- Curve Finance founder Michael Egorov was recently hit with major liquidations on his lending protocols.

- Egorov has announced plans to tackle the incident and mitigate its impact.

- Industry figures have criticized the Curve founder’s financial fallout.

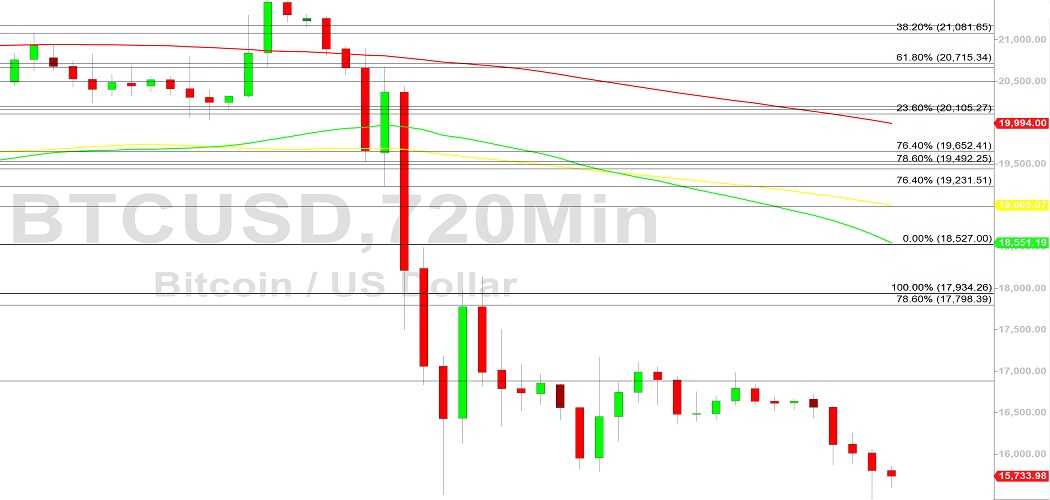

The decentralized finance protocol giant Curve Finance was recently rocked by significant turmoil centered around a hefty financial fallout for its founder, Michael Egorov. On June 13, 2024, Egorov experienced a sharp liquidation cascade totaling approximately $27 million, triggering a severe value crash for the ecosystem’s native token, Curve DAO (CRV).

In response to the fallout, the Curve Finance founder has outlined repayment plans.

Curve Founder to Repay Debt

On Thursday, June 13, 2024, founder and CEO Michael Egorov took to social media platform X to address the liquidation incident, assuring the team that ongoing plans are being made to resolve and mitigate the aftermath.

Addressing the root cause of the liquidation, which triggered a depressing 34% crash for Curve’s native token CRV, Egorov emphasized that his lending positions were too large for the market to handle, thereby triggering approximately $10 million of bad debt.

The Curve executive further stated that 93% of his debt has been repaid, adding his intentions to sort the outstanding 7% in the near future. He added that this is aimed at rectifying the financial damage caused by the liquidation and relieving its impact so that users do not suffer from the situation.

However, Egorov’s assurance was not met with the warm reception he had hoped for but rather with criticism.

Was the Liquidation Crisis “Planned”?

Responding to the Curve founder, Uniswap head executive Hayden Adams highlighted that similar instances of potential liquidation had occurred previously without resolution.

Adams added that the outcome of the recent liquidation was somewhat expected, indicating that Michael Egorov, as a “smart enough” industry player, likely understood the risks involved.

Ethereum core developer Econoarr also previously emphasized that despite the major CRV liquidation, the Curve founder didn’t incur substantial losses. Instead, he gained nearly $100 million from his 140 million CRV position, avoiding the potential community backlash that selling on the open market could have caused.

At press time, Curve DAO (CRV) is trading at $0.287, only pulling a 3% uptick in its path to recovery in the last 24 hours.

On the Flipside

- In September 2023, Curve founder Egorov similarly repaid debts to allay liquidation concerns on his loans at the time.

- According to DefiLlMA, Curve Finance is presently ranked as the 19th largest DeFi protocol.

- CRV’s current trading price marks an approximate 98% fall from its peak value.

Why This Matters

The ongoing efforts by the Curve Finance team, as outlined by founder Michael Egorov, may alleviate the impact of the fallout and restore market stability. However, the suggestion that the founder was aware of the risks implies intentional jeopardy for the ecosystem, which may harm his reputation.

Read more about the performance of the Curve DAO token over the past months:

CurveDAO Joins Market Losers with 14% Price Slip in 7 Days

The Taiwan crypto industry is getting a regulatory reform, read this to find out more:

Taiwan Targets Stronger Crypto Regulation with New Association

Sourced from dailycoin.com.

Written by on 2024-06-14 18:00:00.