John Deaton, founder of CryptoLaw, criticized the SEC’s overreach in an op-ed that appeared on Fox Business. According to Deaton, Gary Gensler, chairman of the Securities and Exchange Commission, has persisted in seeking to extend the agency’s authority beyond what is permitted by law.

Highly recommended reading✨@JohnEDeaton1’s article succinctly articulates the harm SEC Chair @GaryGensler continues to do & perpetuate towards crypto.

The SEC harms investors and creates disorderly markets by not providing regulatory clarity.https://t.co/vdra1tJjoB

— Moonchaser (@Moonchaser2020) August 21, 2022

He cited how, barring congressional action, the Commodity Futures Trading Commission (CFTC), the primary regulator of investments that are not regarded as traditional securities, has frontline responsibility for regulating digital assets. This may imply that the SEC has limited jurisdiction over the cryptocurrency industry.

The Supreme Court issued its famous Howey Criteria decision in 1946, outlining a four-part test for establishing what qualifies as an investment contract.

Deaton continued by saying that since Howey, Congress has been unable to enact any fresh legislation that would directly regulate cryptocurrencies. This should imply that Congress intends for the CFTC to serve as the de facto regulator of the cryptocurrency industry.

He claims that Gary Gensler, the chair of the SEC, has utilized this alleged lack of clarity to launch a campaign of regulation by enforcement that has stretched Howey to the breaking point.

Ripple Lawsuit: A “lot is at stake”

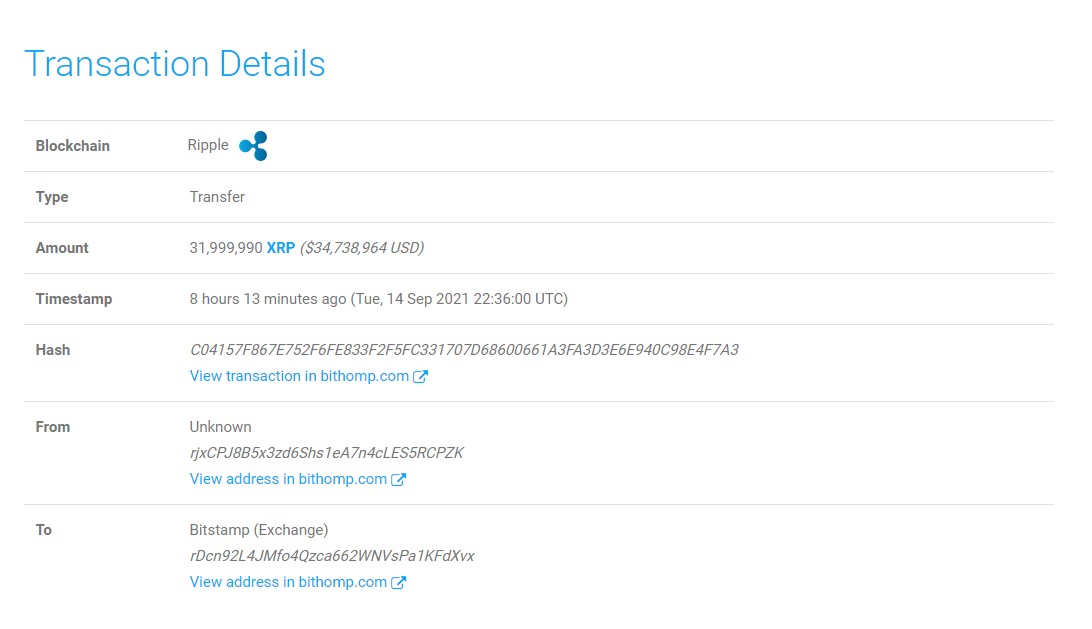

In December 2020, the Ripple case was launched by Jay Clayton on his last day as Chairman of the SEC. The SEC filed charges against Ripple executives for allegedly selling XRP in a way that would have qualified it as a security under Howey because the proceeds were used, according to the SEC, in part to support Ripple’s business growth. As a result, they were required to “disclose” information to investors regarding those sales just like a public business would.

John Deaton previously noted in tweets that XRP is by far the most important altcoin in the cryptocurrency market as a result of the SEC’s action against it.

He pointed out that if Ripple Labs loses the case, it might be dangerous for all other cryptocurrencies because they could be labeled as “unregistered securities” by the SEC.

According to the recently updated schedule and as reported by U.Today, the summary judgment briefings are expected to commence next month.

Sourced from u.today.

Written by Tomiwabold Olajide on 2031-10-21 09:38:07.