chain interoperability protocol, works on top of Arbitrum, as does its token ZRO. The latter is currently experiencing an airdrop event. Notably, the airdrop required participants to pay a small fee of $0.10 to claim their airdrop rewards.

The airdrop caused a substantial increase in transaction volume, resulting in a median gas fee soaring to nearly 35 gwei, a significant rise from typical levels.

On the positive side, Arbitrum’s network revenue reached an all-time high of $3.43 million, with a net profit of $3.29 million. However, as users must pay transaction fees in Ethereum, Arbitrum’s immediate economic benefits are minimal. What is more, questions remain about the long-term effects of the congestion.

What LayerZero Airdrop Congestion Means for Arbitrum

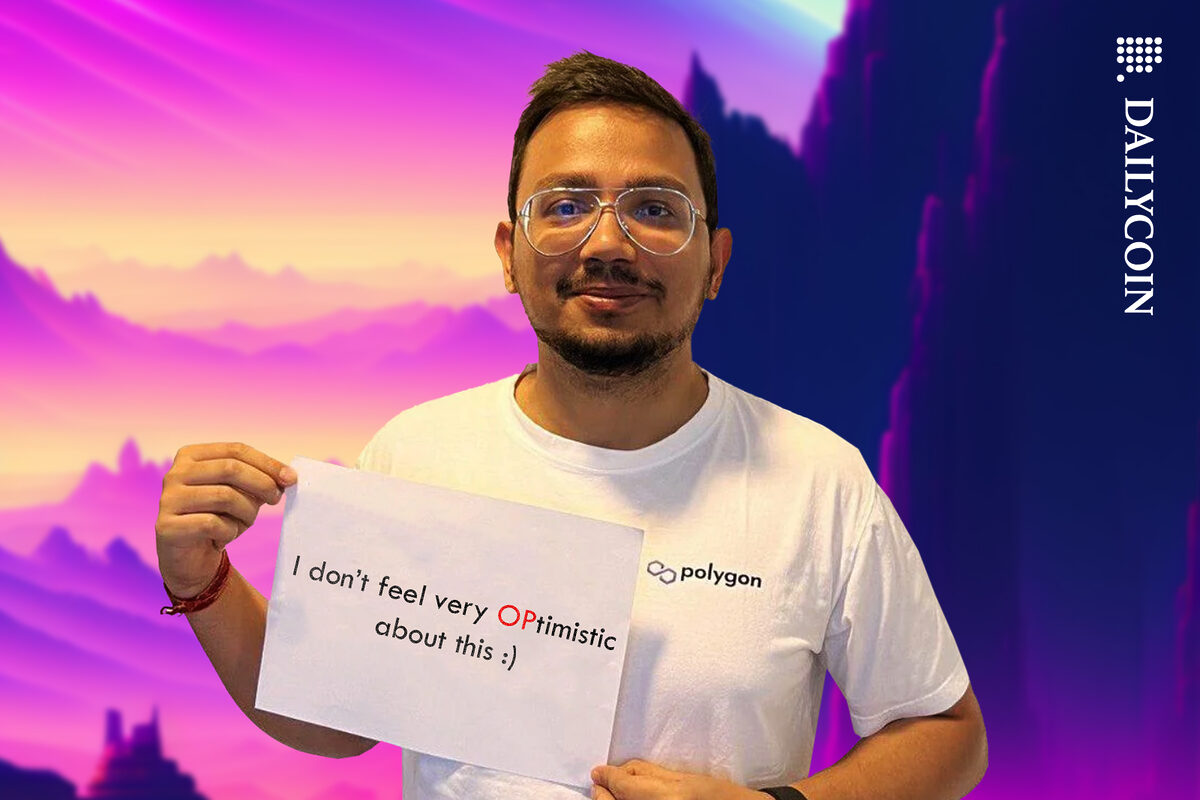

Network congestion resulting from the LayerZero Airdrop may significantly impact Arbitrum. For one, it undermines its narrative as a scaling solution to fix Ethereum’s congestion.

Chronically high gas fees can also deter users from interactions with the network, potentially slowing down adoption rates. Moreover, they can also push developers to look for alternative Layer 2 solutions or other blockchain platforms.

Besides causing issues for Arbitrum, the LayerZero airdrop faced its own controversies. For one, several users expressed frustration over low rewards and reported bugs in the claim process.

On The Flipside

- Like Arbitrum, Solana experienced congestion since the memecoin explosion on its platform. As a result, the network still struggles with a high rate of transaction failures.

- Crypto airdrops face criticism from “airdrop farmers” who create multiple wallets to maximize their rewards from such events. These actions, also known as Sybil attracts, can lead to unfair distribution and result in immediate selling pressure.

Why This Matters

Events leading to high network congestion are the battle test for crypto networks, revealing their true capabilities. For Arbitrum to grow, it must optimize its network scalability further.

Read more about LayerZero’s airdrop:

Major Exchanges List LayerZero (ZRO) Amid Disappointing Airdrop

Read more about TON’s latest win with Binance listing:

TON Gets Major Usability Boost With Binance’s USTD Integration

Sourced from dailycoin.com.

Written by on 2024-06-21 21:30:00.