So, you have an astounding NFT collection that makes your crypto friends green with envy, but you’re worried about it losing value should the NFT market cash (like it just did in 2022). Read on to learn how you can hedge your NFT portfolio during the next NFT crash.

The NFT Hype & Crash of 2021 to 2022

The 2021 NFT hype was arguably triggered by the sale of Beeple’s NFT art — Everydays: the first 5000 days — which sold for $69.3 million. What followed was a rise in investor speculation, the emergence of new NFT projects, celebrity interest, and a buzz of activity on NFT marketplaces as more and more creators minted a wide range of NFTs.

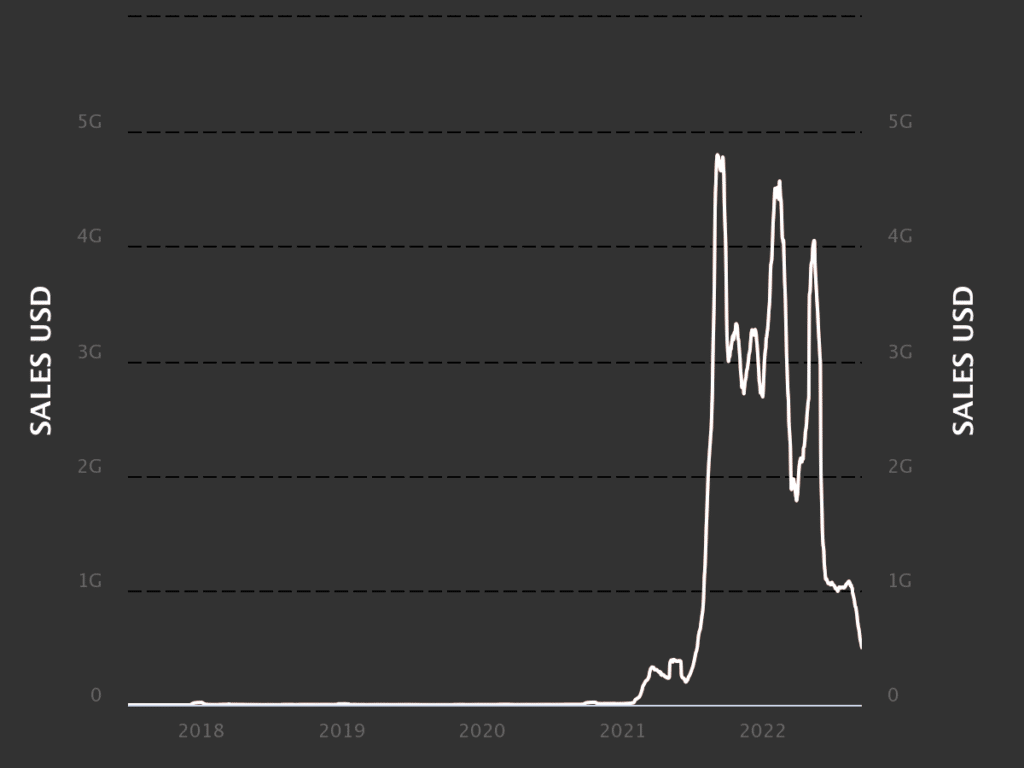

Although the market crashed in April and June, NFTs recorded sales volumes above 27 million in 2021, up from about 1.4 million in 2020, according to a NonFungible report.

Moreover, NFT trading volumes rose by a whopping 21,350%, hitting $17.7 billion. And that’s not all.

2021 was such a huge year for non-fungible tokens (NFTs) that Collins Dictionary made “NFT” the word of the year.

NFTs continued to perform well in January and February of 2022 but began declining in March 2022, only to experience a deeper crash in June 2022. Sales have been declining ever since. Trading volumes dropped to around $8 billion in Q2/2022, with Yuga Labs’ projects contributing over 30% of the trading volumes. The quarter also recorded a net profit of $460 million, down from $2.3 billion in Q1/2022.

