Lending protocol Aave has frozen stablecoin trading and set the loan-to-value (LTV) ratio to zero in response to recent price volatility on stablecoins after USD Coin (USDC) depegged on March 11.

According to Aave’s governance forum, the trading freeze follows an analysis from decentralized finance risk management company Gauntlet Network, recommending that all v2 and v3 markets should be temporarily paused.

“Setting LTV to 0 definitely helps everywhere, but on the Avalanche v3 Pool, given that cross-chain infrastructure doesn’t cover Avalanche, the Aave Guardian can act immediately. Setting LTV to 0 in practise discounts the “borrowing power” of the asset, without affecting the HF of any user position,” noted one participant in the forum discussion.

LTV is an important metric determining how much credit you can secure using crypto as collateral. Expressed as a percentage, the ratio is calculated by dividing the amount of credit borrowed by the value of the collateral.

Gauntlet’s risk analysis examined the number of insolvencies that might occur under different scenarios, considering that the price of USDC stabilizes, recovers or declines significantly:

“V3 emode assumes correlation of stablecoin assets, but at this time, those correlations have diverged. The risk has increased given that the liquidation bonus is only 1% for USDC on emode. To account for these assumptions that no longer remain true, we recommend pausing the markets. […] At current prices, insolvencies are ~550k. These can change depending on the price trajectory and further depegs.“

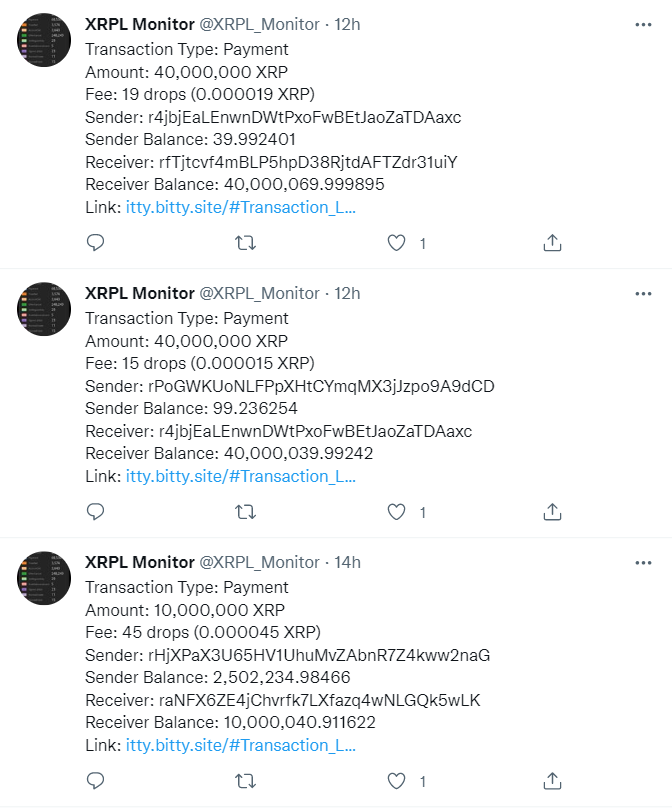

Centralized crypto exchanges have seen a surge in trading volume in the past hours following the Silicon Valley Bank (SVB) collapse on March 10, according to digital assets data provider Kaiko.

Two big $USDC markets on exchanges seeing heavy sell pressure and huge volumes in last 24 hours

Despite plenty of reassurance on crypto twitter, most investors still selling USDC at a big discount pic.twitter.com/W9uy2HHax4

— Conor Ryder (@ConorRyder) March 11, 2023

SVB was shut down by the California Department of Financial Protection and Innovation on March 11 after a bank run triggered by the bank’s latest financial reports, which showed it had sold a large chunk of securities worth $21 billion — at a loss of about $1.8 billion. The California watchdog also appointed the Federal Deposit Insurance Corporation as the receiver to protect insured deposits.

Circle, the company behind the USDC, disclosed on March 11 that $3.3 billion of its $40 billion reserves were stuck at SBV, resulting in its price falling below its $1 peg and impacting other stablecoins.

Sourced from cointelegraph.com.

Written by Ana Paula Pereira on 2023-03-12 14:29:35.