- The crypto market extended a $40 billion weekend loss into Monday.

- Economic uncertainty around U.S. interest rates is blamed.

- Most cryptocurrencies are nursing losses over the past week.

2024 has proven an exceptional year for the crypto market, with the total market cap peaking at $2.76 trillion in mid-March. This surge reflected growing institutional adoption and renewed retail investor confidence in digital assets.

However, this upward trajectory has come unstuck lately, with a noticeable downtrend emerging from early June. This decline culminated in a significant $40 billion drawdown over the weekend, giving even the most optimistic bulls food for thought.

Crypto Markets Retreat

Over the weekend, the crypto market suffered a significant downturn, shedding $40 billion to sink to $2.39 trillion at the time of writing. This decline represented a substantial 13% drawdown, or $370 billion loss, from the year-to-date high of $2.76 trillion recorded in mid-March.

The latest Federal Open Market Committee (FOMC) meeting on June 12, in which the Fed opted to keep rates unchanged at between 5.25% and 5.50% for the seventh consecutive time, coincided with the downturn in crypto prices.

The Fed’s decision to keep rates unchanged was partly influenced by a robust labor market, prompting caution against premature rate cuts.

Trader Cypress Demanincor offered insight into the market’s recent behavior, suggesting that the market stutter is largely due to major players anticipating that rates will remain higher for longer. Cypress Demanincor stated that in this economic environment, market participants are favoring U.S. dollars over cryptocurrencies, leading to weakness in digital assets.

The dollar index (DXY), which measures the U.S. dollar’s value against a basket of major currencies, saw a notable increase. From June 6 to June 14, the DXY rose from 104.10 to a six-week high of 105.55.

Dollar strength, coupled with shifting market sentiments, has had a ripple effect throughout the cryptocurrency ecosystem, leading to widespread declines.

Seven Day Slide

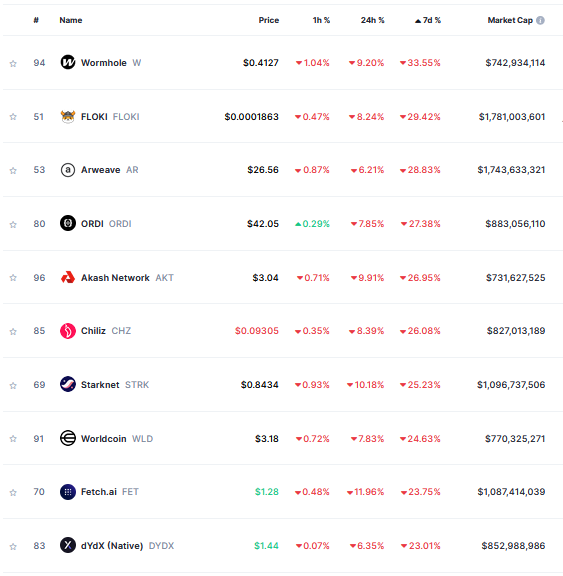

The crypto market has suffered widespread declines over the past week, with many top 100 tokens nursing significant losses. Among the hardest hit, Wormhole, Floki, and Arweave stand out as the top three losers, plummeting by 33.6%, 29.4%, and 28.8%, respectively, since last Monday.

Meanwhile, Bitcoin has shown relative stability, trading relatively flat since June 10. However, the market leader’s seven-day performance is down 5.3% to reach $65,600, marking a 3-day low.

On the Flipside

- Crypto markets are volatile in either direction and sudden reversals can occur.

- Past drawdowns have seen bigger drops than $40 billion.

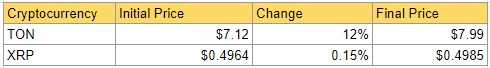

- Toncoin has been the standout large-cap performer, growing 10.6% over the past 7 days.

Why This Matters

This $40 billion plunge underscores crypto’s infamous volatility, reminding investors of the risks involved with crypto investing.

Read more about crypto market indecision following the latest FOMC meeting.

Crypto Markets Awaits Clues as Fed Looks to Hold Rates Steady

Charles Hoskinson reiterates the importance of governance for long-term success.

Cardano Founder: “Ethereum Wouldn’t Exist” if Not for This

Sourced from dailycoin.com.

Written by on 2024-06-17 19:00:00.