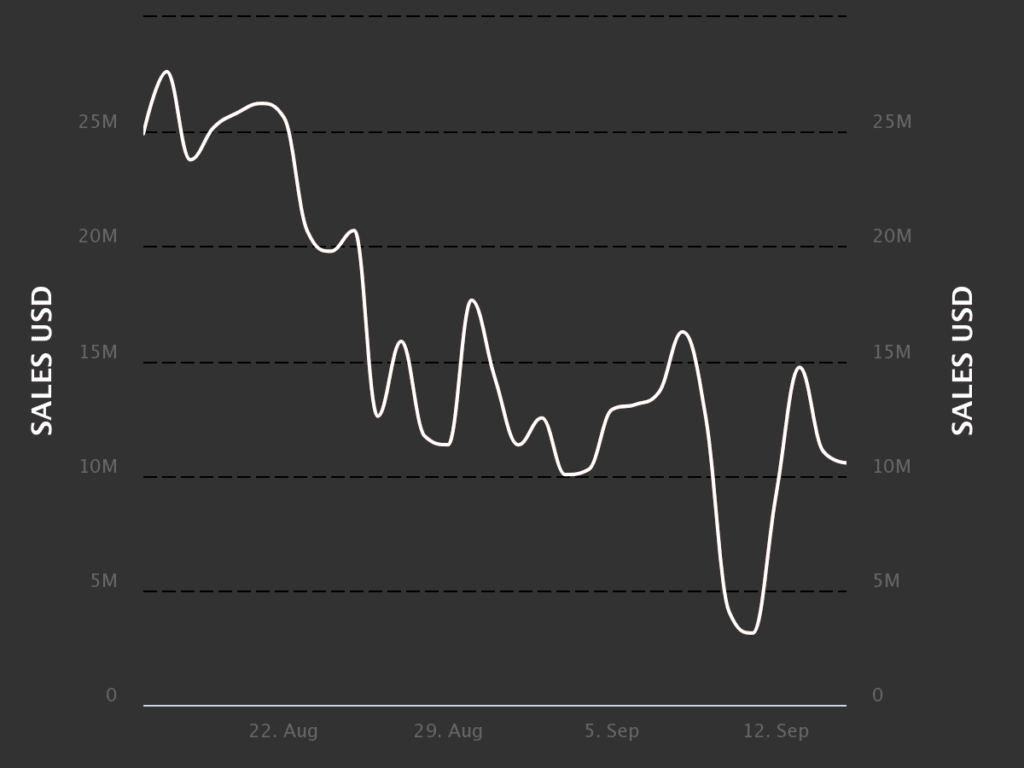

At the time of writing this article, 30-day NFT sales have dropped significantly, as shown in the graph below. The crypto bear market clearly contributed to the NFT crash we experienced this year.

The NFT hype has waned significantly, and the resale market is looking dismal for some investors.

For instance, Sina Estavi, the investor that purchased Jack Dorsey’s NFT of the first tweet, closed an auction in April 2022 after bidding fell short of his $48 million target. Following the letdown, he told Reuters: “I will not sell this NFT […] because I do not think [anyone] deserves [it].” Estavi bought the NFT for $2.9 million in 2021.

How to Protect the Value of Your NFT Collection During an NFT Market Crash

Reselling NFTs during an NFT market crash may not be a possibility for many investors because they can’t fund a buyer, or they simply aren’t willing to part with their JPEGs at these compressed price levels. To prevent yourself from experiencing the same challenges as an NFT collector, you could protect the value of your NFT collection by hedging it in the Ethereum derivatives market.

Most NFTs are minted on Ethereum and are priced in ether, which means to some extent, the NFT market is tied to the value of ETH. Therefore, you could use Ethereum derivatives to hedge your portfolio.

Hedge Your Collection Using Ethereum Futures

You could hedge your NFT collection with ether futures contracts. Ether futures are financial derivatives where two parties enter into a contract agreeing to buy or sell a certain quantity of ETH on a specified date at a predetermined price in the future.

An ether futures contract allows you to place a directional bet on the future price of ETH, the underlying asset, by hedging an existing position in a correlated asset class (your NFTs priced in ETH).

You can trade Ethereum futures on a crypto exchange like Binance or a regulated derivatives market such as CME.

You can hedge a portion of your NFT collection or all of it against a crash in the NFT market by selling (going short) ether futures. The potential profit you make from your short ether futures position will offset a drop in the value of the NFT collection.

Here’s an example:

Assume you want to hedge 50% of your NFT collection from a possible decline in value in the next six months using ether futures. So, you could short 150 ether futures contracts at $1,500 per contract bringing the total cost to $225,000. If the price of ether falls by 15% during the contract period, the price of one contract drops to $1,275. This means you can buy the 150 ether futures contracts at $191,250, making a profit of $33,750 in your hedge. The profit on your short ether futures position will offset some of the losses caused by the drop in value of your NFT collection.

Hedge Your Collection Using Ethereum Options

Ether options give the holder the right but not the obligation to buy or sell a specified quantity of ETH (the underlying asset) at a predetermined price on a particular date in the future. An option is more flexible than a futures contract because you don’t have to buy or sell it when the set period expires. Nevertheless, you will pay a premium whether you make a profit or loss. Using this derivative, you also speculate on the future price of ETH.

Here’s an example:

Let’s say you believe that the value of your NFT collection could potentially drop by 20% in the next six months. Therefore, you buy ether put options at $1,200 each, which is 20% lower than the current ETH price of $1,500.

If your prediction is correct and your NFT collection loses more than 20% of its value, you’ll be “in the money” because you can sell the put options for more than $1,200 each and make a profit on your hedge to offset losses you incurred from your NFT portfolio.

FAQs

Are NFTs still profitable?

Generally speaking, you might not come across NFTs currently (September 2022) selling for more than $50 million. However, some NFT projects are getting a lot of attention despite the ongoing crash.

For example, Doodles recently recorded a 1,200% surge in NFT sales following the announcement of a $54 million fundraising round led by the VC firm of Reddit co-founder Alexis Ohanian. Other NFT projects recording high sales, as reported on DappRadar, are Bored Ape Yacht Club (BAYC) and CryptoPunks. Also, Otherside and Known Origin are registering top sales.

Is it safe to invest in NFTs?

NFTs are extremely risky, just like most crypto investments. You should, therefore, never invest more than you can afford to lose. Moreover, do your own research before investing in any NFT.

Has the NFT market collapsed?

Yes, the NFT market collapsed in 2022, together with the crypto markets as a whole, resulting in a steep drop in NFT prices and trading volumes of up to 90% and more.

Will NFT prices recover?

It could depend on the direction the overall crypto market takes in the coming months (or years) since the price of leading crypto assets, especially ether (ETH), affect the NFT market to a large degree. However, nobody knows if NFTs will sell for the – arguably ridiculous – prices they sold for in 2021 ever again.

Can NFTs lose value?

Factors that may affect the value of an NFT include user demand, real-world benefits that collectors can draw from the NFT, and project development. If investor demand declines and the project fails to innovate further, an NFT could lose its value. Moreover, the NFT market correlates with the performance of the general crypto markets, so that needs to be taken into account in your NFT investing strategy.

Are NFTs a long-term investment?

NFTs with strong communities, widespread adoption, forward-thinking project leaders, and real-world benefits could work as long-term investments. However, the asset class is so new and has only gone through one hype cycle that the jury is still out on whether NFTs will end up emerging as viable long-term investments.

Sourced from crypto.news.

Written by Alex Lielacher on 2022-11-01 09:37:22.