Both BTC and ETH derivatives continue being affected by the high levels of market uncertainty, indicating the high likelihood of the continuous market recession that may last about 3-6 months, according to investors’ dominant expectations.

Latest Derivative Data

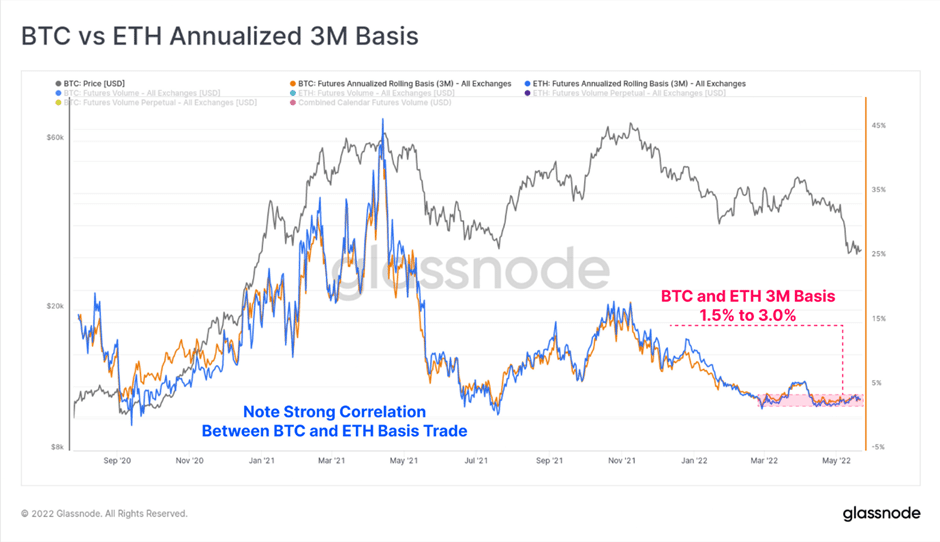

Derivative data are historically significant for communicating the reliable information on the market potential of the major cryptocurrencies in the short and medium term. According to a Glassnode report, BTC and ETH demonstrate the close correlation of their futures cash-and-carry yields. During the period of 2020-2022, the average yield of about 3M could be obtained from both assets, and any instances of divergences were not long-lasting as traders tended to utilize them for increasing their returns, thus contributing to the overall stabilization of the crypto market.

However, the current situation in the market is different, implying that liquidity and trade volume indicate the changing perspectives for Bitcoin and Ethereum. The current 3M basis rolling yield is just 3.1%, which is very close to the US Treasury yield of 2.8%. Such tendencies indicate that market participants still assess the current risk level as being disproportionally high, especially for the period of the next 3-6 months. The implied volatility has increased significantly after the rapid decline in BTC and ETH prices last week.

The following option data are highly informative on the actual situation in the crypto market and dominant assessments made by investors. Thus, short-dated at-the-money options IV more than doubled, reaching the record level of 110%, while 6-month dated option IV reached 75%. Thus, most market participants remain pessimistic about the crypto market’s dynamics in the following few months. The historical evaluation of these levels confirms the high likelihood of the prolonged “crypto winter” being observed throughout 2022.

Figure 1. Dynamics of BTC and ETH Annualized 3M Basis: High Correlation and Historically Low Levels; Data Source – Glassnode

Implications for the Option Market

The current market conditions correspond to one of the most bearish sentiments in the past 5 years. For this reason, most investors demonstrate the clear preference for put as opposed to call options. The put/call ratio for open interest has rapidly increased from 50% to 70% in the past 2 weeks, indicating that most traders perceive the risks of further crypto market’s decline as being significant. Moreover, put options also allow determining the key strike prices that mostly correspond to the major psychological levels of $25,000, $20,000, and $15,000. In contrast, the concentration of call options is much lower, and it is mostly observed around the critical level of $40,000.

However, the long-term assessment of the crypto market’s dynamics remains highly positive, despite the current recession. The long-term trends indicate that about 70% of traders demonstrate the clear preference for call rather than put options. The concentration of call options is within the important price range of $70,000-$100,000. In contrast, the option strike prices are around $25,000 and $30,000 which are still much higher than those observed during the past few months. Thus, the existing sentiments for different time periods differ significantly.

Price Implications

As most investors assign the main priority to protecting their funds from risks, a new bullish cycle is not likely to occur in the next few months. At the same time, the period of panic sales has also mostly completed, implying that horizontal corrections are likely as market participants may require additional time and data to make better-supported decisions regarding future price movements.

Figure 2. BTC/USD Price Dynamics (3-Months); Data Source – CoinMarketCap

The BTC price reached its local minimum several weeks ago, indicating an important support level at the price of $26,500. At the moment, the market tends to consolidate within the range of $26,500-$32,000, indicating the major horizontal correction after the bearish pressure. Bulls need to exceed the price of $32,000 to target an important resistance level at $40,000.

Figure 3. ETH/USD Price Dynamics (3-Months); Data Source – CoinMarketCap

Similar market patterns are also observed in regards to Ethereum. The major support level corresponds to the price of $1,800 that effectively prevents the major altcoin from uncontrollably losing its capitalization. The current price range refers to $1,800-$2,200 that may remain stable within the following weeks. At the same time, only after exceeding the important level of $2,200, the market can approach the main target level of $3,000.

Sourced from crypto.news.

Written by Dmytro Kharkov on 2022-07-14 20:25:46.